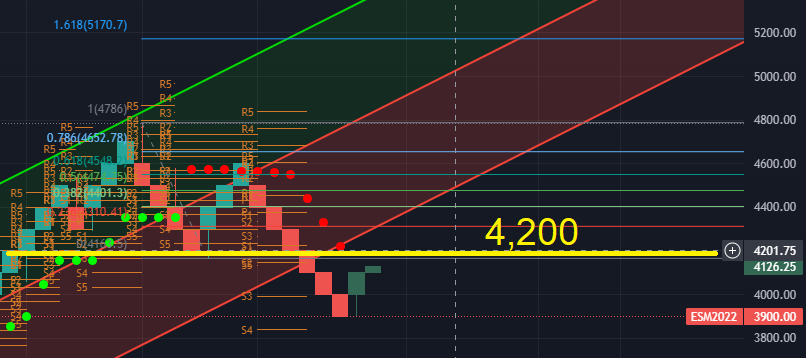

- We stated on May 26th to be a seller at 4,150/75 in the S&P 500 (futures), the high yesterday was 4,199.

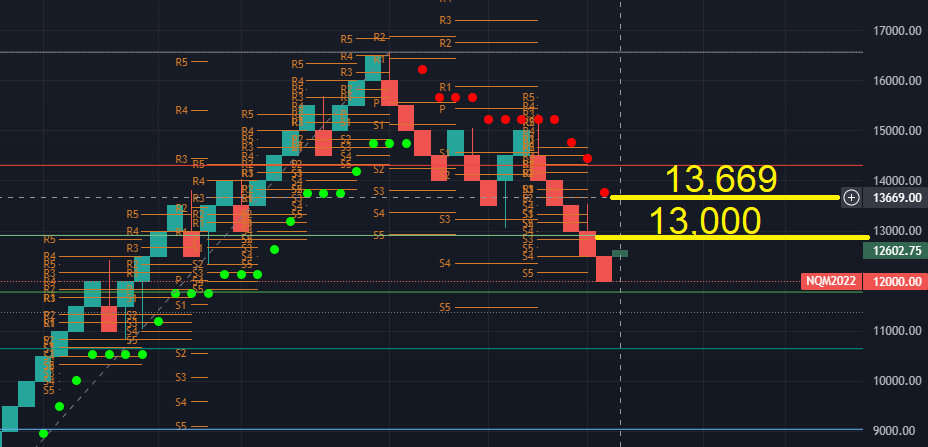

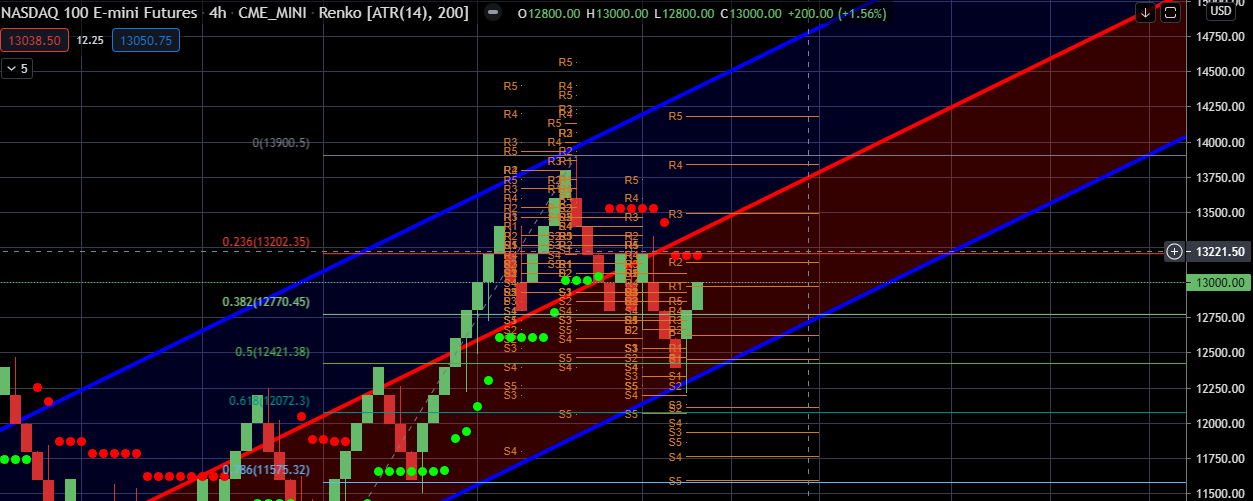

- We stated on May 26th to be a seller at 13,000 in the NASDAQ (futures), the high yesterday was 12,868. Slightly off our reduce risk level.

- Jamie Dimon turns negative, stating the economy is heading for a “hurricane” vs. his previous statement of “storm clouds” were on the horizon two weeks ago.

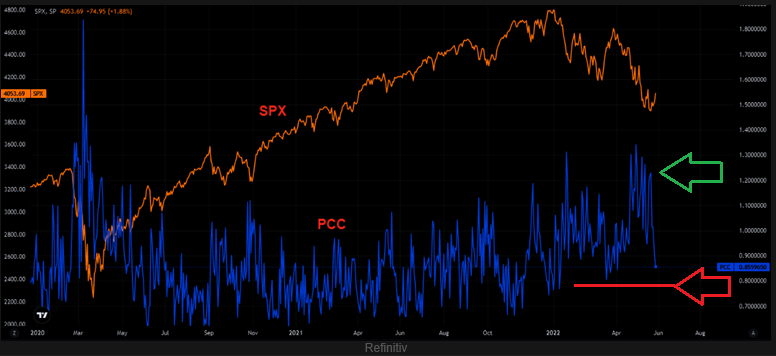

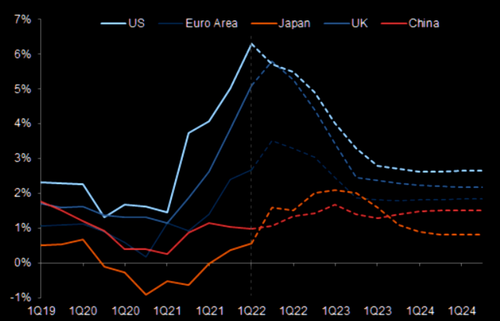

- Markets, especially rates starting to price in a slower easing policy trajectory as economic condictiones collapsed over the last several weeks. The market actually priced in a cut for Dec 2023 as the markets saw weaker economic conditions. HOWEVER, the Feds Bostic through a wrench in that theory, as he said a September “pause was not likely. Remember, we discussed the market went from a 80% chance of a .75% cut in September two weeks ago to less than 40% last week. Market got a little over Overzealous on the path. This in my view was the most bearish event for risk assets today!!

- Then you had ISM showing that (hotter) pricing pressures continue as PMI signaled stagflation as new orders slowed with continued.

- NASDAQ futures: 12,900/12,999. I am not saying we will get there, however, it will not take much. This is a level, where I would reduce technology.

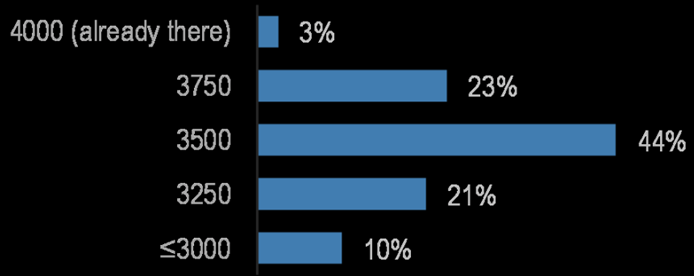

- S&P 500 futures: We could easily rally back to 4,170, no issue based on the S&P 500 blended model with a -58 reading. Which I would reduce exposure to anything that is economically sensitive like financials and materials.

The Fed & Wed Rally

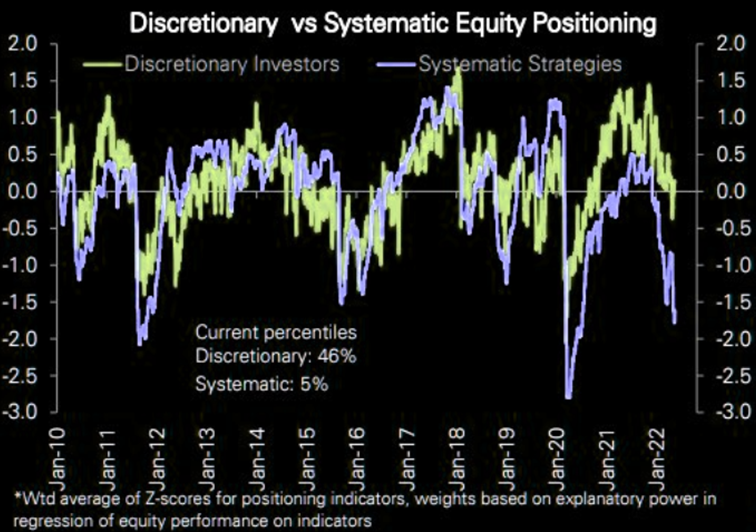

The equity positioning yesterday was set up for a rally as shorts covered as the Fed reduced the possibly of a .75bps rate hike for June. Even though it was a low probability the markets started to price in late last week a possibly for .75%. What caused yesterday rally once again was your typical gamma squeeze caused by positioning. Powell in our opinion was buying time and was weak on inflation yesterday as we can only assume the Fed hopes (prays) that the data will improve before killing economic output. Maybe he knows how CPI will look next week??

Thursdays sell off

In my opinion Thursdays sell off was because Powell lost a lot of credibility and the market realized he will need to be more aggressive than letting on. Where did he lose credibility? Well the fact he had no clear rational why he was starting the roll off the balance sheet on June 1st when they were suppose to start in April. He had no clear process that really was a loss of credibility to me.

- S&P 500 (Futures)

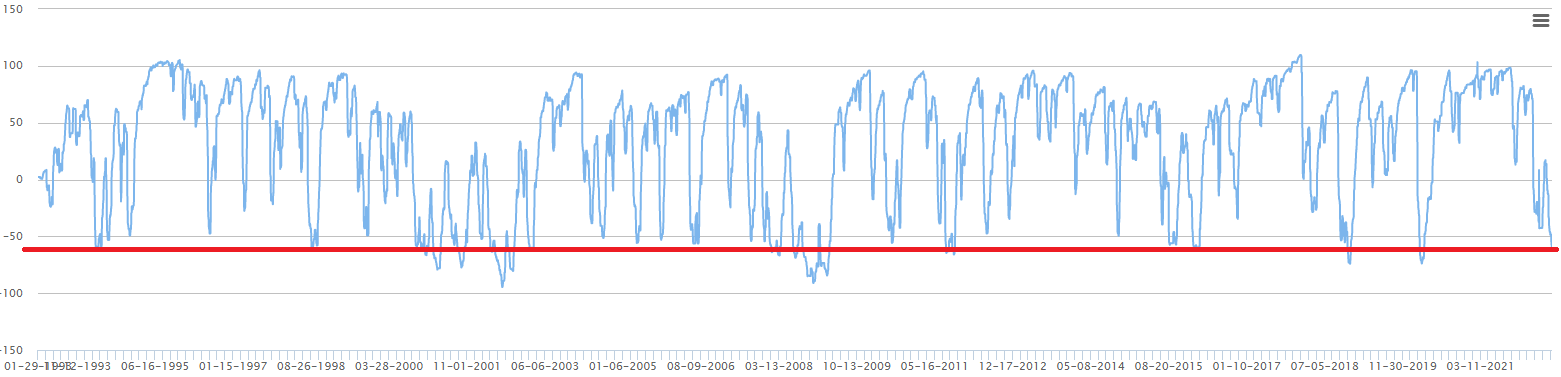

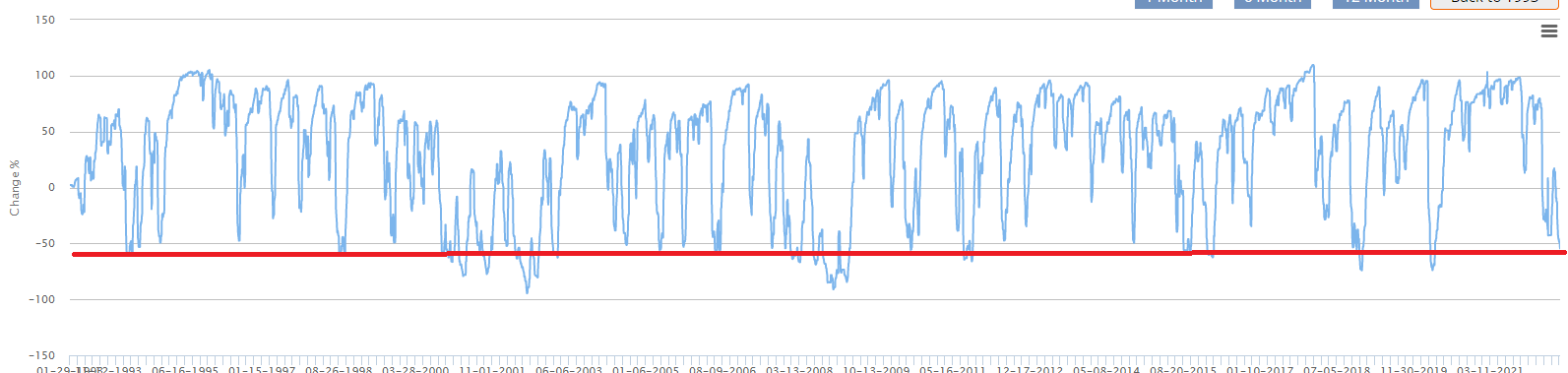

- We said late January that it seemed probable that our S&P 500 model (seen below) could reach a -51, which would take the index to 4,125. February 24th the S&P 500 (futures) hit a low of 4,102.

- We said a -51 reading on our model would be a typical correction and cause a counter trend rally taking the S&P 500 back to 4,548. Today the index closed at 4,534.

- We said the S&P 500 would not fail and revert lower from the -41 reading as it increased to -33 until it moved well above 0. Currently the model has a reading of 15 reading.

- We said the S&P 500 was much more constructive than the NASDAQ and we currently favor the S&P 500 over the NASDAQ, especially the equal weight S&P 500.

- NASDAQ (Futures)

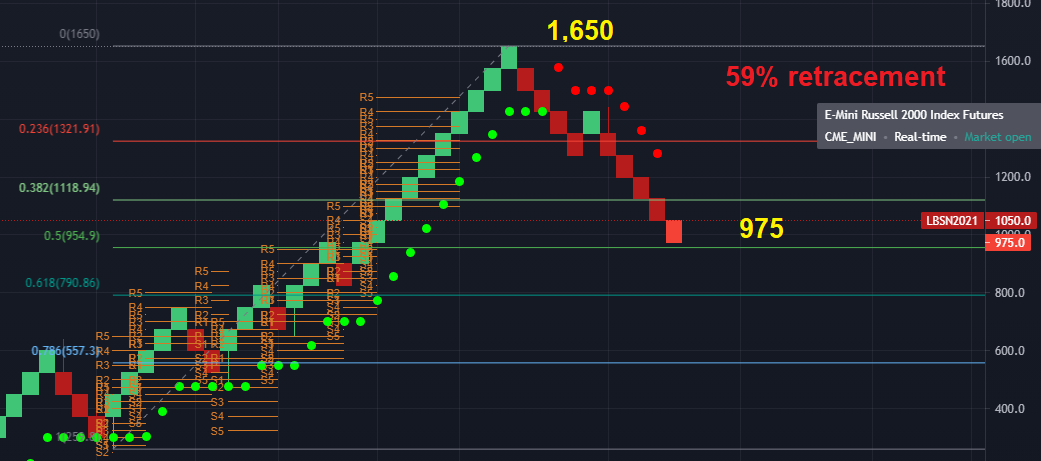

- We said early March that a pre-market gap down on the NASDAQ futures to 12,900 would cause a large counter trend reversal to 14,330.

- On March 15th the NASDAQ did gap down to 12,958 and in just 4 days rallied to our first target of 14,330.

- We said we would reduce growth exposure once the NASDAQ reached 14,330 and 14,900 respectively. Today the NASDAQ closed at 14,841.

- Even though April is seasonally a strong period, we believe the NASDAQ will retest 14,175 and potentially much lower.

- The NIM (net interest margin) expansion easy money rally which started last May is over. Regardless of the shortest part of the curve the 3 month to 10 year yield being steep, the 2/10 inversion is what really matters, don’t be fooled. The 3/10’s is not what is in play here. Even if rates rise slightly more within an inverse curve, the Fed needs to slow growth and that ultimately causes 2 things that will hurt banks, 1.) An increase in loan loss reverses from a weaker economic activity and 2.) slower loan growth. Don’t believe all rising rate environments work blindly for financials. Bottomline, if you are going to play this sector you better know your stocks and not blindly own XLF.

- Now that every is talking about the inversion of the 2/10’s, we included as in yesterday’s email, we wanted to opine on a few things.

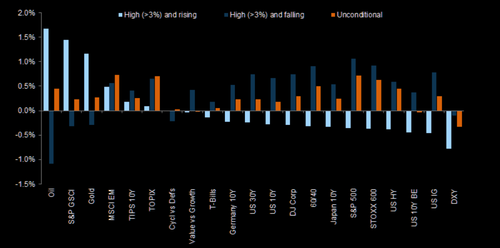

- Stats can be dangerous if not used in the proper context. While historically as seen below, an inversion on the Yield Curve doe not significantly impact the S&P 500. In fact the following 3 and 6 months on average equities are positive.

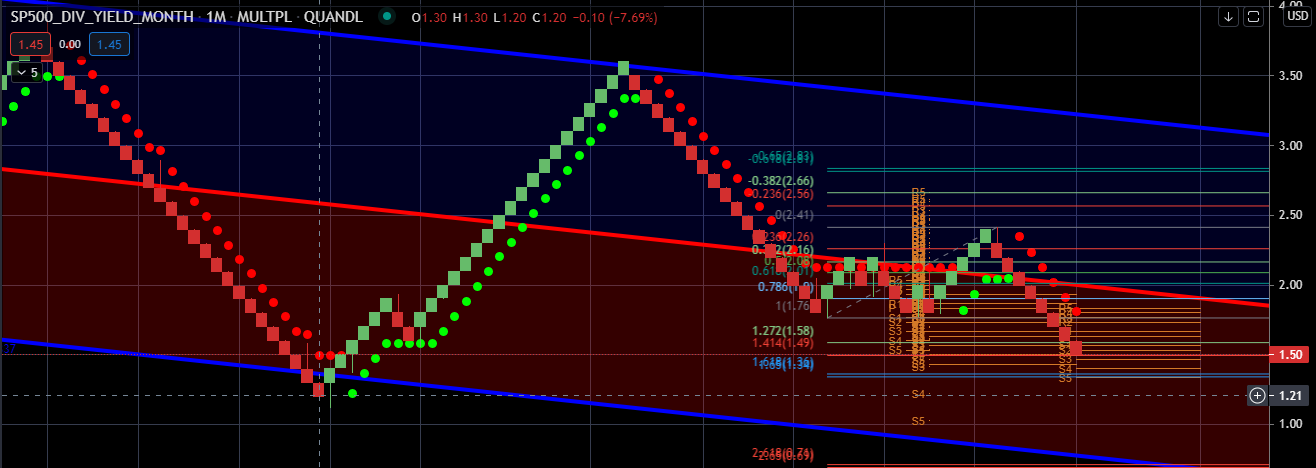

- However, seen in the second chart only 1 out of 8 times has the S&P 500 multiple been higher than today during a tightening cycle. Only in 1999 was the Case-schiller PE higher than today. We prefer looking at the Case-schiller PE as it is an average inflation-adjusted earnings from the previous 10 years vs traditional PE ratios.

- Lastly, none of these periods had CPI prints as high as we currently do caused by monetary and fiscal stimulus.

- This time is truly different!!

Many Fed watchers are now say after the Fed minutes revised language that the Fed has three more 50bps hikes and the Fed is done and the next move will be a cut a economic growth recesses. If the market starts to price this in we will see a massive late 2022 rally. We will see!

June 18th

A lot to go over here as things are starting to get very interesting.

- Wednesday kicked off an outlier when the Fed committee now sees 1 rate high in 2022 and potentially a discussion of tapering bond purchases at Jackson Hole. This for obvious reasons sparked a unwind of the reinflation trade. Which after 10 months can have even more to go on the downside i.e. energy, materials, financials. The discussion of possibly tapering sent yields down on the long end as this will reduce growth forecasts as well. However, the short end of the curve remained rather stable. This caused the 2/10 yield curve to almost flattened completely destroying the banks.

- Yields took another dive on Friday after Fed’s Bullard said the discussion of tapering is on the table and he is concerned of a housing bubble.

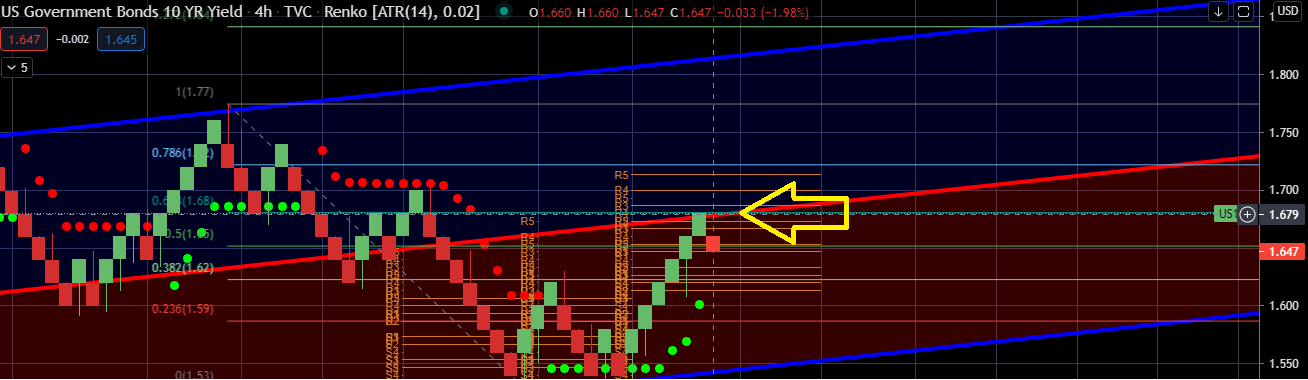

- The 10 year yield needs to hold 1.38% or the reinflation sectors financials, energy and materials are going to unwind. As we have been discussing for the last 4 weeks, we thought 1.38% was possible and this is where we would look to reduce technology.

- We also said 14,215 on the NASDAQ was another level we would be looking to reduce technology.

- We also have been saying that the consensus would be wrong on inflation and now that seems to be correct for now.

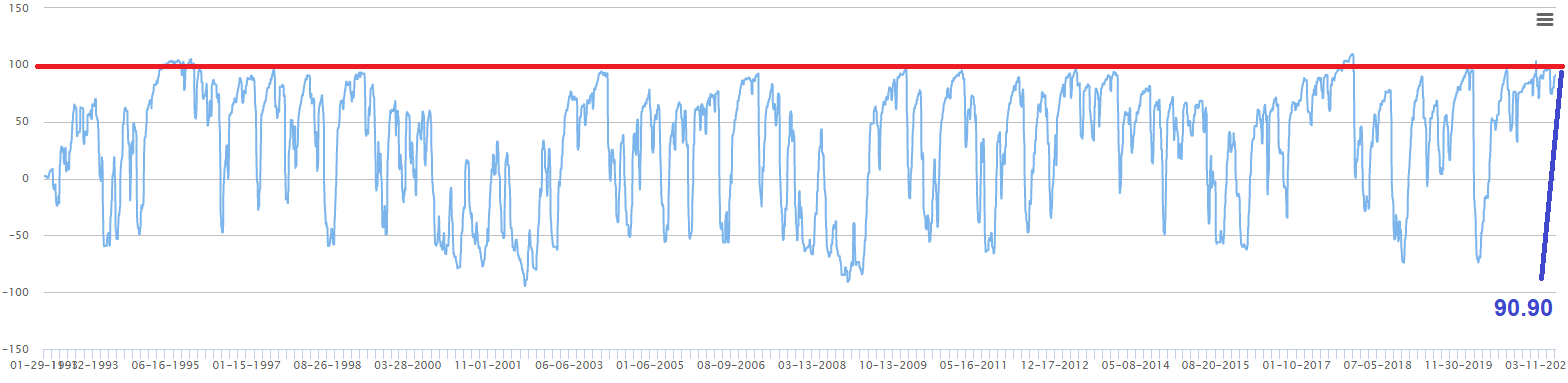

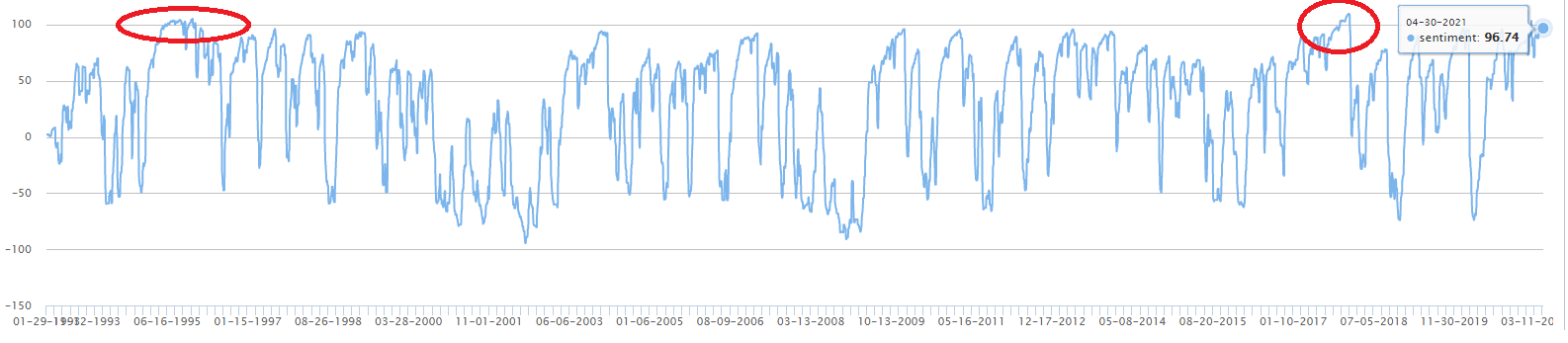

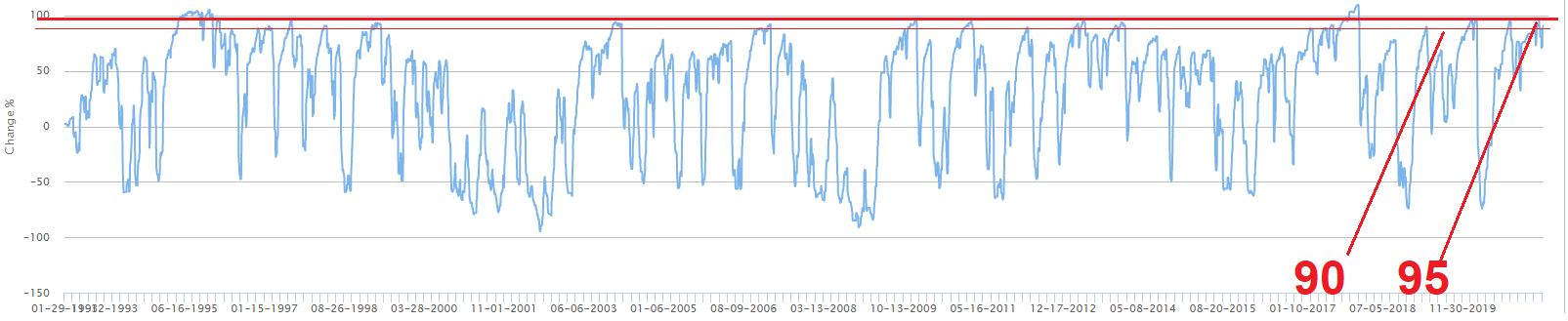

- The S&P 500 seems like there is more downside if rates keep on this current path. We did say reducing S&P 500 exposure at a 91 reading seemed to be warranted.

- I can almost see the S&P 500 correcting to 4,000 to 4,050 and then the Fed steps in walking back their hawkish stance on tapering to support equity prices.

- I certainly would not be adding to the growth trade (NASDAQ) names now after this massive reinflation unwind. I think before we know it, it will be time to start reallocating back to the reinflation trade after another leg lower on the 10 Year Yield.

- I am not a buyer of anything yet.

June 16th

Premarket we had a lot of data that should come as no surprise. The less important inflation gauge of Producer Prices rocketed to 6.6% year over year in May the fastest pace on record. This had little impact on rates, as an .80bps increase in the 10 -Year Yield couldn’t hold and the 10 Year closed flat. Retail sales declined 1.3% after last months weaker than expected number. It seems as though the consumer pent up demand might be waning after stimulus has run its course.

In our June 2nd commentary we highlighted commodities and the case of transitory inflation, stating, Does the recent run up in Commodity prices represent true fundamental (inflationary) demand or simply a function of supply chain shortages? When investors push up Commodity prices based on anticipation of higher inflation this could be deemed non-fundamental longer term inflation and more transitory.

If we just looked at Lumber Futures and Cooper, this would possibly be a signal that recent higher inflation is transitory as these markets have and starting to mean revert. Lumber broke its Vol stop on May 14th the same time the 10 year started to see significant resistance. Cooper certainly a better market signal, however, Lumber did stared to break first.

Many signals seem to be signaling inflation will be transitory. Again consensus is that a new Super Cycle is underway. In our opinion consensus does not create Alpha.

Tomorrow we have the main event and our play book from yesterday is know longer in effect as energy rallied and tech failed to reach 14,215.

S&P 500 model

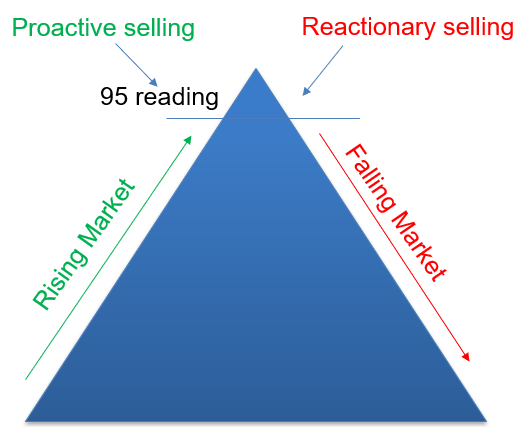

Our S&P 500 model is now at about a 91. As we know we like to reduce risk as the model gets close to the 95 reading. However, a 95 would be another 2.5% to 3% higher from here. Reducing exposure prior to 95 maybe warranted as there is no certainly 95 will be achieved.

June 14th

Back on May 19th we stated: “something unusual is happening and I don’t know if it is the start of a new trend. However, the 10-Year Yield jumped 2.50% today as the NASDAQ was exceptionally strong yet reinflation sectors energy, materials, and con. cyclicals were crushed. While I cant provide a hard factual explanation. I do believe the market is sensing growth is slowing and the stimulus effects will decline both in terms of growth and inflation and thus sell reopening stocks and get long tech as rates go lower in the second half of the year”.

- Banks were exceptionally weak as the 10 Year Yield rose 3%. I discount the weakness slightly as JPMorgan said today trading revenue would be lighter in the second half.

- However, regional banks that derive all their income from loans and fees and not FIC trading were down as much as the money center banks. Even the insurers were down as much as the money centers.

- The move today in financials was not in my opinion a result off the back of JPM’s comments. Conversely, Materials, Industrial and Energy as well the Russell / reinflation trade were sold hard.

- The consensus believes the Fed will not change its messaging and not entertain the question of tapering. However. everyone knows the Fed is stuck in a corner, even my 11 year old knows this. Powell will keep moving hit goal post, he doesn’t want a market collapse on this term. We will see what happens in Sept when extended unemployment benefits end and boost the jobs numbers in Oct. But until then, he won’t disrupt the waters.

- Macro traders therefor are trying to get ahead and have for weeks ahead of Wednesday Fed’s meeting.

- Many believe this would cause a clear run way for the growth heavy NASDAQ to run further.

- As mentioned, on June 10th we were looking for 14,215 on the NASDAQ futures to reduce long exposure. If the index does reach this level prior to the Fed on Wed, I expected to see a reversal on the NASDAQ late Wednesday or Thursday as almost sell the Fed statement regardless as positioning already took advantage of this setup. Furthermore, a possible small counter trend rally back into Materials and Energy maybe Financials would bee likely if these sectors see further weakness tomorrow.

Today we had the fastest CPI increase since 1992. The increase came once again from the same inputs, housing and autos. The market reaction is seeming to be transitory as the 10 Year Yield reversed to the downside 2.50% now flat. The bottom-line is that the bond market was still heavily shorted and now bonds are no longer oversold. In summary, 14,000 and 14,200 on the NASDAQ futures are levels reducing tech exposure would be warranted as I do not believe the 10 Year yield will break below key support of 1.37%

The Great Debate – Inflation

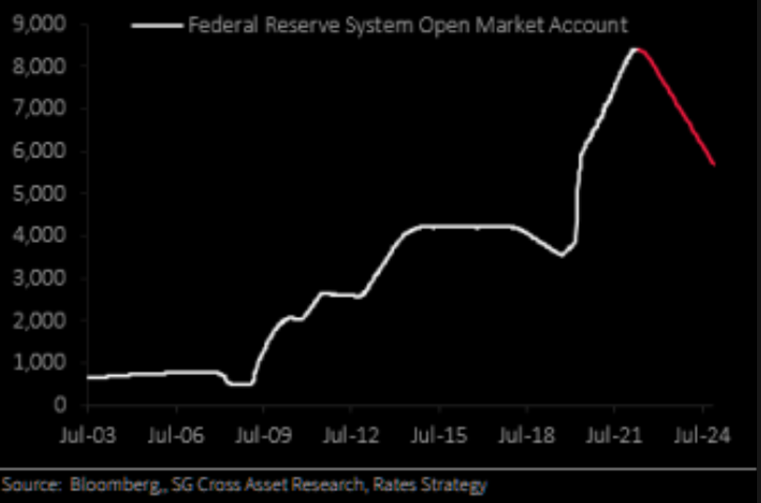

The consensus on Wall Street is inflation will be the driving factor and catalyst for the Fed to taper. The question all investors are debating is whether or not this current spike in inflation is transitory. Some investors do feel that the Reverse Repo market can be another reason the Fed might need to taper sooner rather than later as banks have nowhere to put all their excess cash. The REPO market ended the month at its highest level ever.

We aren’t trying to answer the question of when the Fed will taper or if inflation will be transitory. However, traditionally when the consensus is so heavily weighted to one side, rarely does the consensus get it right. Below we highlight a few data points from May, which could be suggesting growth will slow in the later half of the year, which could cause the blockbuster inflation prints to be transitory. If this were to be the case, the eight month regime change of early cycle re-inflation (value) trade could transition back to mid cycle higher growth sectors.

May’s Inflation and Growth Takeaways:

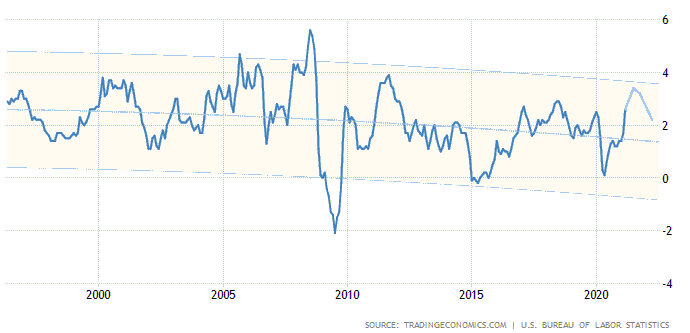

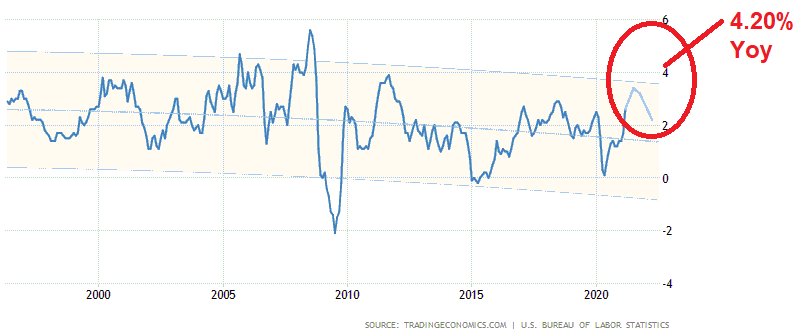

- CPI: May saw CPI break above its long term trend coming in exceptionally hot at 4.20% vs. its expected 3.75%, driven predominantly from new/used cars and housing. However, the treasury market was completely unfazed and yields reverted lower. This reaction by the treasury market could be a sign that it believes inflation could wain.

- Core PCE Deflator soared 3.1% YoY, the hottest print since May 1992. However, Yields that day fell 1.34% after the print, disregarding the Feds key inflation data point. Once again this reaction by the treasury market could be a sign that it believes inflation could wain.

- Treasury Yields: Treasury Yields did not break out of their range. As we mentioned last month, the 10 Year Yield would remain range bound for the short term as bonds remained oversold and it would take a significantly negative catalyst for yields to break above 1.77% on the 10-Year Yield. The 10 -Year Yield opened the month of May at 1.68% to close lower at 1.60%. Our opinion is the markets could be forecasting a slow down in growth in the later part of the year as stimulus dissipates and extended unemployment benefits stop in September.

- Transitory: The question every investor is trying to forecast is: Will inflation be transitory or not? Interestingly enough Fed Vice Chair Richard Clarida stated one week after the massive CPI print that the Fed has not reached its inflation target. Shortly after Clarida’s remarks Jerome Powell said he was not happy with the economic progress. This begs the question will the Fed be late to taper. The markets are certainly behaving as though inflation will be transitory.

- Autos: Autos lead the CPI hotter than expected number to 4.20% above trend. However, the market shortly seemed to have discounted this negative macro event. This supply/demand imbalance does seem transitory, possibly a result of the lack of supply from the semiconductor bottleneck. As this bottleneck opens up, potentially in Q4, this could cool CPI as more supply will come back on-line.

- Wages: Wage inflation also started to creep into the market in May as companies like Chipotle, Amazon and McDonalds could not find workers to return to work, potentially exacerbated by both the state and Federal unemployment benefits packages. Many of these companies are increasing wages, but also paying job applicants to interview. However, the market seems to be sensing that wage inflation will not be an issue once the extended unemployment benefits run out in September. Corporations will find it easier to hire, as many individuals will return to work.

- Growth: In previous quarters consumer spending did fade slightly after both rounds of stimulus checks. One outlier to be considered: Will the massive $2 trillion in consumer savings during the pandemic be powerful enough to cause longer term inflationary pressures. We doubt this is the case, but will monitor the issue.

- Re-inflation Trade: We also saw in the last 10 trading days of May the re-inflation early cycle sectors under-perform. Sectors like materials, industrials and financials underperformed as yields in the mid and long end of the curve declined.

- Homes: New home sales had a significant decline in May as home prices had their fastest increase in prices since 2013. This certainly will cause some deflationary pressure if buyers continue to go on strike and wait for pricing to become more affordable. We assume this will ultimately happen with many other goods like Autos and Consumer Goods. The market seems to be anticipating this deceleration could put a lid on growth.

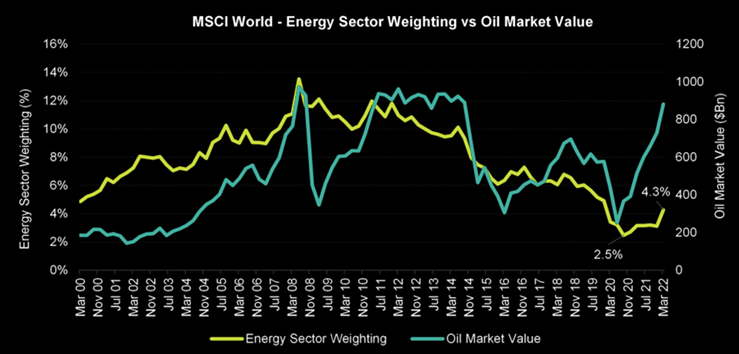

- Commodities: Lastly, below we have the S&P 500 Goldman Sachs Commodity Index that significantly broke out of a 11 year downward trend. Commodity trends typically are longer in nature than equity trends and breaking out of a 11 year down trend can be very powerful and prolonged. Does the recent run up in Commodity prices represent true fundamental (inflationary) demand or simply a function of supply chain shortages? When investors push up Commodity prices based on anticipation of higher inflation this could be deemed non-fundamental longer term inflation and more transitory.

June 4th

Not much has changed regarding our May 14th post stating.

- S&P 500: I find it likely at this juncture the S&P 500 will retest its all time highs of 4,230.

- NASDAQ: likely probability 13,630, and once again I would be selling into this level if you bought any tech on the recent weakness.

Today the S&P 500 futures did hit 4,232, while the NASDAQ futures did close above 13,600 at 13,760. We did say on numerous occasions, 14,000 seems likely.

Today we had bad news that was received very positively because once again that will push out taper talks by the Fed. The jobs number missed by 100,000 jobs, but the whisper was really about a 500,000 miss as the market was looking for 1 million new jobs. This weaker than expected number sent the 10 Year Yield down 4.30% to 1.555%.

In September many extended unemployment benefits will expire and those who are earning less than $32,000 a year will be forced back into the labor market. This will cause an significant increase in new jobs added and will spark rates to significantly increase. Thus I am still a seller of technology as the NASDAQ reaches 14,000.

Next stop to reduce equity exposure for the S&P 500 is 4,300.

May 25th

Now we are starting to really see our theory of lower growth less inflation play out. I do think the market as previously stated is seeing slower growth as Biden’s stimulus comes to an end and the extended unemployment benefits run out in Sept and Oct.

The evidence:

1. Real rates are down significantly since CPI, the 10-Year Yield is 1.567% today after the strongest 2 year auction in 2021 and in the last years. If bond investors were fearful of higher longer term inflation, why would the 2 year auction have been the strongest in almost a year.

2. Energy, materials and financials look very weak as technology continues to catch a bid.

3. New home sales had a significant decline as homes prices had their fast increase since 2013, this will cause some deflationary pressures until prices become more affordable. We will see this with Auto’s and consumer goods. All deflationary.

4. The market senses the consumer will not be able to keep bidding up prices as stimulus benefits start to dry up and the extended unemployment benefits come to an end. All seemingly better for technology as yields could move much lower.

5. I am cautious on consumer discretionary, materials, energy and even financials.

May 24th

As we pointed out last week, there seemed to be a new trend developing where technology could lead as reinflationary, early cycle sectors like energy, financials and materials would lag because the market is forecasting growth slowing in the back half of the year. Weather or not this theory is correct, we wont know for many months.

So far this trend has been 3 out of 4 days, so not much of a trend yet. As we discussed, this is possibly as a result of slower growth and possibly the market discounting inflation as transitory. Deflationary risk are real as every investor is in the camp inflation is going to continue. After the 4.20% CPI print the 10 Year Yield is actually down. The consensus is rarely right, as there are no good market forecasters.

Additionally, the NASDAQ took out a big level of 13,630 today on the back of China trying to cool inflation as their credit impulse number went negative. This is deflationary and inversely correlated to global technology as rates decline.

- If this current level on the NASDAQ of 13,630 holds, the index could retest 14,100.

- As for the S&P 500 nothing has changed in our view from last week, we were looking for new all time highs. Today the index closed at 4,200, so we are only 38 points away from the all time highs.

- Feds Bullard was out saying the Fed is not ready to discuss tapering. It will never be ready, The Fed has no choice but to let this bubble continue or risk a market failure. So far they have done a good job in talking down yields from breaking out since February’s move.

May 20th

Yesterday we pointed out, “something unusual is happening and I don’t know if it is the start of a new trend. However, the 10-Year Yield jumped 2.50% today as the NASDAQ was exceptionally strong yet reinflation sectors energy, materials, and con. cyclicals were crushed. While I cant provide a hard factual explanation. I do believe the market is sensing growth is slowing and the stimulus effects will decline both in terms of growth and inflation and thus sell reopening stocks and get long tech as rates go lower in the second half of the year”.

Today that trend has continued as reopening and reinflation trades were red versus a strong rally in growth, especially technology. Now this could be the narrative as mentioned yesterday that the market is forecasting economic growth to slow, putting pressure on yields, thus this would potentially get the NASDAQ back to 14,000. Last week I did say I thought the S&P 500 would retest its highs and still believe that. Here are a few reasons to be a little more bullish.

- The market was extremely overbought on the S&P 500 level and could not correct to last weeks lows or the typical 7% from the 96 blended S&P 500 reading… Bullish

- The market had some big macro shocks like last weeks massive inflation risk that it completely disregarded… Bullish

- Hedge funds are the most net short in 5 years technology, everyone is positioned for risk off on the buy-side…Bullish

- Tomorrow is a big options expiration day and could take see some downward pressure.

May 19th

Market participants can pontificate on today’s market weakness. Although, as we always say, there will always be a new narrative when markets are overbought and find a reason to sell off. I have been in the camp for well over a year that the Fed’s policies has caused excessive expansion in multiples. This is not a theory, its a fact as equity risk premiums are the second lowest ever next to 1999 as seen below. Unfortunately the Fed is making investors take extra risk. We discussed this two weeks ago with this chart below. We all keep playing the game knowing the risks of extremely low equity risk premiums (S&P 500 Yield / Risk Free Rate 10 Year) are eventually going to cause a lot of pain. However, when does it end, being in all cash can be a real liability.

My point is what is the game changer yesterday or today to make equity risk premiums reverse higher to a more normalize levels. Nothing. Not yet at least. However, when they do normalize multiples will be squeezed. The Fed knows this very well. They know once they stop the $120 billion monthly CMS and other bond purchases along with communicating more taper talk, the market is done.

Today’s Fed minutes was not remotely a game changer, they really said nothing except Kaplan wants to start the taper discussion sooner than later. Fed Chairman Powell knows he needs to keep the market up at all costs. That is why he keeps saying he is not happy with the economic progress. He needs to talk down the markets expectations of tapering.

Furthermore, unrelated to the Fed, something unusual is happening and I don’t know if it is the start of a new trend. However, the 10-Year Yield jumped 2.50% today as the NASDAQ was exceptionally strong yet reinflation sectors energy, materials, and .con cyclicals were crushed. While I cant provide an hard factual explanation. I do believe the market is sensing growth and is slowing, stimulus effects will decline and thus sell reopening stocks and get long tech as rates go lower in the second half of the year.

Bottom-line today in my opinion was not a game changer for the big correction. BitCON caused liquidations in other areas of the market and once BitCON rallied back the market stabilized.

May 18th Market Commentary

The last two days have been slow, but the price action has been terrible. I strongly dislike the type of BS artificial rallies we got last Thursday and Friday as a result of short covering. According to Goldman Sachs Prime brokerage, their Hedge Fund Clients are the most net short the technology sector in 5 years. That certainly can explain for the massive reversal last Thursday and Friday and lack of a bid in the last 2 days.

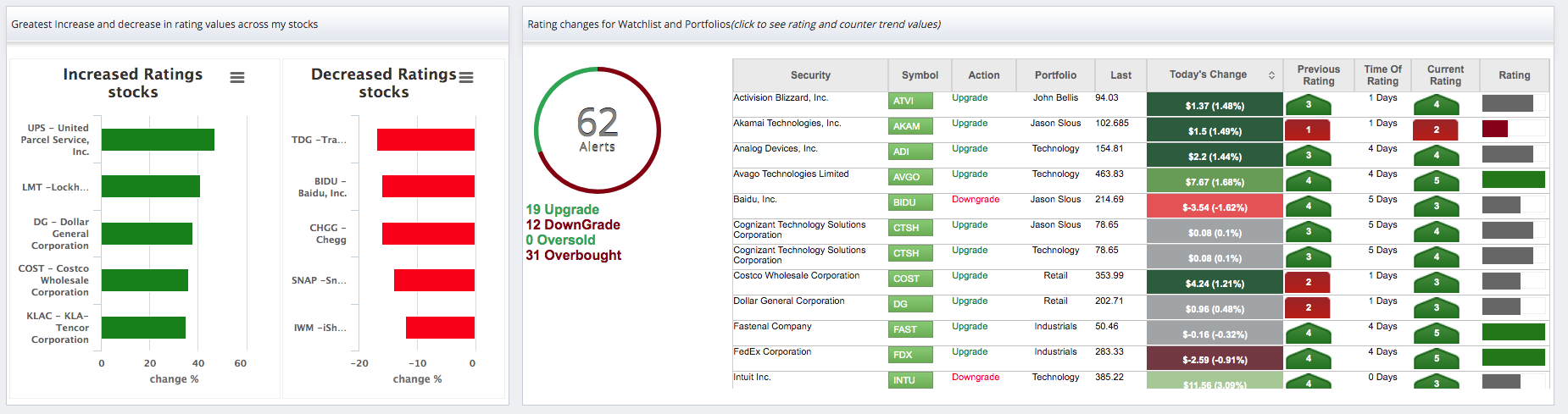

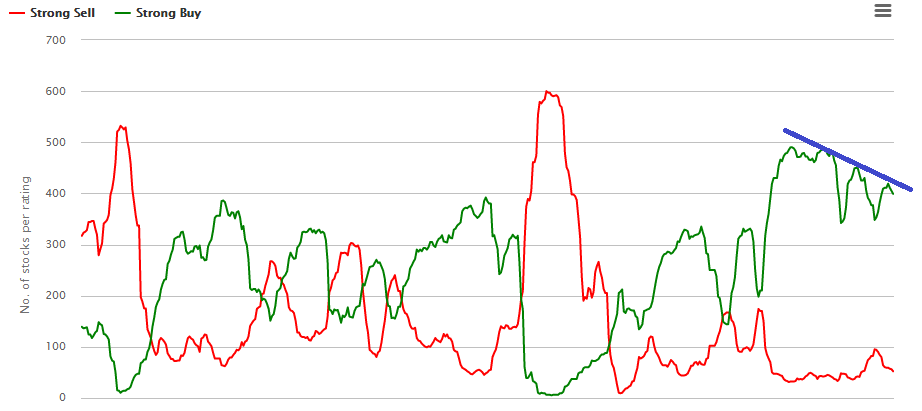

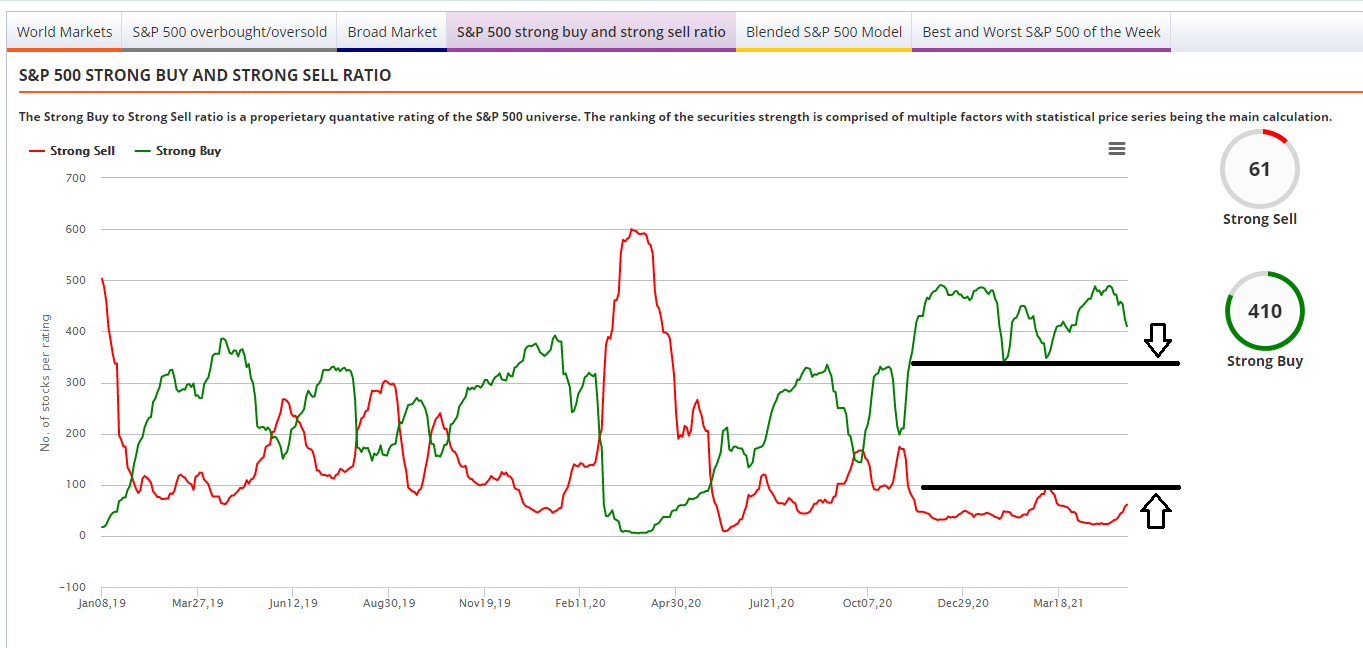

I do not like the lack of participation in the S&P 500, its starting to get narrow. What I am currently watching for in terms of breadth is the Strong Buy to Strong Sell Ratio. We are starting to see the Strong Buys decline and Strong Sells increase. We will have to wait to see where these two lines stop, if not converge.

Market 14th

The strength within the NASDAQ on Wednesday told the story, too much liquidity to take this market down, not even inflation astonishingly can cause more than a 4% correction on the S&P 500.

We said we wanted to get long for short term trade on the NASDAQ futures at 12,700, but that was wishful thinking as the index only traded to 12,896. Furthermore we said getting long the S&P 500 around 3,970 seemed constructive, however the index only reached 4,025.

Today in my opinion was a lot of short covering once again and a rally spark by bad news is good news. Retail sales completely missed expectations, which reduced fears of higher inflation and just maybe the recent inflation is transitory from the fiscal stimulus checks. Which in my belief spells stagflation. For those who don’t think retail sales is that important its, vital as 3/4 of GDP is consumer spending. Bottom-line, we won’t know if inflation is transitory for months to come.

As I have mentioned several times, maybe this liquidity is just too much of a force and has completely backstopped all risk in the market. I can’t begin to tell you have many institutional investors and hedge funds that say the market and fundamentals are completely broken from reality. Something you would never hear on CNBC or the main street banks as they don’t get paid fees to sit in cash

Today was nothing more than machine taking out levels. Once short term levels are taken out they keep bidding to the next level until we get to medium term resistance, this is something that has become more and more prevalent on days of short covering. Between all the excess liquidity the dominance of passive investing and 90% of the intra day volume from non humans. The market is know longer the market you once knew that reflects true price discovery.

S&P 500: I find it likely at this juncture the S&P 500 will retest its all time highs of 4,230.

NASDAQ: likely probability 13,630, and once again I would be selling into this level if you bought any tech on the recent weakness.

May 12th Post Market

Not to much to elaborate upon our morning comments.

- I think the NASDAQ showed a lot of strength today, yes that sounds ridiculous, but it refused to break the 12,950 level we have been discussing. The NASDAQ futures hit a low today of 12,959, only 9 points from our target level. However, I am still not a buyer of technology yet.

- Short term intraday: If the NASDAQ had a large gap down tomorrow to 12,700, I would be buying only for a short term intra day trade.

- Long-term investors: I am not excited about the set up and will be taking our lead once rates either retest 1.77% and fail or breakout to 2%.

- Both scenarios above are very different set ups.

The S&P 500 on the other hand actually had some damage done as it close below the 4,080 level we discussed. Not even financials and energy the two best sectors for rising inflation and rates could remain positive. The next major support area is 3,970, which might be very constructive to start averaging in. This level needs to hold, or 3,895 is the big test level. We will have to wait and see for a game time decision.

We hope that know one jumped the gun trying to buy the dip as we discussed hundreds of times before the risk to reward with the blended S&P 500 model reading 96.70 is not worth adding to longs. We can not call bottoms, nor will we try. All we are attempting to do is wait for less risk in the market to deploy capital to high quality names in sectors that are strong.

May 12th Pre Market

What did we learn today from today CPI, nothing new really. I actually think the market is reacting very well, but the close is what will determine the truth.

- NASDAQ: Yesterday we said with a hotter than expected number the NASDAQ would test 13,060, the low so far was 13,036. It really doesn’t matter anyway, because it shouldn’t be bought anyway. The time to buy the NASDAQ is once we get the next major breakout of Yields, If yields do break above 1.77% and test 2% and this is a big IF, because bonds are still oversold, that will be the time to start reallocating to technology.

- S&P 500 took out 4,109 we discussed and needs to 4,080.

- Again the S&P 500 model was a a massively overbought level of 96.70, it would be very typical for the S&P 500 to pullback to 3,950 to complete a garden variety correction.

As we can see form the graph from yesterday, CPI blew right through the trended forecast.

What could save the market is if Powell comes out within the next day or so and reassure the markets this is 100% transitory. Powell needs to say that today’s CPI jump is not going to be the start of a new bigger trend of inflation.

We will be back after the close.

May 11th The Close

Not even inflation is a match for the massive liquidity.

Massive reversal in the NASDAQ and bid hard right at the the market open, almost 300 points from premarket. The market liquidity is just too much for a plan vanilla 10% correction. More and more companies are raising wages as they cant find workers. This is extremely bad for the S&P 500 earnings because it is less elastic than the NASDAQ as many of the companies are consumer cyclicals and staples. These companies have a harder time passing on these extra costs before buyers reduce spending. Wage increase will certainly hit the income sheet of these companies.

- S&P 500: I remain neutral on the S&P 500 here. We stated this morning the S&P 500 had a lot of support at 4,109, the index tested 4,104. However, the index was weaker relative to the NASDAQ as did buyers couldn’t help themselves as there is just too much liquidity for an old school 10% pullback.

- NASDAQ: I am not as neutral on the NASDAQ and do think its going to cause more pain than financial happiness at these current levels. We stated this morning the NASDAQ had to hold 12,950. The NASDAQ futures only hit a low of 1,3060. We are not day traders so buying any 5% dip in the NASDAQ is not working getting out of bed for. I still am a seller of the NASDAQ names, but not at this level. As we have discussed many many many times, I want to be proactive not reactive. Proactive is selling at 14,000 on the index as we said. Reactive is selling into weakness and too late.

- Tomorrow at 8:30am we have CPI and its going to make or break the NASDAQ. A much hotter number will crush the index potentially to retest today lows. While a much less than expected number will potentially have the NASDAQ test 13,550 and potentially higher. Inflation and expectations is everything for the NASDAQ now. CPI is back award looking, so its possible a retest of 13,060 is bought if the number comes in a lot hotter than anticipated.

- Last month: The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.6 percent in March on a seasonally adjusted basis after rising 0.4 percent in February, the U.S. Bureau of Labor Statistics reported today. The March 1-month increase was the largest rise since a 0.6-percent increase in August 2012. Over the last 12 months, the all items index increased 2.6 percent before seasonal adjustment.

- Below is the annualized forecast for CPI from the BLS. It will take a lot tomorrow to negatively shock the market, as I believe the markets are already pricing in a significant ramp in inflation for the next quarter or 2.

May 11th Premarket

Futures look ugly this morning, but I think anyone looking at yesterdays close could see there was no bid the last few minutes which was unusual. Just a quick note on the S&P 500.

- S&P 500 futures have a lot of support at 4,109, which needs to hold on a close or the index will test an important level which is the mean of this upward trend of 4,080, if you close below this you will get to 3,970. I think if you hit 4,080 today it will bounce off that. For longer term investors, wait to get long. The index is so massively overbought 3% is not enough of a pullback for the risk reward.

- NASDAQ need to hold 12,950, or 12,200 is in play, which might be a decent risk to reward long set up.

May 10th

Today the markets are now starting to worry about inflation. Which we have stated, we have no idea if this current jump in inflation will be transitory or not. However, it doesn’t matter because commodities are telling you all you need to know. Below is the S&P GSCI commodity index and while it broke out 2 months ago of its 10 year declining channel, now today markets are worried of the risk maybe its not transitory. No one knows if it will or will not be transitory.

However, what I will say are two things about the period of inflation.

- How often do you see inflation rises in food and homes to reverse quickly or decline at all? I do not recall a period unless you get a severe economic down turn, which I do not see.

- Commodities trend very well, especially because most of the investors within this asset class are trend followers and systematic global macro traders. After a 10 year decline, I just don’t see this trend ending so soon.

This is why we have said for over 6 months now we disliked Technology as this sector is most at risk of inflationary pressure that will contract multiples.

- The NASDAQ needs to hold 13,300 on the futures. A close below this level the index has little support until 12,900. Maybe we walk into tomorrow and we are up 300, However, I think at this juncture, we all realize high growth is currently not a safe place to be hiding out right now. I felt this way since October and I still feel that way.

- The Fed is not going to do anything about being less accommodating after Fridays jobs number, yet inflation is picking up. Furthermore, I believe the Fed is off based to tied all policy strictly to pre Covid job statistics. The weak jobs number this pass Friday in my opinion was a result of labor shortage and not economic weakness. The State and Federal unemployment benefits has created a situation where anyone making less than $32,000 a year does not want to return to work.

- Lastly, now we are seeing something new, “wage inflation” starting to creep into the markets. Today Chipotle said it is raising its minimum wage as they cannot find workers and McDonalds is in discussions as well to do the same.

May 7th

Mid morning

Just a remember the S&P 500 hit our 4,220 level were reducing more equity exposure is warranted. Let me stress, this is not an attempt to call market tops. As we said a week ago, it is possible we see a 1995 and 2018 melt up were the blended S&P 500 model reach 100. At which juncture we could see 4,300, I did say I didn’t think we would get to 4,300 without a pullback first. Unfortunately , I don’t call 2% a pullback to 4,120.

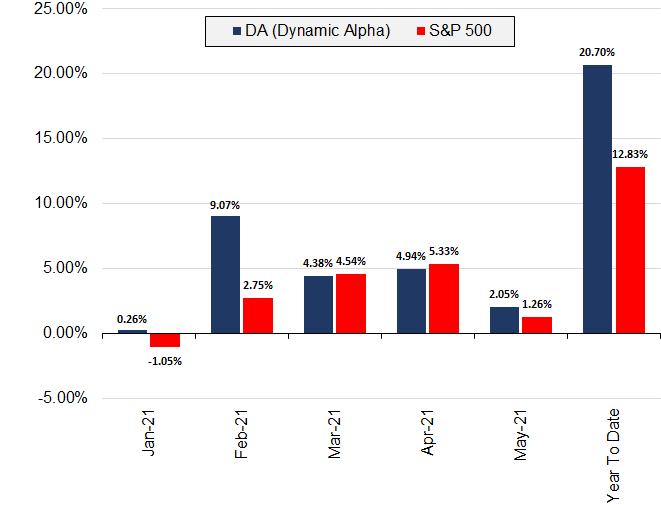

I have also respectively said everyone has a different objective and risk tolerance. The way our firm Trowbridge Capital Partners manages money is a risk first approach. We care first and foremost about migrating large draw downs not crushing the S&P 500 with excessive risk. As of May 7th our Dynamic Alpha portfolio is in 50% cash, but we are already up 20.70% for the year. This is the trade off for any investor. If the markets not make a parabolic move higher we will certainly miss out.

Remember, there is no way to neutralize risk perfectly without sacrificing some upside. We just want to be as systematic as possible and that is why I have been suggesting at large levels reducing some not all equity exposure.

Disclaimer: Trowbridge Capital Partners is not an entity of ChartLabPro.com

Disclaimer: Trowbridge Capital Partners is not an entity of ChartLabPro.com

Performance data quoted represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns, and principal value will fluctuate and shares when sold or redeemed, may be worth more or less than their original cost. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. The performance figures are net of fee performance. Actual investment advisory fees incurred by clients may vary. Performance does reflect dividends reinvested and commission generated from transactions. S&P 500 compounding return is calculated using daily data based on the closing price with dividends. Data provided by yahoo finance via Interactive Data.

NASDAQ

As for the NASDAQ I have been saying reduce technology exposure at 14,000 and still think the same. I would also as I have said many time now reduce technology if the 10-Year Yield reaches 1.40% to 1.45%. This is because their is big support at this level and will give the shorts a chance to reload for higher yields.

I won’t be writing the rest of the day as I am sure everyone is tired of my emails.

Premarket

Wow a very disappointing April payroll. Some whispers were for 2 million new jobs and the consensus was 1 million. The number came in a just 266k. My theory is lower wage job workers are making too much in unemployment benefits to go back to work. McDonalds is now pay some applicants in Florida $50 to interview. If that doesn’t tell you something about the current shortage of workers, I don’t know what will.

In reaction the 10-Year Yield took a nose dive down 5.10% based on Fed tapering expectations. In contrast, the NASDAQ jumped 200 points as rates were hammered to a 2 month low. I am uncertain the NASDAQ will hold these gains as the 10-Year Yield has rallied off the lows gaining 3.5% since writing this.

We will be back after the close of market today.

May 6th

Once again the market demonstrated unbelievable resilience almost ignoring all the negative news. Today’s close had all the makings of a short covering melt up into the close.

I say this for the following reasons:

- There was no positive catalyst’s for the S&P 500 to rally 34 points and the NASDAQ 110 respectively.

- We actually had negative Fed rate talk early morning as Dallas Fed President saying the Fed should start tapering sooner rather than later.

- Biden said he will keep Trump’s Investment Ban to keep pressure on China.

- Late day into the close the Federal Reverse released its semi-annual Financial Stability Report stating the following:

- “…should risk appetite decline from elevated levels, a broad range of asset prices could be vulnerable to large and sudden declines, which can lead to broader stress to the financial system.“

- “Elevated equity issuance through SPACs also suggests a higher-than-typical appetite for risk among equity investors.”

- Vulnerabilities associated with elevated risk appetite are rising. Valuations across a range of asset classes have continued to rise from levels that were already elevated late last year. Equity indices are setting new highs, equity prices relative to forecasts of earnings are near the top of their historical distribution, and the appetite for risk has increased broadly, as the “meme stock” episode demonstrated. Corporate bond markets are also seeing elevated risk appetite, and the spreads of lower quality speculative-grade bonds relative to Treasury yields are among the tightest we have seen historically. The combination of stretched valuations with very high levels of corporate indebtedness bear watching because of the potential to amplify the effects of a re-pricing event.

After reading a few excerpts from the Fed’s Financial Stability report they absolutely know they are inflating a bubble and realize that they need to keep the bubble going or else it will all collapse causing significant pain. At all costs Powell will keep the narrative no inflation long term and rates are going nowhere.

May 5th

Early Morning

- Markets early trading got a lift after Yellen walked back her comments about inflation and rates, especially the NASDAQ. At all costs the Fed and now the Treasury will do what is necessary to convince markets that there is no inflation. Yesterdays reaction is a warning to those investors who think valuations can be supported at these levels without the Fed easy monetary policy.

- The question is will historical multiples ever return to normal as it seems plausible that the Fed will never be able to remove their bond purchases or raise rates.

- While I am not bearish because of the technical set up, I am very concerned how dependent upon the market is on the Fed at these current valuations, especially as the economy does not need emergency liquidity programs. Granted this has always been the case since the Fed’s existence, but never more so than now.

Mid Day

- Mid Morning the markets did give up the early gains as yet another economic data point suggested the potential for growing concerns over stagflation. ISM Services disappointed with their April expectations as output declined, however, prices increased. Although, the bond market did not really reflect this.

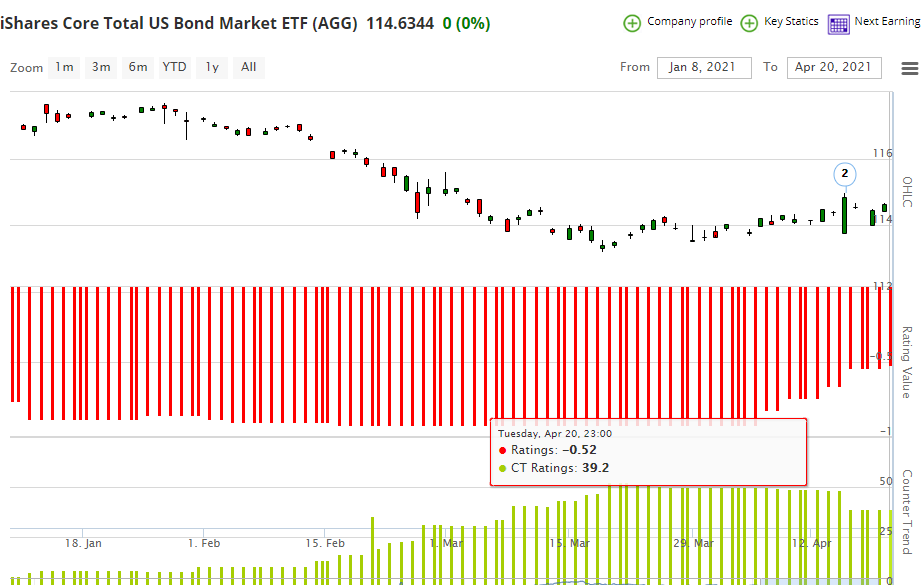

- The reinflation trade (financials, energy, materials) was bid for again for a second day, while large cap tech was weak. However, longer dated yields were negative. As we have said for weeks, until this oversold condition is worked off, in my opinion it will be hard for yields to move a lot higher or breakout. Our Counter Trend for AGG is still a +29.14, which is rather oversold. See chart Below.

Late Day

- Late day trading the NASDAQ reversed almost 160 points from it’s high on news the White House will back the WTO plan to Waive IP Protections for COVID Vaccines. While this is not a real catalyst in my opinion for a real sell off. It is another anti-probusiness move from the government, which was perceived negatively. The NASDAQ was hit the hardest on a relative basis as U.S. technology is especially sensitive to IP as the sector has been fighting to keep it’s IP protected from China. The bottom-line line is, it won’t take too many negative catalysts to start eroding the short term positive trend at this massively overbought condition.

IMPORTANT: Job number May 7th

Friday we get the jobs number and this is the most important data point right now as the Fed policy is strictly tied to the employment rate. The consensus just around 1 million jobs created. However, it is well publicized the market is looking at close to 1.5 million jobs created. I would fully expect anything greater than the whisper number of 1.5 million for the markets to spike significantly and sell off hard as rates will rise in fear of the Fed moving. However, the Fed is never going to taper and this will be an overreaction.

Job number May 7th

Friday we get the jobs number and this is the most important data point right now as the Fed policy is strictly tied to the employment rate. The consensus just around 1 million jobs created. However, it is well publicized the market is looking at close to 1.5 million jobs created. I would fully expect anything greater than the whisper number of 1.5 million for the markets to spike significantly and sell off hard as rates will rise in fear of the Fed moving. However, the Fed is never going to taper and this will be an overreaction.

May 4th

Markets also took an additional hit right after our morning email as Janet Yellen had a pre-record speech at The Atlantic Future Economy Summit. However, she has no control over monetary policy, so does it matter what she says anyway? No, and the weakness in Tech has been evident for several days prior. Here are the two statements from Yellen that hit the markets.

- “It may be that interest rates will have to rise a little bit to make sure our economy doesn’t overheat”

- “We’ve gone for way too long letting long-term problems fester in our economy”

The markets were mixed later in the afternoon as the reinflation trade was alive and well and bid, like Materials, Energy and Financials. I actually think the S&P 500 was very strong. The NASDAQ held its support level we discuss of 13,400 today. We will have to see what tomorrow brings for the index.

Oh but wait, before the ink could dry, Yellen walked back her comments on The Wall Street Journal’s CEO Council Summit

- “Let me be clear it’s not something I’m predicting or recommending”

- “transitory for the next six months or so”

- “if there is an inflation problem she is certain the Federal Reserve can be counted on to address it”

The word of the Day “Stagflation”

Now every Bank is worried about inflation! The consensus by most Wall Street strategist is that rates will continue to rise in Q3 and Q4 as there will be a temporary rise in inflation. However, the real outlier is once all the monetary and fascial emergency stimulus is exhausted, will inflation moderate significantly. This spike in inflation caused from all the excess stimulus, will presumably put a drag on the economy as prices of homes, autos, food and energy continue to rise. his could ultimately cause stagflation, as higher prices put a drag on the consumers purchasing power, thus hampering economic growth without additional stimulus or real wage growth.

We have been rather adamant about reducing technology once the NASDAQ hit 14,000. As you will recall, we believed this regime change from growth to value was not over and have been less bearish on the S&P 500 because of its diversification. Investors are now getting concerned and talking about stagflation. Yesterday we saw this with rising prices with weaker ISM than expected. Today we got a weaker US Factory orders but higher prices. The last thing we want is weaker economic data points with higher prices. As you know, I always say when you are this overbought in this case a 96.70 on the blended model, the market will just just create a new narrative to worry about to cause selling. At the end of the day, the pullback is strictly a result of mean reverting technically.

Market Levels

- NASDAQ (futures) has a large support level at 13,400.

- S&P 500 (futures) has a large support level at 4,080

May 3rd

The only real market catalyst in my opinion today was ISM Manufacturing and Markits Manufacturing PMI. The early reaction was deflationary as the 10-Year Yield reverted 3.25% causing the NASDAQ to rally 90 points and the RUSSELL to revert lower off the initial headline numbers. While the numbers came in exceptionally strong on a historical basis, the market was disappointed. There is a lot going on within these numbers as the readings were pushed higher from delays and prices paid increased. But the initially take away was the market (NASDAQ) seemed almost relieved the numbers didn’t come in as hot, almost alleviating some inflation fears, even though prices paid did increase.

However, by mid morning the NASDAQ reverse 170 points off the highs and the 10-Year Yield recovered 2.25%.

April 30th

Month end and some rebalancing for May.

- Rates once again declined on 2 strong economic data points today, which can only be a result of bonds still being in an oversold condition.

- Strong economic data today, yet the inflation trade moved lower? The market had an inverse reaction today as University of Michigan Sentiment & Chicago PMI came in exceptionally strong. Yet, yields reversed lower, Small caps were slammed and reinflation sectors like Financials, materials and energy were hit the hardest.

- University of Michigan Sentiment hit a new pandemic high in April from 86.5 to 88.3. Oddly, you would assume an increase in consumer confidence would lead to a rise in yields and not a decline of 1.40% on the 10-Year.

- Furthermore, Chicago PMI ripped higher from 66.3 to 72.1 in April. PMI has not had a reading this high since February 1980. Again, why are rates not moving higher off this expansionary economic data?

- S&P 500: The blended S&P 500 model is now at a 96.70 the third most overbought level since 1992. This is why we sell or reduce equity exposure in tranches and not all at once. Know one can time the market, we are simply reducing risk at frothy levels. We have stated, reduce equity exposure at 4,130, 4,180 and waiting for 4,220 to reduce more. Can the model reach 100 obsoletely, there is roughly a 12% probability if we use historically calculations. 100 would take the index to roughly 4,300 on the index. However, I think we are closer to seeing a pullback than advancing to 4,300. I would like to see a nice healthy pullback to 4,036. If 4,036 does not hold the bigger level to get more aggressive would be 3,950.

- NASDAQ: Nothing has change in our opinion here and still do not like higher multiple technology for the basic fact once the oversold level on bonds is worked off, the 10-Year Yield will at least retest 1.77% if not break above this level. A break above 1.77% will cause another reset in pricing.

April 29th

- April 29thA lot of things happening today in the markets. As yields go so does the market.

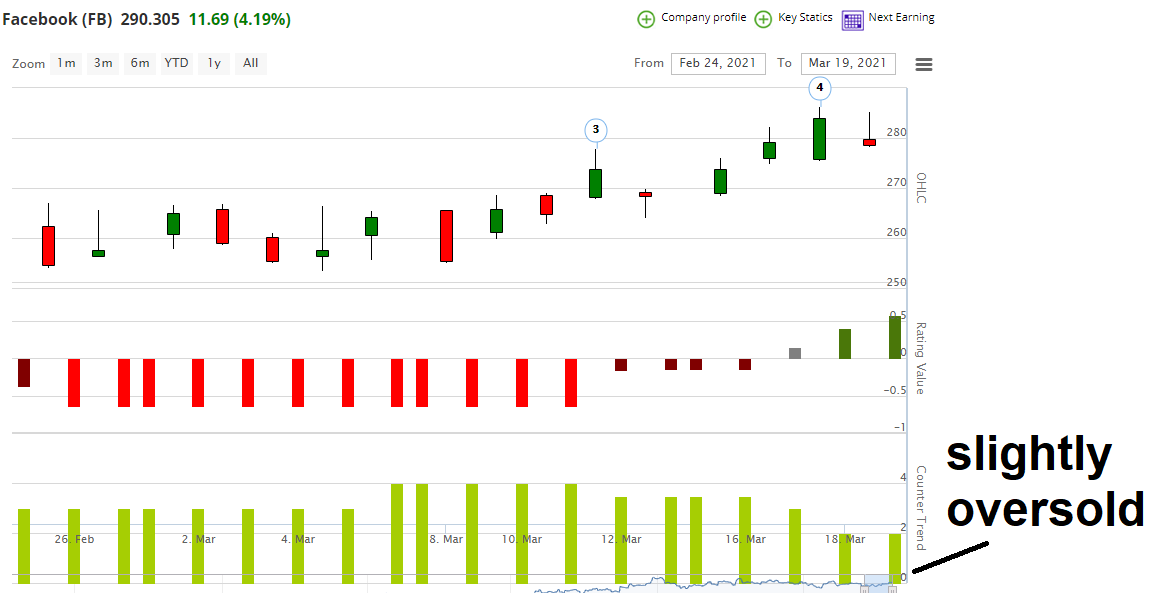

- Growth at a reasonable price: Today was a good example of what we talked about a few weeks ago about understanding buying growth stocks at a reasonable price. It is my opinion as rates rise higher multiple growth stocks will be most effected. As we stated, Facebook was fundamentally cheaper than an Apple based on its growth rate and forward multiple. Thus Facebook would hold up better if rates rose. This morning both reported earnings and saw their prices significantly rise initially. However, Facebook held onto its gains, while Apple faded 4% into the red. This in my belief is because FB was relatively much cheaper vs. AAPL. Again, I am not a fundamental analyst and a quantitative trend follower, so take my point of view with a grain of salt.

- Yields: Today the economy saw positive jobless claim numbers, although this was expected. Job numbers is the Key to everything in the market right now as it will dictate the path of the Fed’s tapering. Shorting after the job number release, the 10- Year Yield jumped 4.00% to a meaningful resistance level of 1.677% before reversing. This was one of 2 main catalysts why the NASDAQ peak to trough reversed almost 260 points. (see chart below)

- The Administration: Another factor for the reversal in the market today was news that the administration would start to view gig employees as apart of employment numbers. These would be Uber type of jobs. This is perceived to be important because it would positively skew the job numbers, ultimately that could impact the Feds tapering decisions. I personally think, its a big nothing to worry about.

- S&P 500: The S&P 500 futures hit an all time high of 4,210, almost hitting our target of 4,220. The S&P 500 had every opportunity to make a key reversal of a significant gap up opening to close red. However, rallied back significantly to close at 4,195.

- NASDAQ: The NASDAQ Futures as well hit an all time high today at 14,064. I have been very cautious on tech and still remain so as I do think rates are going higher. However, the index was saved today from a key reversal. The index had every opportunity to fail today and could not.

April 28th

Today was Fed day. The market is beyond resilient and the price action is exceptionally strong. The S&P 500 once again made an all time high intra day before reversing. The S&P 500 futures hit 4,193.75. As we mentioned, we are looking for 4,220 to reduce more exposure.

Today was Fed day. The market is beyond resilient and the price action is exceptionally strong. The S&P 500 once again made an all time high intra day before reversing. The S&P 500 futures hit 4,193.75. As we mentioned, we are looking for 4,220 to reduce more exposure.

The story with the Fed remains the same, why should this day be any different:

1. At all costs control the narrative of inflation being transitory.

2. Committed to not removing any liquidity programs or rates for the foreseeable future.

3. The economy is growing and improving

Its really astonishing the Fed is still in the market purchasing $120 billion a month at this part of the cycle. As we mentioned several weeks ago, how can the Fed know if the rate of change of inflation will be transitory. We said its impossible for them or anyone else to truly know this. Just yesterday Jeffrey Gunlock told Bloomberg, the Fed is essentially guessing and hasn’t a clue if inflation will be transitory. Hopefully they are right and there will be a smooth transition. The Fed is so backed into this corner now, the slightly move off zero rates will trigger significant market disruption.

As we mentioned several weeks ago, how can the Fed know if the rate of change of inflation will be transitory. We said its impossible for them or anyone else to truly know this. Just yesterday Jeffrey Gundlock told Bloomberg, the Fed is essentially guessing and hasn’t a clue if inflation will be transitory. Hopefully they are right and there will be a smooth transition. The Fed is so backed into this corner now, the slightly move off zero rates will trigger significant market disruption.

I firmly believe nothing matters now except the Feds narrative. Today, they were able to talk down the middle to the long end of the curve in Treasuries. If they can keep this magic act up equities will keep moving higher. Multiple’s will just keep expanding as long as revenue comes in slightly better than expectations on earnings. Tonight you had just that with FB – Facebook and APPL.

S&P 500 Multiple Yield

Below is an interesting & fun looking chart. The S&P 500 is now yielding 1.45%, the lowest yield since 1.20% in 1999/2,000 which was the lowest yield ever for the index. Has the market structurally changed forever because of Central Banks intervention and will we see 1.20 in this cycle?

Friday 23rd

Another Day another S&P 500 record high. However, the market has been seeing some selling pressure the last 20 minutes in the last 2 days. You have AAPL, MSFT GOOGL and AMZN reporting this week. They make up over 20% of the S&P 500 market capitalization, however, I don’t think in-line earnings or even a miss in earnings will derail the market. This is because true fundamentals don’t matter. Until, the Fed or the market starts to hint at reducing the emerging $120 billion monthly liquidity purchases the market has a back stop.

TSLA reported earnings and while I will not go into the valuation. Here is a interesting note from Zerohedge I could resist highlighting.

- TSLA reported $594MM in income from operations, but regulatory credits accounted for a whopping $518MM of it, the highest on record and up from $401MM in Q4 2020.

- So while GAAP net income was just $438MM, this means that for yet another quarter the company did not generate actual net income without regulatory credits. Add that another $101MM in profits came from “sale of bitcoin”..

- TSLA owning $1.3BN in digital assets at the end of the quarter, which means it sold around $272MM of the bitcoin it previously owned.

- So in addition to over half a billion in reg credit sales, made $101MM in profits from sale of $272MM in bitcoin (reducing its total from $1.5BN to $1.331BN at the end of the quarter).

Enough with TSLA. We have CPI on deck and that will trigger the markets. However, I still think Yields on longer dated bonds are going to trade in a tight range until bond are bought and the shorts get a chance to reload. I think investors need to reposition their positioning IF and when the 10 year does retest 1.40 to reduce technology and get long financials.

Sunday, April 25th

Food for thought

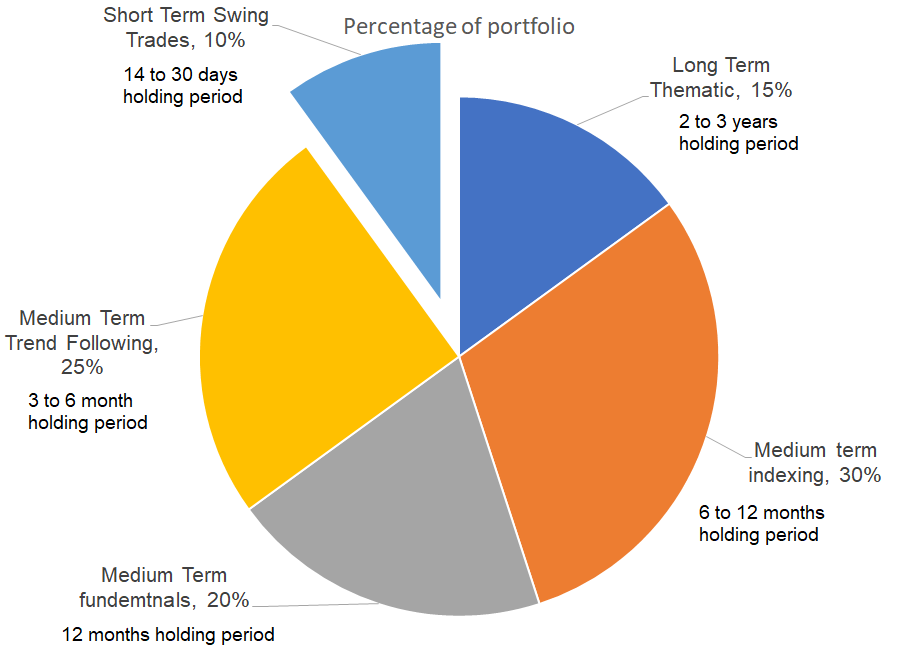

I thought I would provide some simple insight not with the markets but more on process. Investment process is one of the most important aspects of investing. While this lesson may seem logical and for beginners, it might help you generate more alpha and become a better investor.

Diversification

Diversification is vital for both performance and risk management. Diversification often is thought of correlation or “correlation coefficient”, how two assets move together in relation to each other. For a well diversified portfolio we want assets that have low correlations with each other. Think in terms of equities vs. bonds, historically equities fall, bonds rise and protect a portfolio to a certain degree because of the inverse relationship. I realize this is investing 101 and you get this concept already. I am not going into the benefits of the correlation matrix of assets and sectors. But if you are a long term investor and don’t have an understand of your diversification within your portfolio, you certainly should.

Today we want to talk about another type of diversification besides correlation, “time”. Yes, time can help you generate alpha and mitigate risk, especially when markets are oversold and overbought.

Lets take this hypothetical example of Investor A.

Investors A. allocates his/her portfolio based on several trade and investing strategies and time periods. As a systems trader/investor, I like to have a process that is mapped out and will work for most investing periods. Each time frame should have different sell rules, which we will not discuss today.

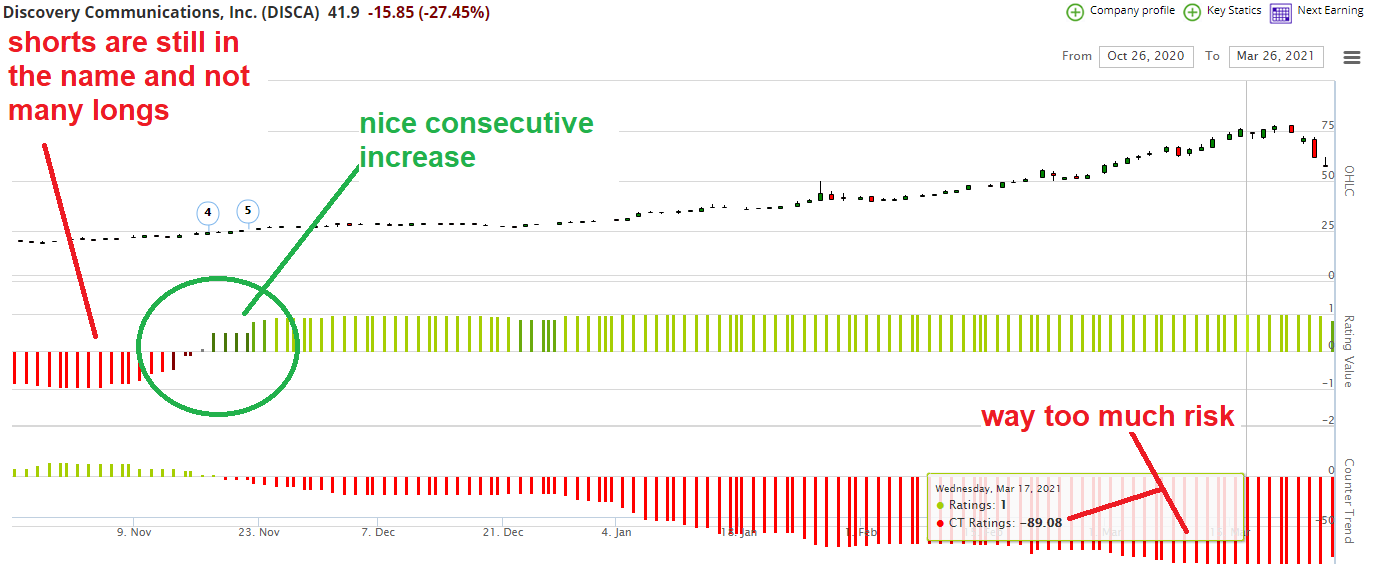

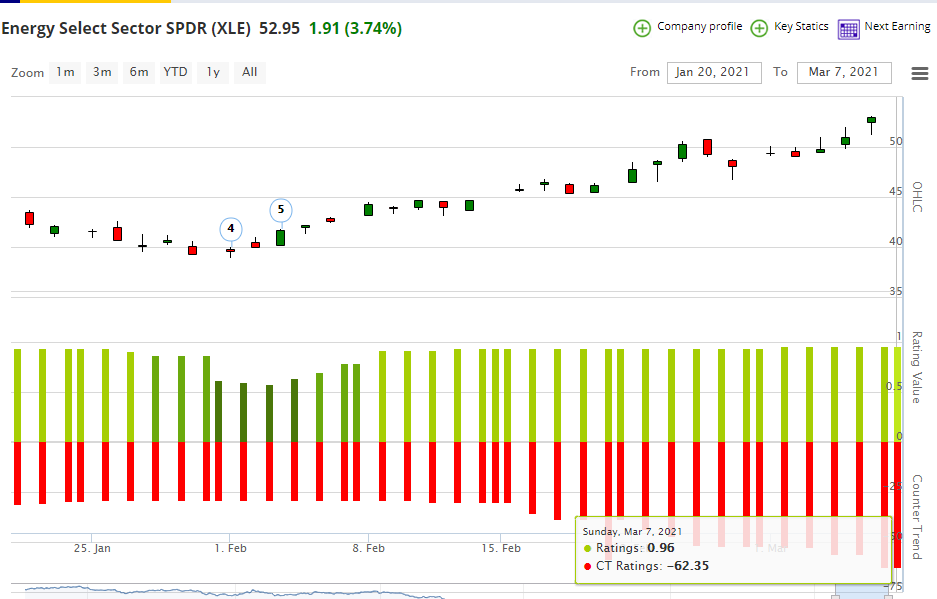

What I want to discuss is the shorter term swing trading as the S&P 500 is very overbought. As we raise cash in stocks that have massive gains, we can still take advantage of potential new opportunities that are just starting to breakout. Selling stocks in our portfolio that have had massive gains over the last 4 to 6 months and overbought is prudent as they will sell off the hardest in a correction. However, stocks that have not participated and just starting to break out or just moved to a 5 or strong buy could have some potential to outperform the index.

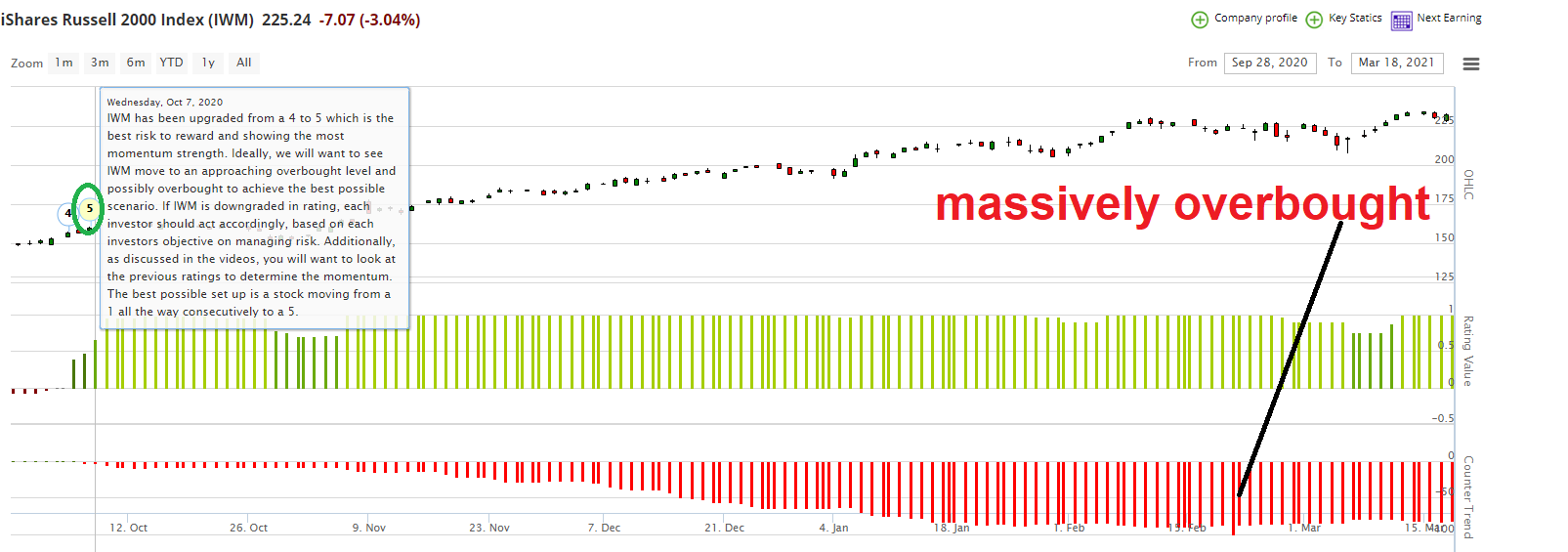

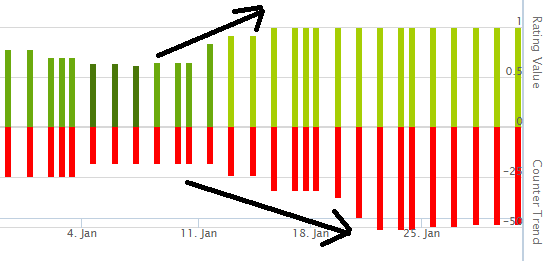

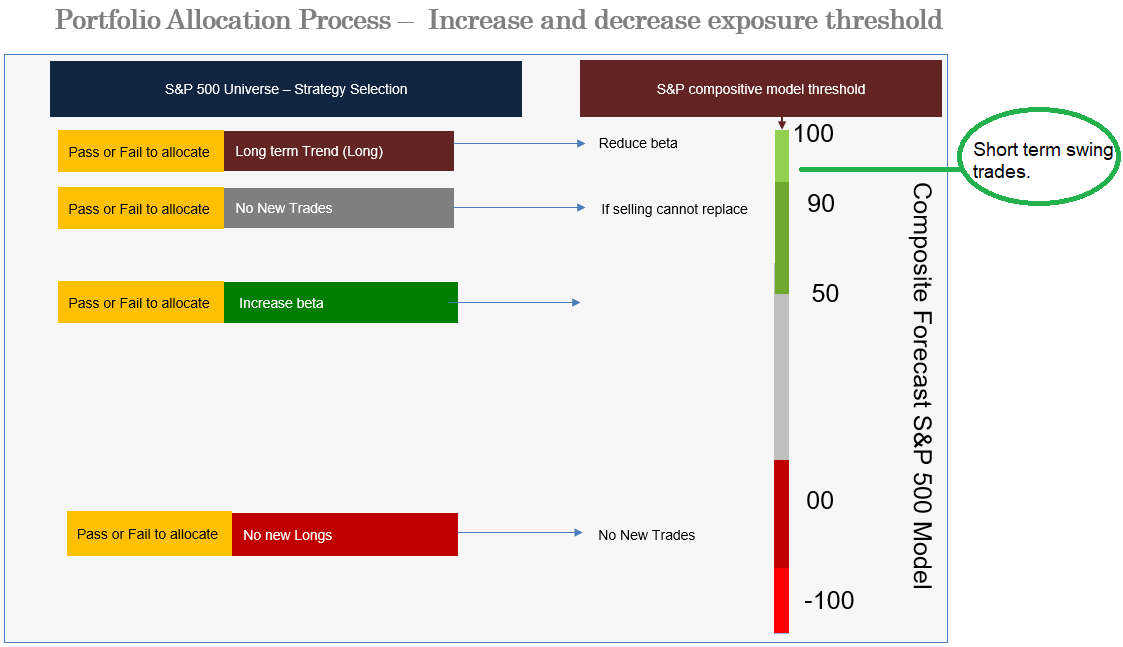

The second graph is how I visualize how to both proceed with caution and yet try to take advantage of short term trading in massively overbought markets.

Since these swing trades are meant to be lower risk and shorter term. I will typically look to exit the position with either 1 rating value decrease or 1 CT increase.

Well today was interesting to say the least. New all time high on the S&P 500 at 4,186.75. Yesterday was rather telling, as we mentioned the price action wasn’t that bad based on the news in my opinion. I think today was nothing more than large funds positioned for a sell off. Once the indices couldn’t break lower at the open, coupled with better economic data, the short covering began to cover. Once covering started, the intra data day system traders bought to take out every support level. The move was completely mechanical.

New home sales came in the highest in 15 years and U.S. Manufacturing and Service PMI rocketed to record highs. However, yields did basically nothing with the 10-Year Yield up .90bps. Both economic data points clearly suggesting more inflation. However, as we know bonds are still oversold and need to work this off before yields can take out the 1.77% level.

For those investors who reduced exposure at 4,180, there is nothing to do. As previously discussed 4,220 is the next level to sell into. The question we get a lot is how much cash should investors raise. Unfortunately, that is not something we can answer for you. It comes down to your preference and risk tolerance and time frame. The your higher risk tolerance and longer the time frame, the less you will want sell is a general rule of thumb.

This process has worked well for me over the last 2 decades. For those oh you who invested in 1999, will realize you can’t have your cake and eat it too. We want to be proactive and not reactive, not to sell after the selling has taken place.

I did not think today’s sell off was that bad. We held the lows from Monday on all the indices. I question, who didn’t see Biden’s aggressive tax plans coming? For weeks he said infrastructure spending was going to be supported from higher taxes. Granted, the Capital Gains tax increase was maybe more aggressive than many were expecting, almost a double! From my understanding, its almost double the current rate of 20% on Capital Gains rate for those who earn more than $1 million in ordinary income. This is very different, but equally as negative as higher corporate taxes for the markets. Why is this so relevant to the market?

- More Selling: You will get a large amount of investors who will front run the higher rates by selling now at 20% Cap gains rate. This will put a ceiling on the rally in theory. However, maybe the liquidity in the system will soak it up. We can’t quantify how this plays out.

- Less long term support: You will also get less long term capital coming into the markets that will bid up the market creating less demand.

- Not Pro Business: Lastly, the other reason, this will be perceived as unfriendly economic not pro-growth policies from the administration.

- Overall the price action in my opinion wasn’t as bad as it should or could have been. Well off Mondays lows, however, that doesn’t mean we wont see follow through tomorrow.

- We have said many times rates would be an issue only until it smacks investors in the face.

- Now many bulls will suggest this will never get passed, but they are missing the bigger picture. Biden is not about Wall Street friendly policies and this just should everyone how serious he is.

Conclusion:

Don’t buy into the first 1% pullback when the S&P 500 model is still at a massive 95 overbought reading. You will get a much better chance as the odds of a further decline is growing. Massively overbought markets as we have said repeatedly take weeks to correct, as dip buyers keep buying strength. This is the biggest mistake cause by behavior bias of past trends.

However, there has been not technical damage.

- S&P 500: Until the S&P 500 closes below 4,100, nothing really has changed. A close below 4,100 will test at least 4,040

- NASDAQ: Until the NASDAQ closes below 13,670, nothing really has changed. A close below 13,670 will test at least 13,402

- Yields drifted lower and the NASDAQ caught a bid. The fact the NASDAQ recovered from the lows around 10am and the quants kept bidding up any pullback throughout the day as shorts got squeezed. We keep seeing this over and over throughout the last 18 months. As we have said, 90% of the intraday volume is derived from Quants, this is not fundamental investors driving the market anymore.

- Investors over the last few weeks have been de-risking, according to Goldman Sachs fund out flows saw their highest levels in several quarters. Sell side strategist including (Goldman, Morgan & BofA) and including ourselves all have said in the past few weeks the markets were becoming overbought.

- So was that it, a 2% pullback and now we take out the highs? I am not sure, but if we were going to correct, today was the chance to close lower and we couldn’t fail. This was massively bullish.

The S&P 500, NASDAQ and RUSSELL

- A complete reverse of yesterdays small cap and financial weakness as the Russell lead the indices higher up 2.07% at its high. The NASDAQ was most impressive as the index rallied over 160 points from its low to high today. However, the NASDAQ was the weakest performer today of the three indexes.

- Today had not impact on our view.

- We are in the camp of scaling out as we go higher period:

- S&P 500: If you already reduced exposure at 4,1800 (futures), do nothing until IF & when the index reaches 4,220.

- NASDAQ: If you already reduced exposure at 14,000 (futures), do nothing until IF & when the index reaches 14,450.

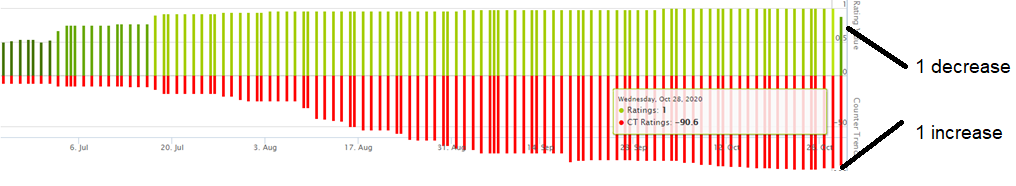

The one thing I am watching closely are Treasuries. Bonds still have not rallied enough to have worked off the massively oversold level. The counter trend (CT) which is our proprietary way of measuring overbought and oversold conditions is fair superior than how traditional technicians use RSI. The CT is still reading a 39, which is still oversold and I would expect before Treasury yields resume higher, the CT rating could get close to 0. This is exceptionally important and it will dictate the rotation of the next move into the NASDAQ or Small Caps and the early cyclical trade. I have no conviction at this current level, I just want everyone to understand this is what I am watching closely.

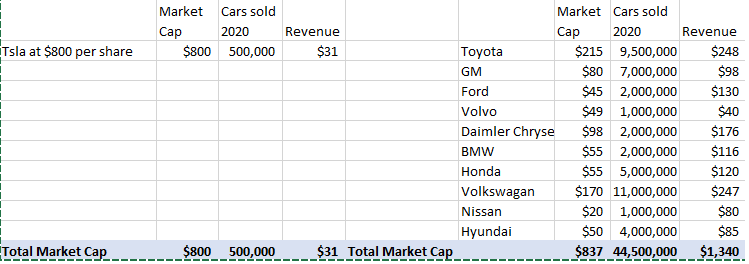

In the last two weeks I had a few people mention TSLA to me and while I don’t recommend stocks, I did want to point out a few things fundamentally. As we all know, ChartLab is a trend following system, so we don’t care about fundamentals with our signals. TSLA is a great trend following stock to trade, however, fundamentally, I personally think the valuation is not rationally priced. While I am a believer that the EV market will dominate the future of car sales, that doesn’t mean TSLA at the current valuation is logical.

As we see below, TSLA at $800 a share had a market cap of $800 billion, $37 billion less than the largest 10 car companies in the world combined $837 billion market cap. TSLA sold 500,000 cars vs. 44,500,000 million collectively for the top 10 care companies. Understandably, TSLA growth of units sold and revenue is significantly higher than these other companies. However, my question is not so much on the current valuation, but the future of these other 10 companies. Is it to be believed that these other companies will have little participation in the EV market in the future? I highly doubt it, so one side of this equation is missed priced on expectations of the future.

Volvo is on record stating, Volvo Cars is committed to becoming a leader in the fast-growing premium electric car market and plans to become a fully electric car company by 2030. By then, the company intends to only sell fully electric cars and phase out any car in its global portfolio with an internal combustion engine, including hybrids.

This is not a recommendation either way to buy or sell TSLA, just a high level observation.

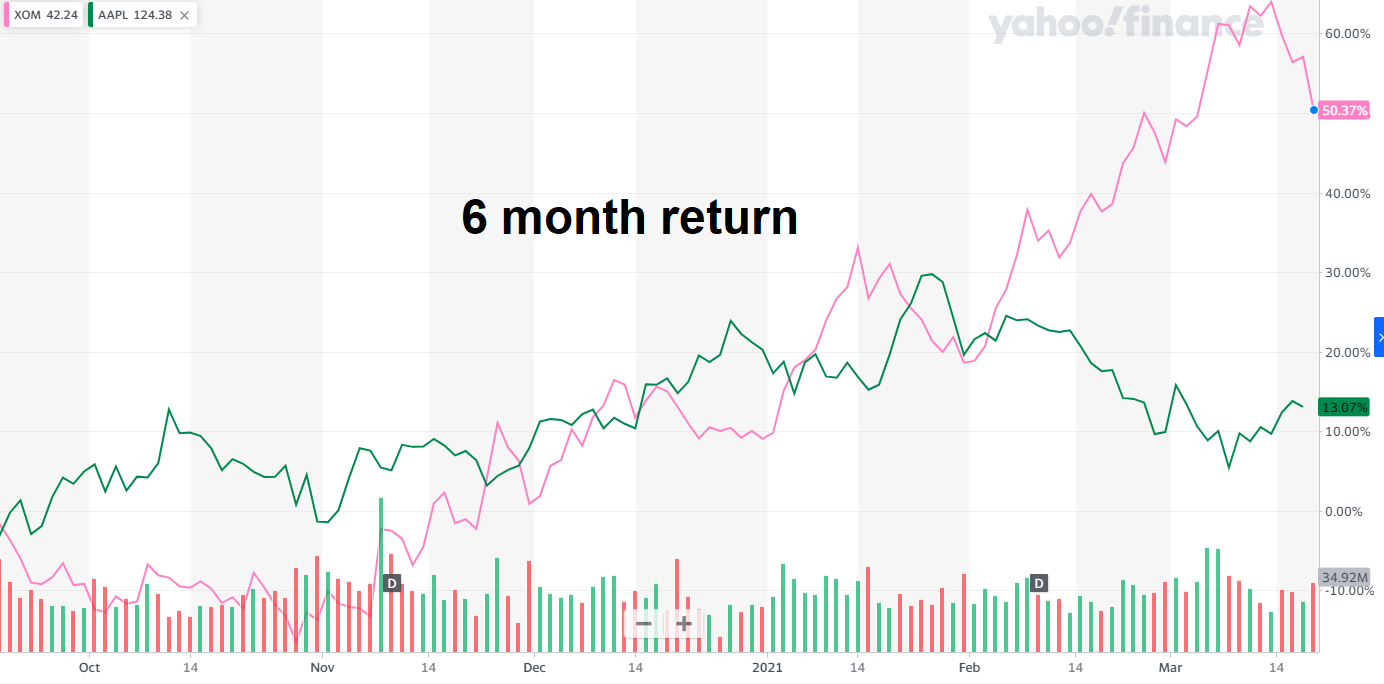

No catalyst for today’s weakness, this is purely technical. Stocks with the great 6 month returns like the massively overbought financials and small caps were pounded today. Overall the NASDAQ and S&P 500 had no real damage. For almost 6 months the reinflation, early cycle trade has outperformed and this is purely some reversion. The question is how do we make money going forward. There will be a great opportunity to get long, however, we first need more downside for a better risk to return set up. There is no certainty this will occur, however, this is what we hope for.

No change in our view. We have expressed our view to reduce risk in equities for several weeks once the blended model reached 95 and 95.90 respectively.

Levels we have discussed

- We said reduce equity exposure at 4,130 and 4,180 respectively on the S&P 500

- We said reduce tech exposure at 14,000 on the NASDAQ

- For several weeks we have said reduce exposure to financials and small caps via the Russell

The levels to watch are the following on the indices.

- S&P 500 (futures) has a lot of support at 4.060 and if that can not hold you can see 3,964 then 3,823.

- 3,964 is a massive level

- NASDAQ (futures) has a little support at 13,699 then 13,402.

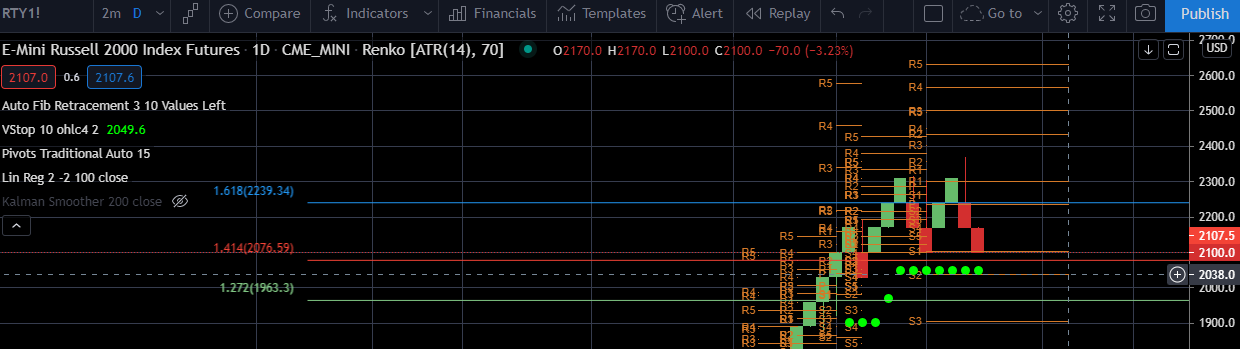

- RUSSELL (futures) has big support at 2,090.

- Massive level 2,070

Monday, April 19th The Close

Many of you expressed that you would like to keep receiving emails, so we will try doing both emails and the commentary on the site. Friday the S&P 500 blended model hit 95.90 the same reading as August before the S&P 500 corrected almost 10%. This is the third most overbought reading since 1992. Today we had no visible catalyst for the weakness in the indices and we will not attempt to forecast if todays move will lead to a correction. However, as we have pointed out, the model does suggest this seems probable. The only constructive part of today’s price action was the fact that the S&P 500 closed relatively strong. Again to reiterate, I do not believe investors should ever try to time the market by being 100% in cash, unless its a complete outlier event.

- We want to increase and decrease the risk to equity exposure based on the S&P 500 blended model to manage risk. We do not want to make it a binary event (all or nothing).

- Many of you should have been scaling out at 4,130 and 4,180 respectively.

- S&P 500 (futures) has a lot of support at 4.060 and if that can not hold you can see 3,964 then 3,823.

- NASDAQ (futures) has a little support at 13,699 then 13,402.

Bonds

The only Head Equity Strategist I ever pay attention to is Mike Wilson at Morgan Stanley, the rest rarely put their necks on the line or get it right. Mike recently said, “if rates didn’t move up on the back of record economic data surprises last year, it’s not hard to see why they didn’t react more to the strong data of the past few weeks when it wasn’t such a surprise.”

While his thesis seems logical, I still think the recent weakness in yields was technical as we referenced AGG last Friday being massively oversold. Why is this so important? If rates truly reverted only because of technical mean reversion and not because the market anticipates this economic rebound is as good as it gets, rates are going higher. Thus, the next big trade theme will be predicated upon higher yields. Which will have a major impact on technology, speculative parts of the market and what will work best early or mid cycle growth trades.

Right now yields are in a holding pattern, so the answer is not clear yet.

Friday, April 16th The Close

- No change in our view from this morning regarding the indices levels.

- S&P 500 hit our 4,130 and 4,180 targets to reduce equity exposure. Next Level 2,220.

- NASDAQ hit our 14,000 level to reduce some tech exposure and next level is 14,430.

Bonds

A lot of talk yesterday about the bond rally and why. As we have been saying for 2 weeks, AGG the Aggregate Bond ETF was massively oversold and a reversal in this condition could propel the NASDAQ higher. I don’t care about the reason, that is almost irrelevant, the bottom-line is AGG was the 3rd most oversold since the ETF’s inception since 2013. Bonds were destined to see reverse to the mean. Both cases previously where our counter trend model was above 50, it reverted to below zero. The model is now a 39, so yields could slide a little more if the model does revert to 0.

We wanted to point out for newer members, remember a 3 to 5 rating jump is ideal. Especially when the counter trend is green (oversold) and move then to a 5. Let me reiterate, our process is not to buy new positions once the S&P 500 blended model reaches a 90 reading. We are just pointing out good set ups, this is not a recommendation. Now if you are strictly trading and in 100% cash when the S&P 500 model reaches a 90, buying this type of position might be warranted.

Remember, half the battle in investing is your process for portfolio construction, risk management not just investment selection.

Past performance is not indicative of future returns.

Friday, April 16th Premarket

Today the blended model reading reached 95.62, which hasn’t really moved that much in the last week or so. However, we are now the 4th most overbought on the S&P 500 since 1992. The model is just approaching 1.20.2020 high of 95.90, which would take the index to 2,200.

To reiterate, we like using a scaling approach to reduce risk, never binary (all or nothing) as the model reaches 95.

Levels where we reduce risk.

- 4,130

- 4,180

- 4,220

Click to enlarge

Thursday, April 15th The Close

- No change in our previous view. To reiterate:

- Reduce exposure in equities at S&P 500 4,130 and 4,180 respectively.

- The S&P 500 (CASH) hit a high of 4,173.

- Amazingly, a close above 4,180 could take the index to 4,220. At which point, I would be aggressively selling long exposure. 4,220 would seem insanely euphoric on all metrics and a typical 7% correction would be larger at that level.

- Reduce exposure in technology at NASDAQ 14,000, 14,430 and 14,830 respectively. The NASDAQ (CASH) hit a high of 14,175.

Amazing to watch how the markets are completely driven by the quants. As JPMorgan published in 2017 90% of the intra day trading volume was from quantitative investors. Today’s move in my opinion looked and felt like trend followers (CTAs) and factor based funds moving the market all predicated on bond yields.

- Trend followers covered their profitable shorts in Treasuries as the 10-Year-Yield broke support at 1.61%.

- This unwind can move more as the oversold condition in treasuries seem to be on a path to normalized to at least its mean.

- As CTA’s / trend followers covered their shorts sending the 10-Year Yield down 6.63% today, factor based quants sold their reinflation trades, like financials, energy and small caps. None of these moves are really being caused by discretionary traders. As we have stated for over two weeks financials were massively overbought and overvalued and exposure to the sector should have been reduced.

- I would not be surprise if yields tried to rally tomorrow as at their low the 10-Year Yield declined 6.63%, closing down 5.48%. Any rally in yields will send the NASDAQ and S&P 500 lower. Inversely, the Russell should rally relatively.

Longer Term View On Yields

- My longer term thesis has not changed because of a shorter term technical reversion move caused by CTA’s in the bond market.

- As we stated previously, yes a reversion to 1.45% in the 10-Year Yield will cause a bid for the NASDAQ, potentially taking the index to 14,430.

- However, I don’t think inflation will be transitory and rates will bounce off support 1.40/1.45%, causing a sell off in the NASDAQ.

- IF the 10-Year Year does test 1.40/1.45 I do believe shorts will reengage sending the 10-Year back to 1.77%, if not breaking out to 2%. Which will cause significant selling across the index, with the NASDAQ getting the most selling pressure.

- You cant have your cake and eat it too! You can’t have all this liquidity and not have repercussions. Rates on the 10 year are not justified to trade at near the S&P 500 yield of 1.45% when the market is running at an annualized GDP around 2%.

Thursday, April 15th Morning

Today is very interesting to me. We had very strong retail sales, which was expected, but the headline number crushed expectations. Jobless claims came in the lightest in several quarters. Earnings rather solid. All slightly inflationary and negative for bonds. However, bonds are rallying exceptionally hard without a significant economic catalyst. The 10-Year Yield is down 5.16%, which could be technical. We stated last week bonds are massively oversold and a little reverse back to 1.45% on the 10-Year Yield is 1.45% would be possible and would propel the NASDAQ with fuel to move higher.

My theory and its only a theory is large institutional investors are hedging for a correction and getting long bonds. Many institutional investors cant buy options or short the market and will use Treasuries instead. There is always a reason for why the market moves. This could be the start of a topping phase until we correct and then once again move higher once again to new highs.

I am growing more cautious especially if larger institutional are now hedging equity risk by going long bonds.

Wednesday, April 14th Post Market

- No change in our previous view. To reiterate:

- Reduce exposure in equities at S&P 500 4,130 and 4,180 respectively

- Reduce exposure in technology at NASDAQ 14,000, 14,430 and 14,830 respectively

Extremely difficult market as Technology was weak at the opening bell as rates reversed yesterday’s declines and moved higher. Conversely, the Russell at one point was up 2%, with the inflationary trade back on.

Today we had the much anticipated IPO of COINBASE. The stock opened up at $381 and hit a high of $430 before actually trading below its opening price to $375. This caused some additional pressure on the NASDAQ sending the index down roughly 70 points. First let me state, I am no expert in blockchain which in theory make s a tremendous amount of sense for financial applications. However, crypto currencies is a different story, which I will not go into my opinion here.

While, I have not studied COINBASE well enough, I will say it seems like this a little aggressive with the valuation. Coinbase in my opinion is nothing more than a transitional broker and in some cases a bank, without a charter. However, unlike other recent IPO’s Coinbase is profitable.