If you have any questions please feel free to email Brett Golden at Brett@trowbridgellc.com

Hot PPI coupled with Hawkish Fed speak crushed the indexes to close on the lows.

The news was pretty straight forward today.

-

First premarket, futures reversed even before PPI was released as Cleveland Fed President Mester said she saw a compelling case to hike by 50bps.

-

Then, the markets took it on the chin with a hotter than expected PPI coupled with weak housing data and a collapse in Philly Fed = stagflation. Markets picked up the selling to the downside.

-

However, the S&P 500 rebounded 50 handles almost unchanged on the day by 12:00 EST. The 2/10 spread actually bull steepened and yields were barely up on the 10 year yield for such hot data coupled with hawkish Fed speak.

-

Then when everyone thought the market couldn’t go down and was immune to bad data, St. Louis Fed president Jim Bullard said markets need more hikes, there are risks of a replay of 1970 and he wouldn’t rule out supporting a 50bp hike in March.

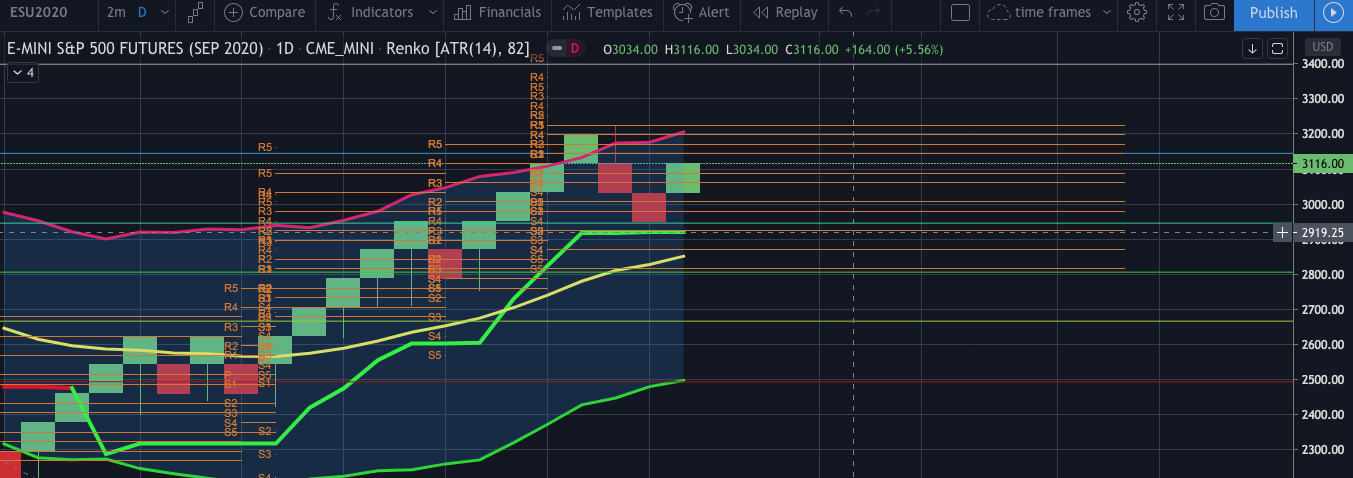

4,100 is a massive level on the S&P 500 futures and we did close below it. If we get a Friday close below 4,100, it’s easy to see the the S&P test the major inflection point of 4,000. We can see 4,000 being an area that those investors who missed this rally will start start getting long. Why? Because everyone missed this rally and are conditioned to buy dips after rallys that are missed.

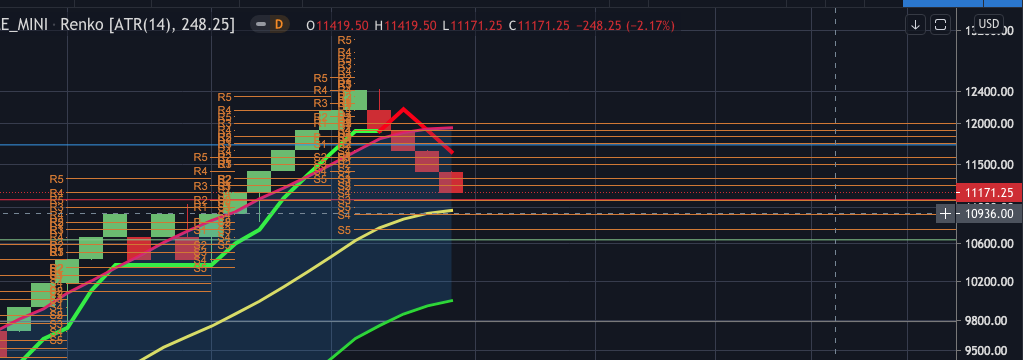

S&P 500 Futures

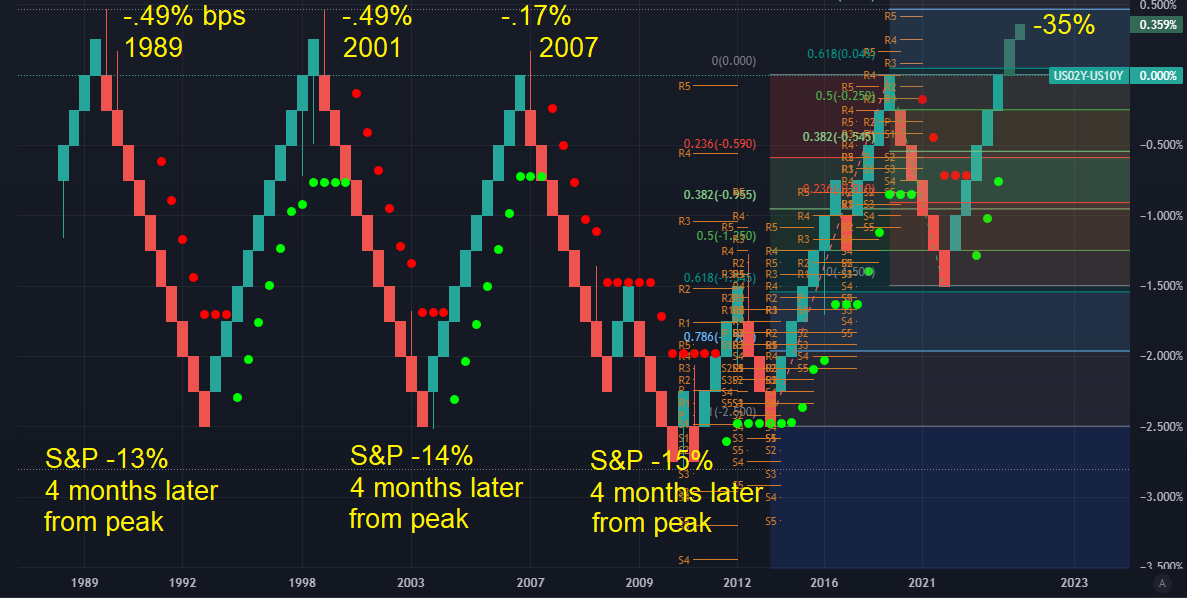

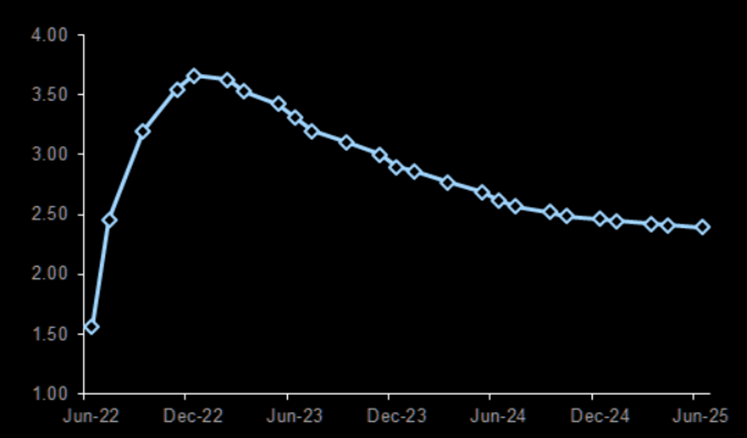

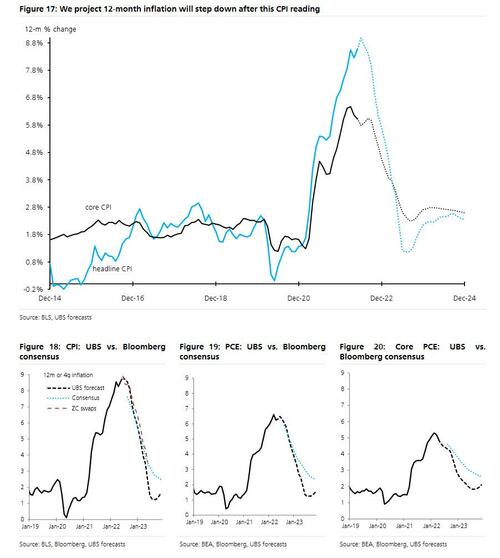

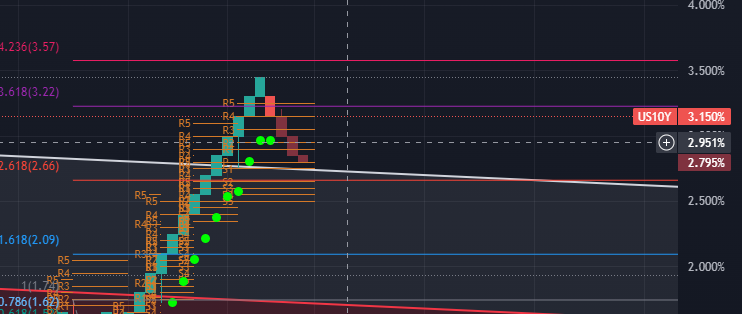

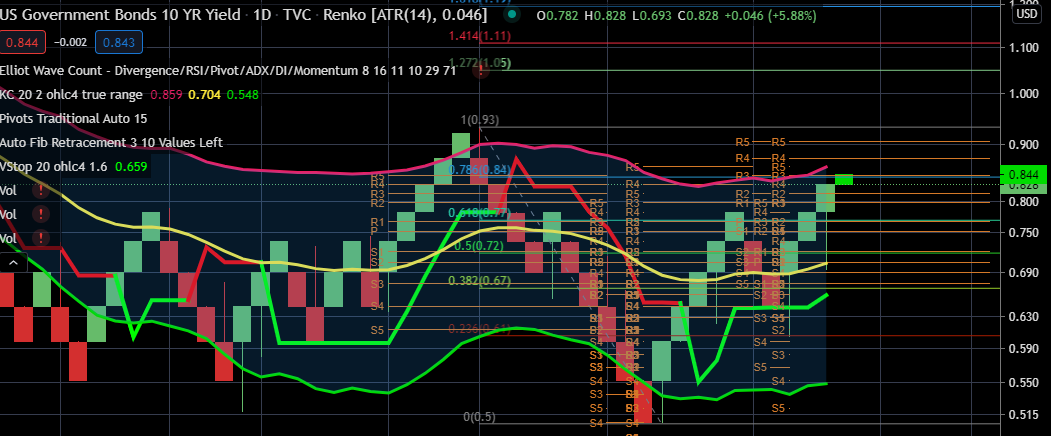

We have previously said since our All Weather models are 40% to 60% underweight their benchmarks in terms of Fixed Income we would increase their exposure if yields start to retest significant levels. Tomorrow we will be adding more bond exposure. If yields revisit their cycle highs (10 Year Yield see below) we will be prepared to add the final allocation if that scenario plays out. Soft, Hard or no landing this trade “not investment” seems logical to us. However, make no mistake, once yields normalize based on our models, our All Weather strategies will go back to their historical allocations of 50% to 70% underweight Fixed Income. Why so little fixed income exposure historically? There are better, less correlated investments than fixed income.

What is going on with this market?

We keep hearing many traders, advisors and strategists seemingly befuddled by the market behavior and that the market should be trading a lot lower. Regardless if we believe in the rally or not, the markets are more efficient than investors comprehend. While we agree this is a very challenging backdrop to understand why the S&P 500 sits at almost 19 times forward earnings as the terminal rate keeps climbing in the last 6 days to 5.30% coupled with earnings that continue to contract. However, let’s take a look at a few bull and bear case points and how we got here.

As we said in December, the markets do not care that earning estimates are declining as long as the market forecasts rate cuts and earnings trough.

First we will discuss the fundamental rationale for the market’s rise. Let us stress, we believe the rally like all rallys are initially mechanical caused by quantitative price action. However, let’s just explore the most simple explanation of the fundamentals.

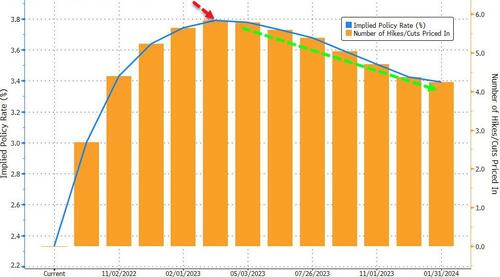

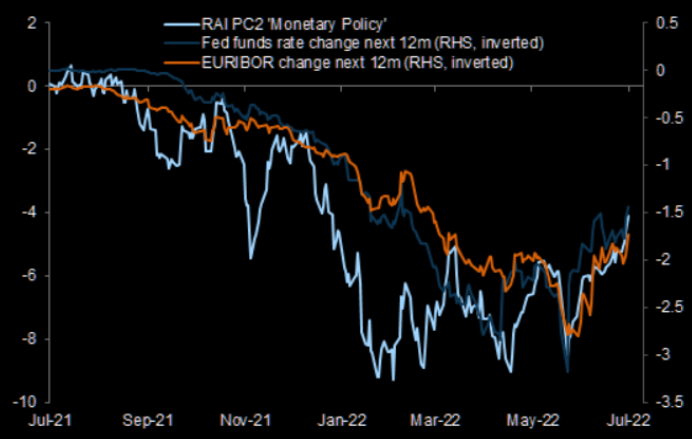

1. For the last quarter the markets have projected 200bps of cuts by 2025, which were pushed forward to mid 2024 after Powell’s last dovish Presser. However, in the last several days the market is now only pricing in 100 bps and the most sensitive stock have not cared and rallied (long duration technology). The chart below was the Fed fund protected rate cuts coming into the end of 2022.

2. Markets are efficient at forecasting earnings peaks and troughs.

- The first chart from Bernstein is why most fundamental strategist are scratching their heads. The S&P index is climbing as EPS for the index is declining for a couple quarters.

- However, the market is pricing in a trough in earnings as revisions in the US and Europe are increasing as seen in the second chart provided by Morgan Stanley.

- The third chart is why so many investors after a tough 2022 want to get ahead of a recovery in higher beta technology. Why investors are jumping in now for the future recovery. As we can see from the third chart earnings finish going down 6 to 9 months before the index already has recovered.

- The fourth and final fundamental chart is showing that forward declines in EPS in an economic decline take a lot longer to happen than investors anticipate.

Now we will discuss our core competency and what we really believe is happening. Trying to trade asset classes and indexes by forecasting if we have a hard, soft or no recession is absolute insanity. This is why we are Trend Followers, while trend following wont work 100% of the time in the entire market cycle, it reduces the emotional guess work, reduces risk and generates returns to meet liabilities. Additionally, this is why we lean heavily on absolute return strategies.

Here is a list by importance why we are rallying.

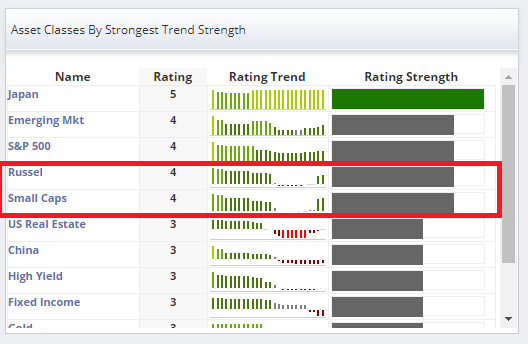

- Momentum reversion: Every January you get a rebalance in the momentum factor. If you watched the video on momentum you will know there is well over a $1 trillion dollars in assets of investment funds that incorporate momentum as a factor. Every stat arb, CTA, Quant Smart beta and even plan vanilla long only managers reference momentum in their process. This December/January had the largest momentum reversion occurring to Goldman sachs. Simply put, the fund sells 6/12 month blended largest returns gainers and buys the lowest scoring 6/12 month losers. This was most prevalent this year as you had a massive variance between inflationary and defensive sectors and stocks like XLE vs. XLK. This started the initial buying in tech which then started to result in short covering.

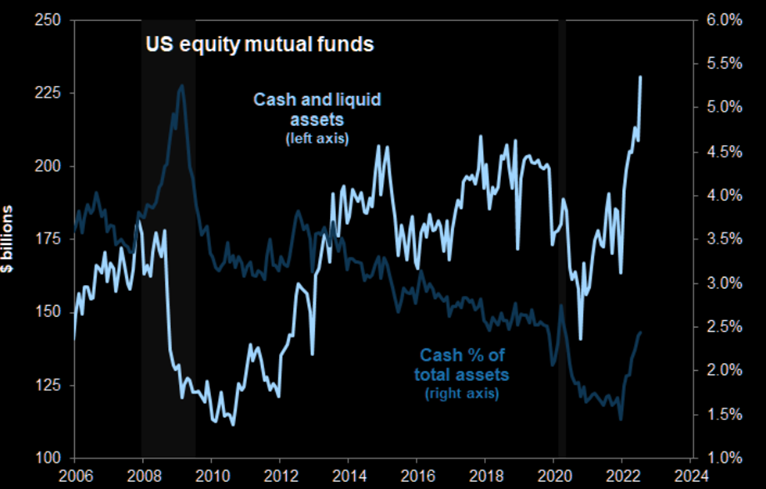

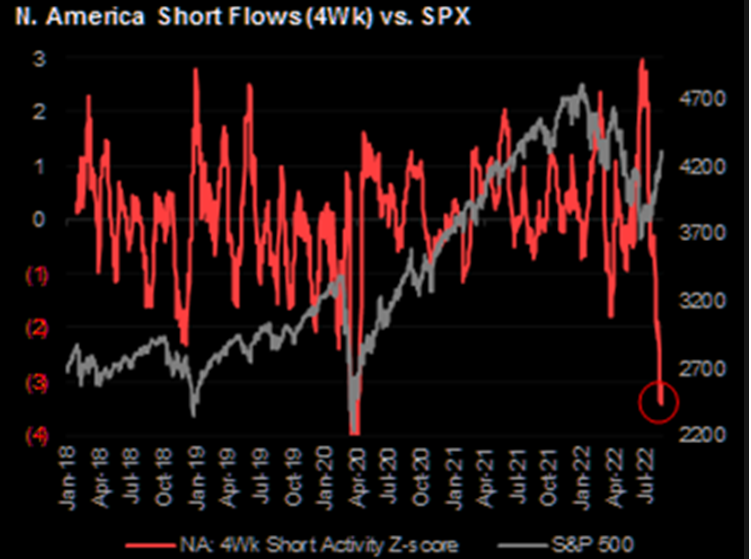

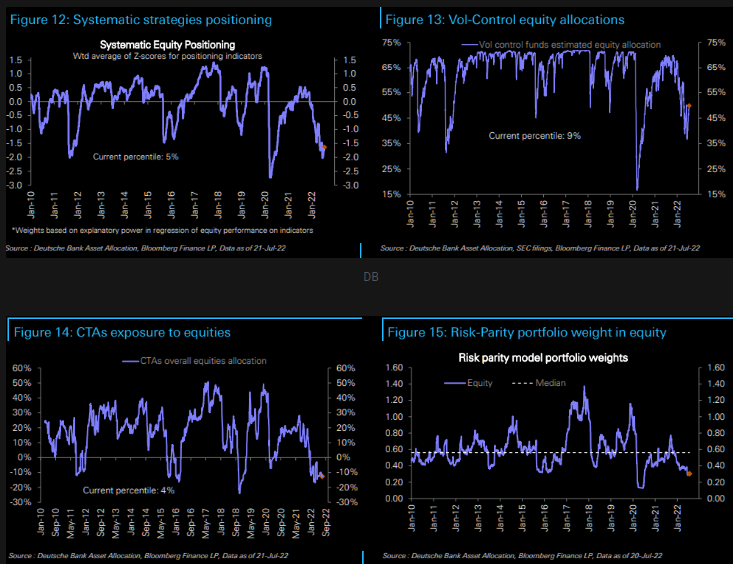

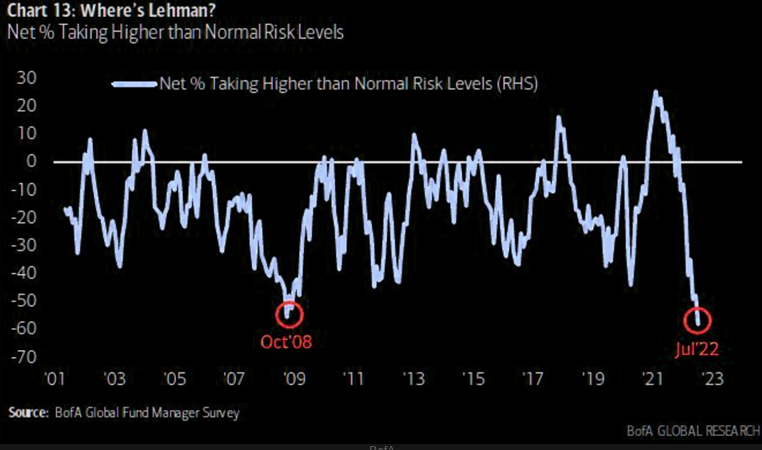

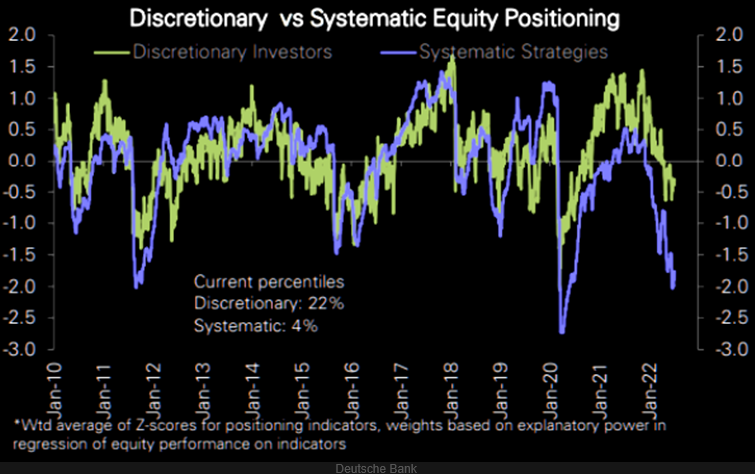

- Everyone came into 2023 underweight risk: Off -sides, either short or in cash. Mutual funds had the lowest level beta exposure since 2019 as we discussed in several posts back.

- Hedge fund negative on tech: HF were significantly short with their lowest long exposure in 4 or 5 years (refer to previous post for data).

- Every Sell Side strategist: like Goldman, UBS, Morgan were all calling back in Dec for 3,600 in the first half of 2023.

- January fund flows: are the biggest in 1 month of January than the preceding 11, soaking up all the supply. (refer to previous post for data).

- Momentum: Many technology stocks that had either negative absolute or relative momentum now are starting to become positive. (Refer to our momentum video on the difference between absolute and relative momentum). This means stocks that had negative momentum in tech for the last 12 months could not be bought by system traders, however are now allowed to buy them.

- Trend followers in equities “Quants” get long as trends go positive and keep building on price strength on their models regardless of the fundamentals. The third chart below is an example of NVDA, the outlook fundamentally has not significantly changed, but the trend certainly continues to improve where quants continue to add until it becomes fully exhausted.

- FOMO and managers need to keep pace with the index as quants are not asking why XYZ has a high PE, they just keep buying as price improves. (See third NVDA chart below)

- Central Bank Liquidity baby! Lastly, the markets are seeing $1 trillion in balance sheet liquidity infused by PBOC China Central Bank, and balance sheets around the world collectively for the first time in maybe a year are not declining. This certainly helps create a backdrop for risk assets. This is supporting the speculative rise in equities everywhere. Lastly, which is very important that no one talks about is the FED’s Reverse Repo Facility has been increasing and you better believe the larger this RRP grows so do multiples on stocks.

One last thing, we have discussed this before and it’s not the cause of the rally but it is why we are seeing irrational moves in mega cap stocks that would otherwise never happen. Nomura’s Charlie McElligott has been discussing this of late what is known as ODTE Option phenomenon, growing more powerful and prevalent by the day. These are Zero Day expiration options. Like black rolete if you will!

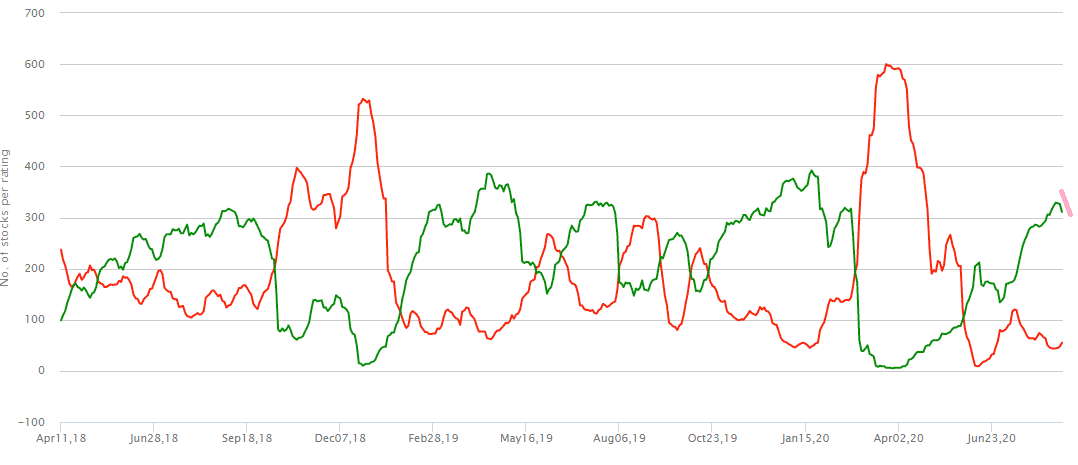

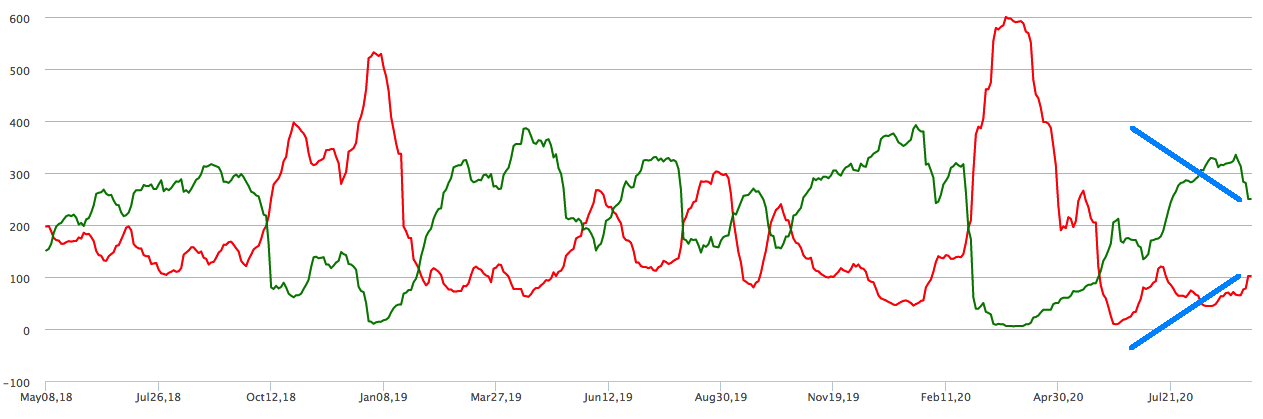

McElligott says on average over the past month, nearly 1 out of every 2 Options traded on SPX, SPY and QQQ are 0 days until expiration. Wow this is crazy. He presents the chart below and you can see how much volume these ODTE options have exploded (in red).

We have shown this chart before by Goldman, but we just hit another new high volume season Tuesday with SPX 0DTE. 50% of all options traded expired 6.5 hours or less on SPX.

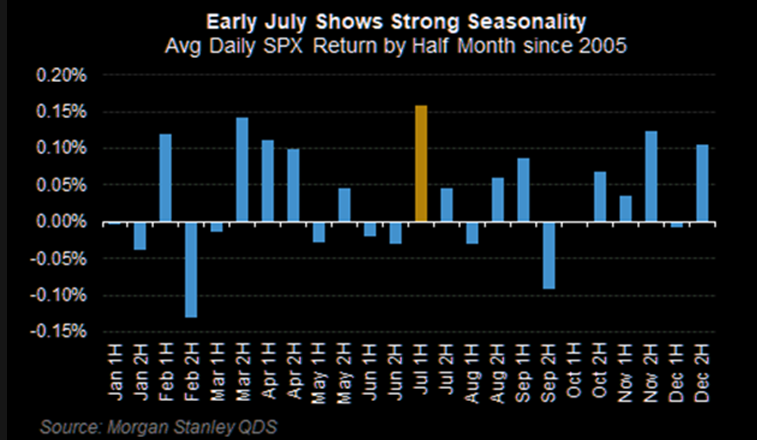

January 13th

Another Massive CPI Print Tomorrow and it is expected to be slightly hotter

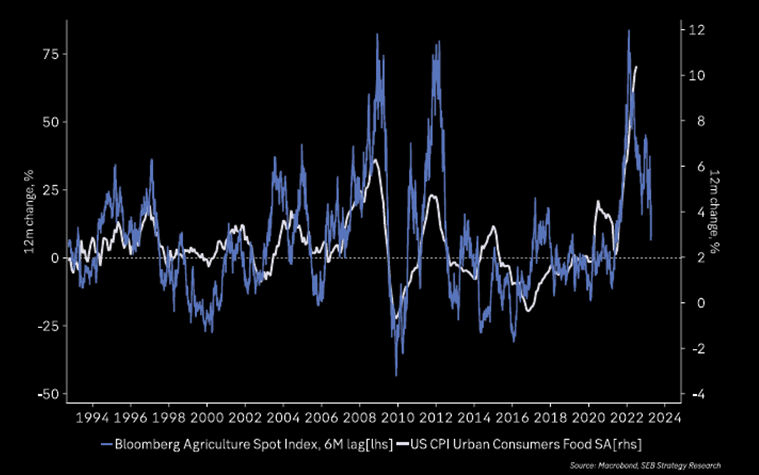

As we can see from the chart provided by Deutsche Banks Jim Reid above, we can see inflation is still falling, however at a slower pace and the new revisions are now higher than the previous inflation expectations. Jim points out that the annualized core rate is tracking 4.25% vs the previous 3.14% from the previous months data.

The market is already pricing this in as rates have already moved .35bps off their lows on the 10 Year Yield after a week ago stronger labor report and BLS’s revised calculation. If you weren’t closely watching, last week the BLS published its annual revisions to CPI and the market viewed this bearish for equities as they changed their weights.

Jim’s colleague Justin Weidner points out used car prices are increasing once again measured by the Manheim Used Vehicle Index.

Lastly, while I think making market calls based on valuations is a terrible strategy, let’s just be aware how expensive the market currently is. There has been only 2 other periods since 1980 where the S&P 500 has been more expensive. I am hearing a lot of advisors telling us that client’s are asking them to put more risk on as they see the market moving higher. This FOMO is exactly the opposite strategy that should be taken at this juncture.

In the short term yes the markets machinacilly are under weight risk and seemly want to move higher. However, the equity markets are exceptionally complacent and if we get a headline print tomorrow of equal or greater to 6.50% markets will want to push higher. However, once everyone is sucked back into the markets the narrative will focus back on the economic and fundamental data and revert lower. If clients are asking to get more risk on, be patient, let the markets come to you to get more aggressive and don’t chase this market. You will get an opportunity at much better levels to deploy capital. In fact, any move above 4,200 to 4,300 would be a welcome opportunity to de-risk.

Feb 8th the close

S&P 500 & NASDAQ levels are still in play. China trade is in play and my thoughts on the Yield Curve Potential breakdown.

-

S&P / NASDAQ Strength: When the trend strength and breath get to the current readings we are seeing on our models, a sudden reversion is not imminent. It will be more of a slower grind of losing support as long systems will keep buying until short term levels break. Additionally, many long onlys missed January’s move and will be compelled to buy these pullbacks.

-

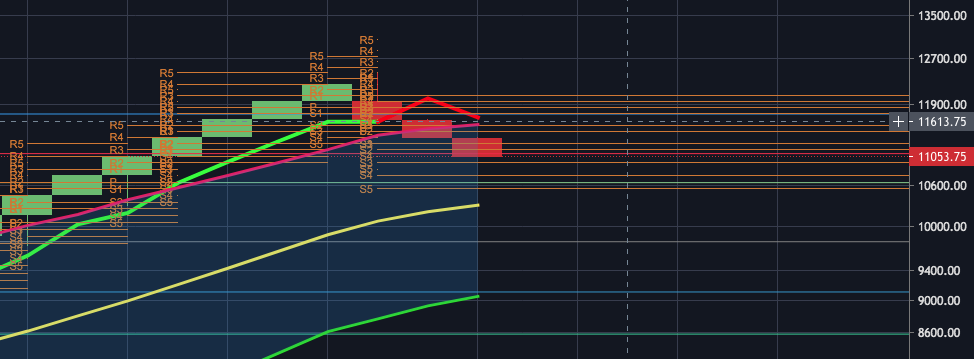

That 4,127 level we discussed on Friday remains a stubborn level to take out on a downside close, but give it another day as 4,067 (updated 4,059) we mentioned on Friday is growing more likely. 4,130 (today’s close).

-

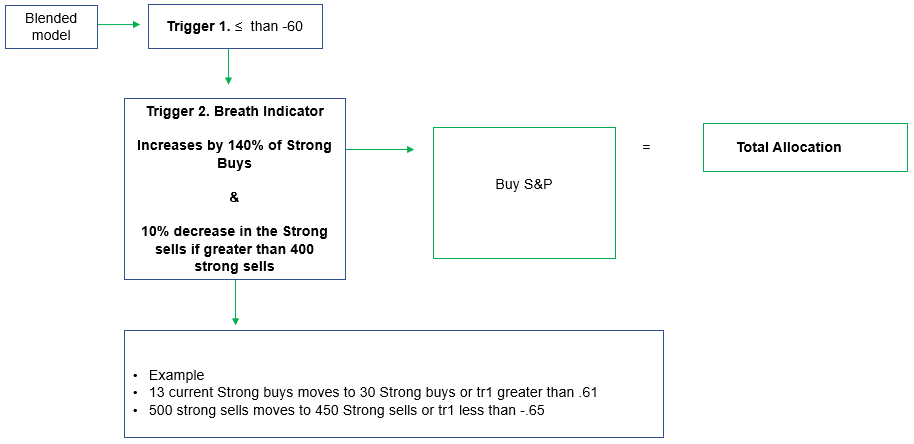

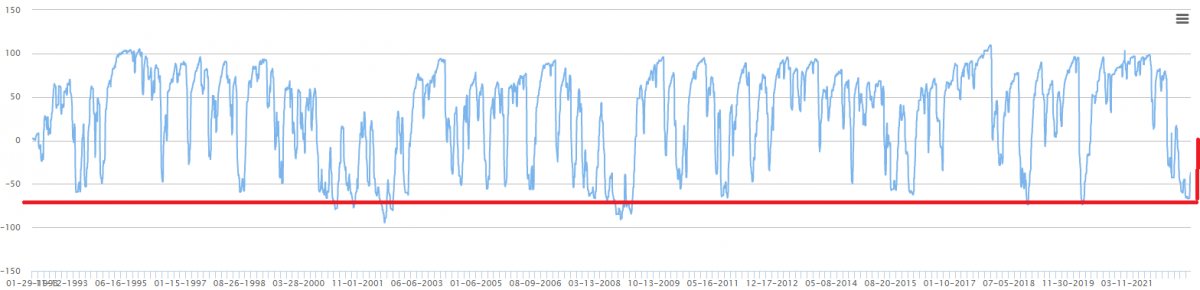

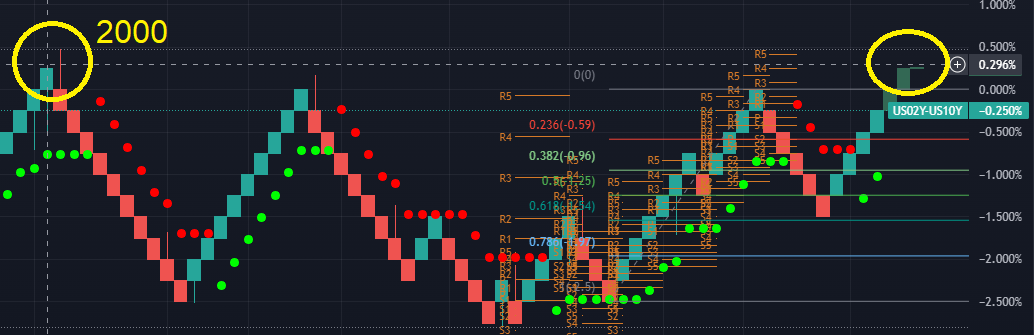

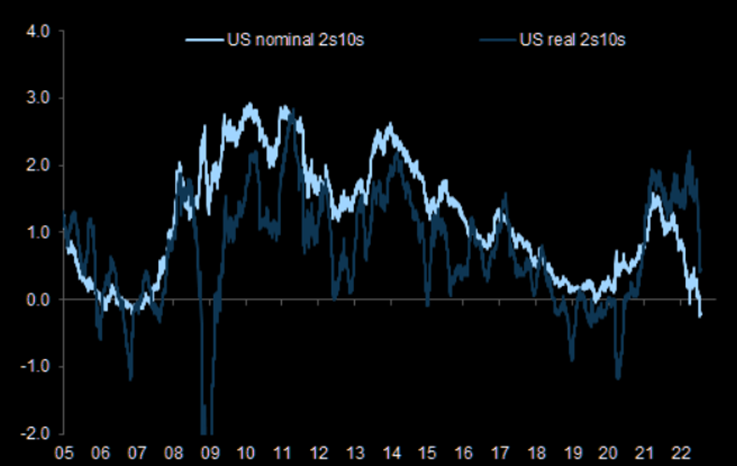

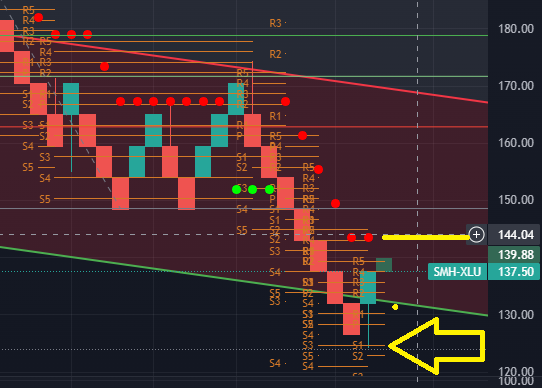

Yield Curve: While we know the lag effect is 10 to 12 months on inversion of the curve to recession and at best its a blunt single. However, keep an eye on the lows of -.845% for a potential break lower. Today you inverted another -2.4% and while this is an irrelevant %. I can see where credit spreads start to expand if we take out the lows of this cycle and move to the next support area of -.942%. I would assume the narrative will shift to one of concern, where markets will focus on the credit markets and the potential for slower lending to the most risky parts of the cap structure. I would expect the massive support level of 3,988 to be tested if the yield curve does invest to -.942%. (see yield curve chart below)

-

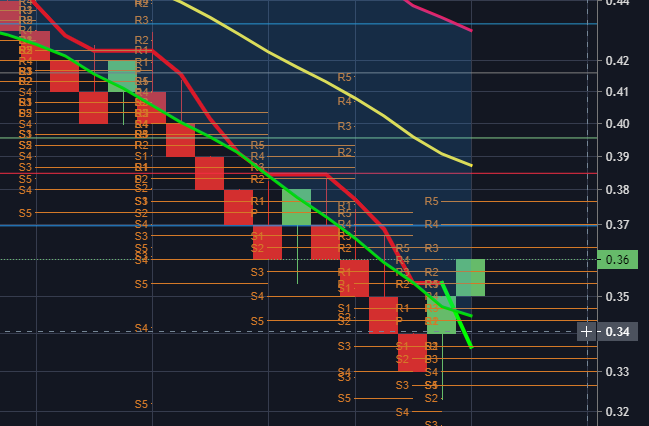

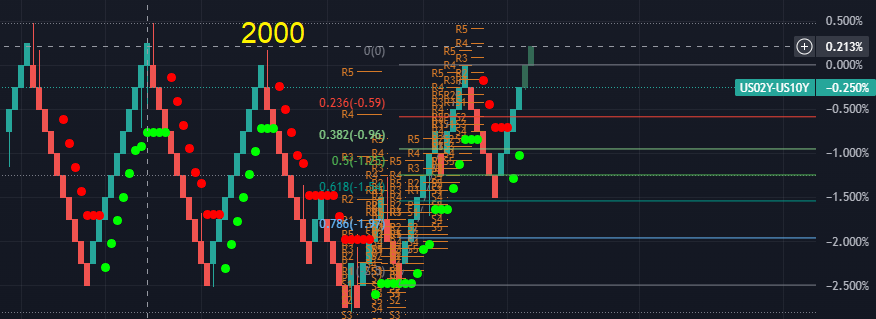

China Update: Last Friday we wanted to alert anyone trading in Chinese names beware of the reversal. We stated, “FXI rejected an upper level and had a medium term break at $31.25 and if this doesn’t hold $30.60, $28.50 is in play”.

-

This trade has triggered and in effect. If you are trading pairs send me your names and I can provide some color on the potential variance. Todays close $30.46.

Now is the time to be very cautious based on the underlying market behavior, this is not a healthy market that we are seeing. If you feel better about the markets and that the worst is over, well we have some data points to share with you. Do not get caught up in FOMO, humans are emotional and this leads to poor investment decisions. If you don’t think these following data points are not concerning, then please call me directly to discuss them (Brett -917-653-3153).

Here are all the concerning key points not in order of relevance.

- S&P 500 P/E: While the P/E ratio and looking strictly looking at multiples are terrible gauges alone for investment decisions, the S&P 500 is trading at a historically high 18 time forward earnings where S&P 500 companies margins are declining. That is concerning. If earnings have trough and the Fed stops reducing the balance sheet and cuts 50bps in q4 we can make an argument for a very high PE of 20. However, earnings have not yet troughed and the balance sheet is still being reduced.

- Profit Margins: Margins are still being compressed, meaning earnings have not troughed. (see 1st chart below)

- Earning revisions are declining significantly in Q4 still no trough, although technology revisions have moved higher. The only bright spot. (see 2nd chart).

- Leverage: There is still way too much leverage in the system, look at the Wilshire to GDP. This is the best gauge of leverage. (see 3rd chart below)

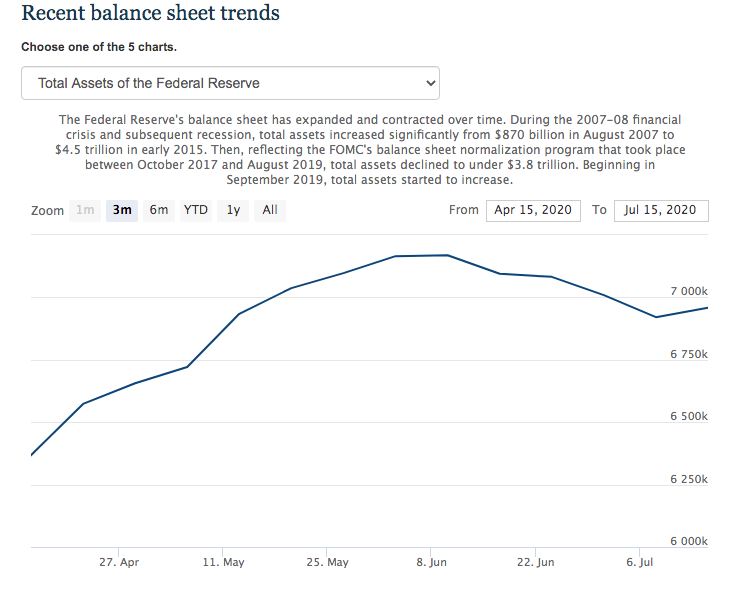

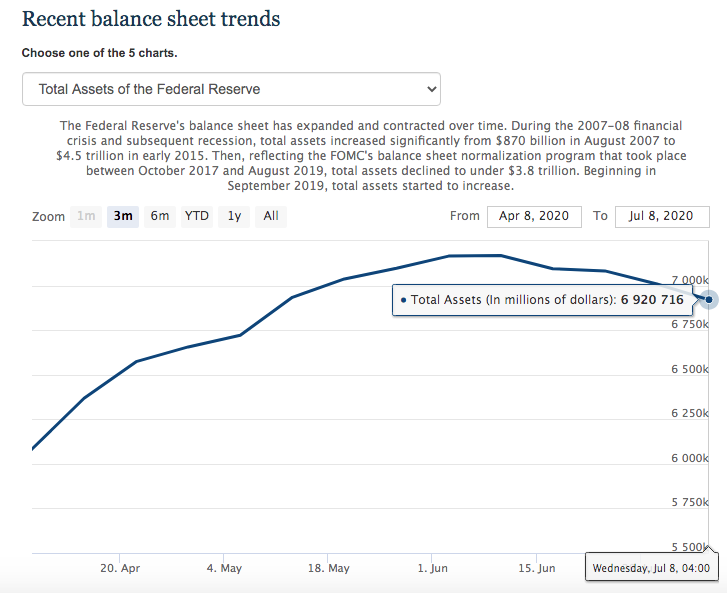

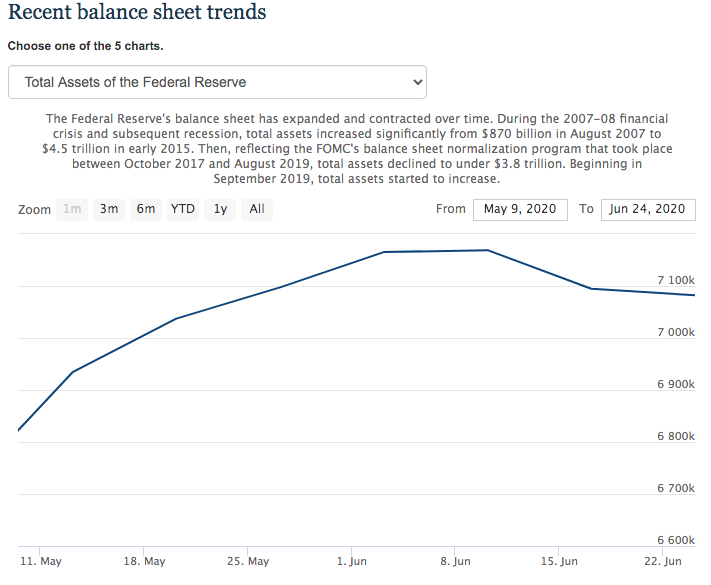

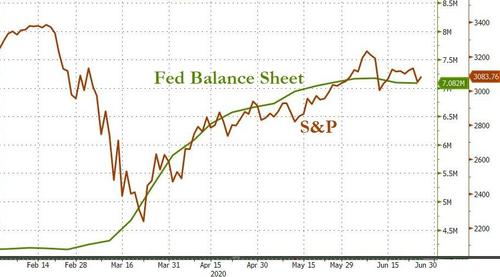

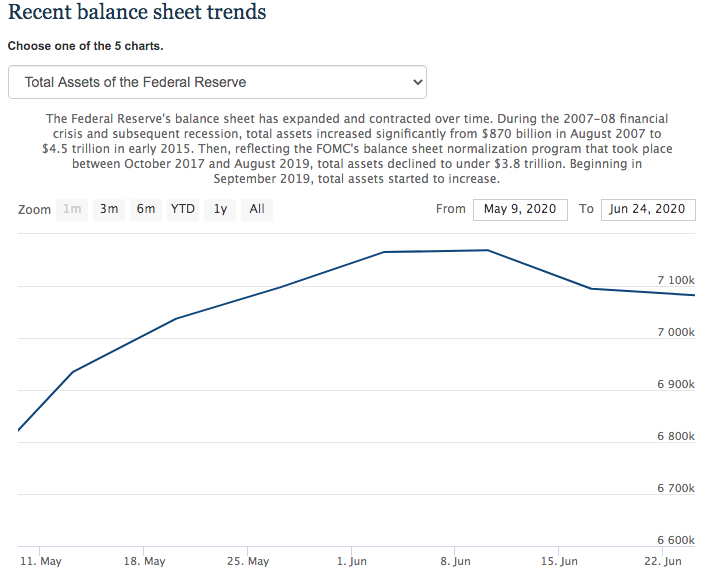

- Balance Sheet: Two years ago The Fed’s balance (see 4th chart below) sheet this was our largest concern, which now is on the back burner because they will need to stop by the end of 2023 or early 2024 if the Fed Fund Futures are currently correct that the Fed will be cutting rates by 200bps (see chart 5 below). However, we still believe this is a headwind for stocks at the current moment. The relationship or correlation of Central Banks balance sheets to stocks we have shown 100 times. The Global Central Banks Balance sheets were the reason for technology & the growth trade to experience its multiple expansion and price increases, it wasn’t earning’s expansion (see chart 6 below).

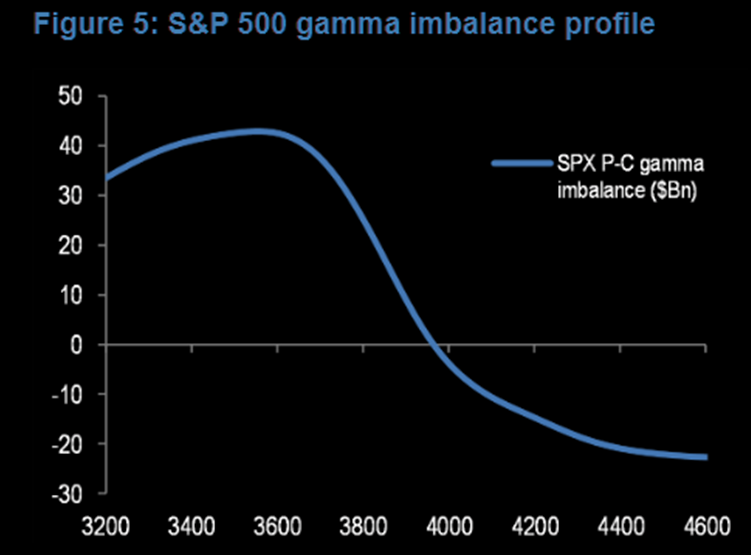

- Funds are weaponizing Gamma: Funds are trading more short dated options than ever before. As prices move higher more quickly dealers need to take the other side to maintain an orderly properly functioning market, this however exacerbates moves in either direction. We believe this is causing gamma squeezes larger than ever before when they trigger, where you see large cap stocks up or even down 15% to 30% in 1 day (even Soft Bank was doing this during COVID with a $5 billion gamma strategy). While, I don’t have data to show the gamma squeeze data (see chart 7 below), the following chart shows the highest one day short term options volume in history last week. That is not investing or hedging a portfolio.

- Short Squeeze: Last Thursday was the largest short squeeze in 8 years, ranked in the 99 percentile, because Powell led the markets to believe 50bps of cuts are now in the cards and maybe they are based on the lag effect of how bad ISM’s are crashing. But you would never know it by a 3.4 unemployment rate that just ticked lower on Friday (see our Friday note below for this). Now we have been saying for 2 months earnings don’t matter and the market was already pricing in 200bps of rate cuts by 2025 and should provide a backstop or a market put. But you can’t have the market trade at 4,500 on the S&P 500 or 20 times earnings when you are still getting margins for the index compressing lower coupled with ISMs still in free fail. While we understand CPI and inflation is significantly declining and on pace for 3% by year-end. At what cost does this leave the economy even if the Fed does cut 200bps by late 2024. For 2023 the upside at this currently level is very limited and risks are set up for the downside. (see chart 8 below)

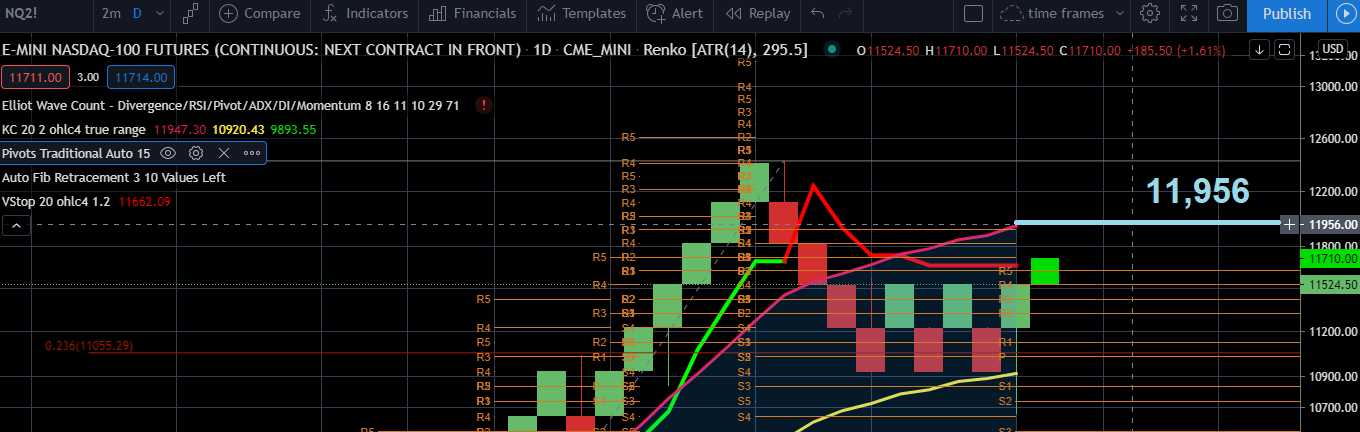

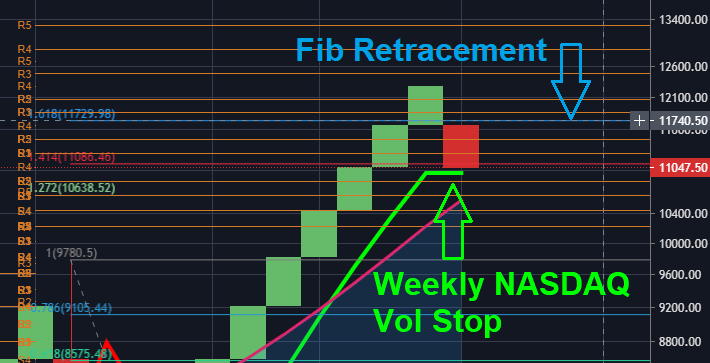

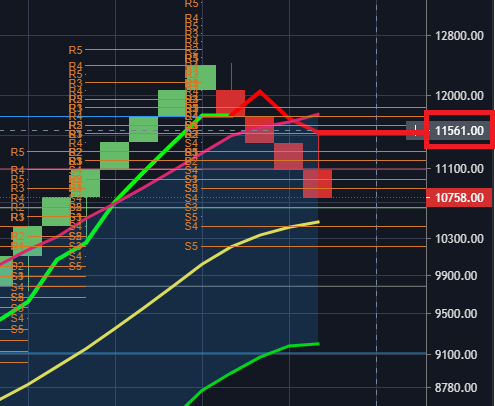

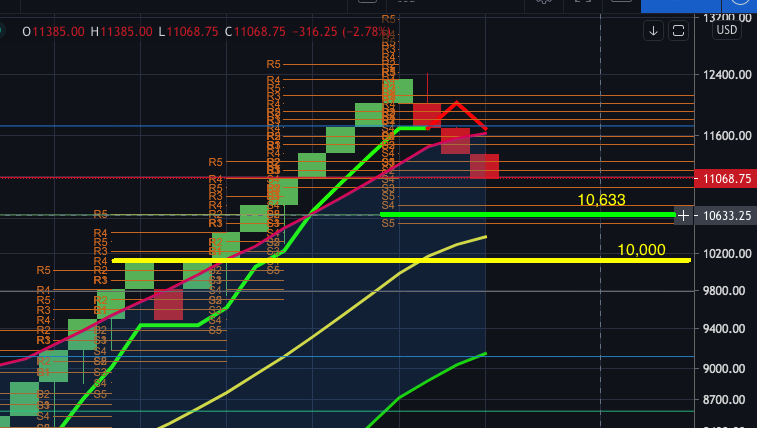

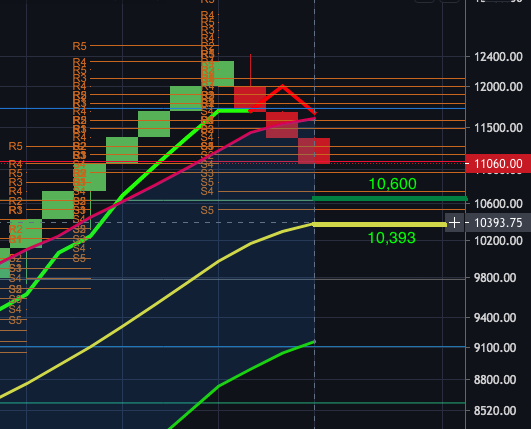

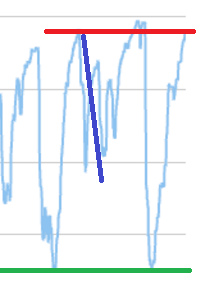

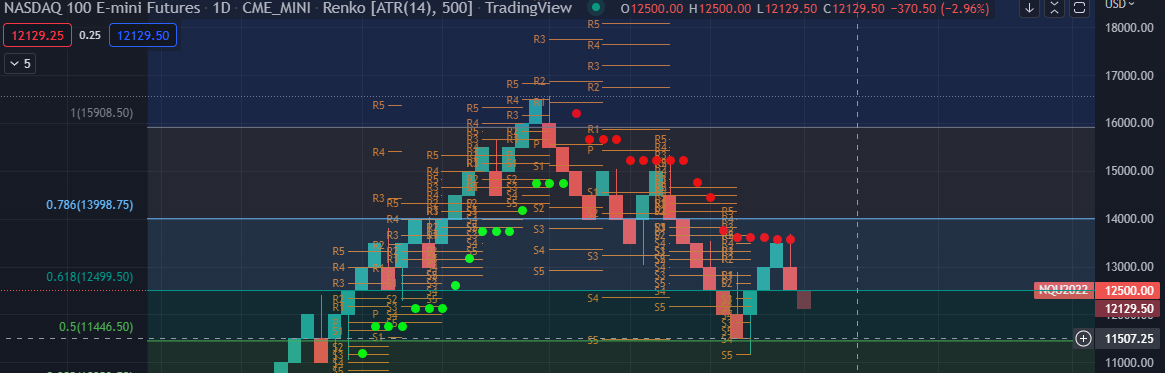

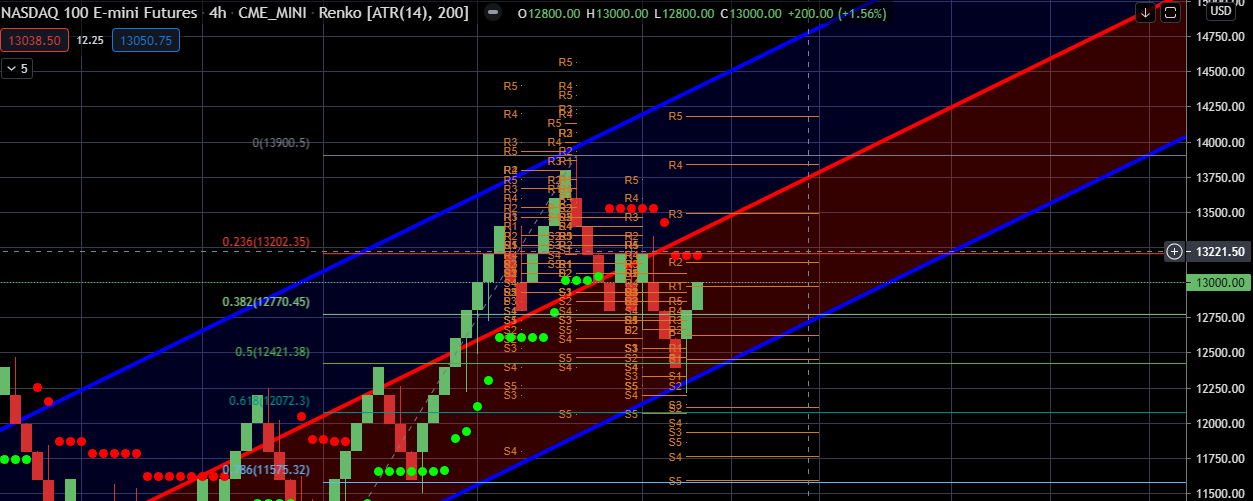

- Inflection point for technology: Since late Nov we have been calling for the upper range potential of 12,800 on the NASDAQ futures which we briefly took out this week. If you have been watching this call, we said 12,800 was an excellent level to de-risk growth because this was its volatility stop. The last 2 failures at the NASDAQ Volatility stops were around 15,300 and 13,600 (see chart 9) and as you will recall you said take down technology and growth risk there. We believe this is a similar set up. However, a weekly close is very possible and will take the index to 13,650, where taking down more growth exposure would be even more warranted.

- Positive Global Growth: The one positive aspect but not for the U.S. is Global growth has bottomed and earning revisions are increasing. This could provide some support for U.S. earnings (see 10th Chart below)

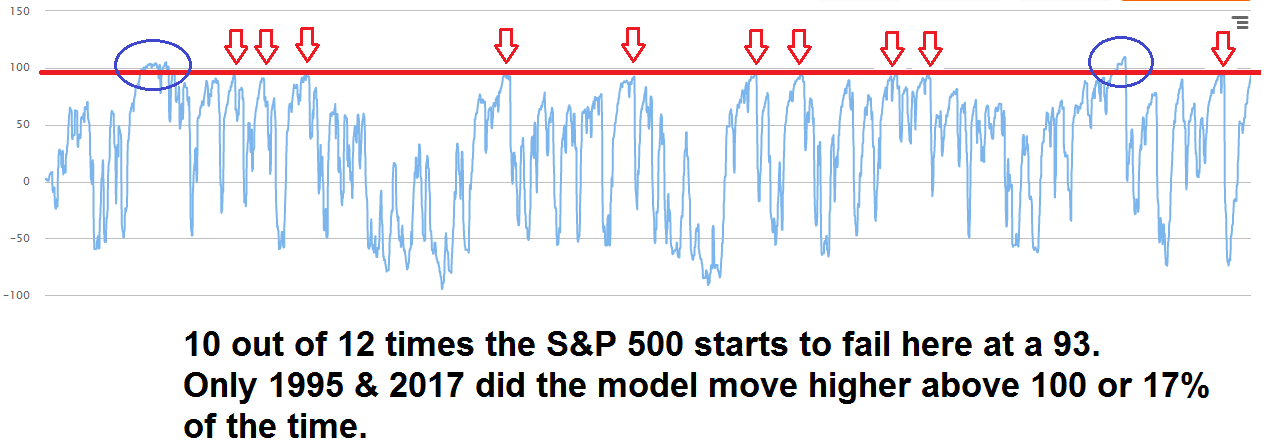

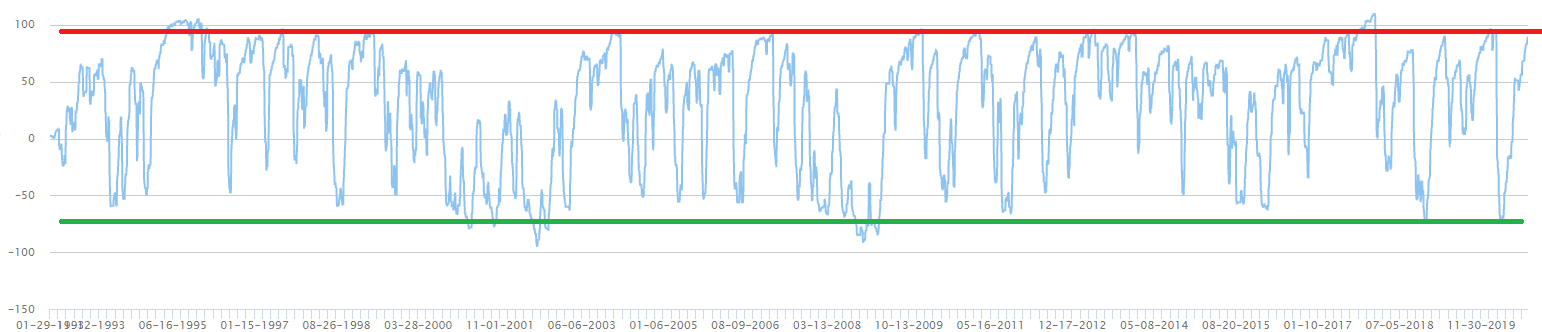

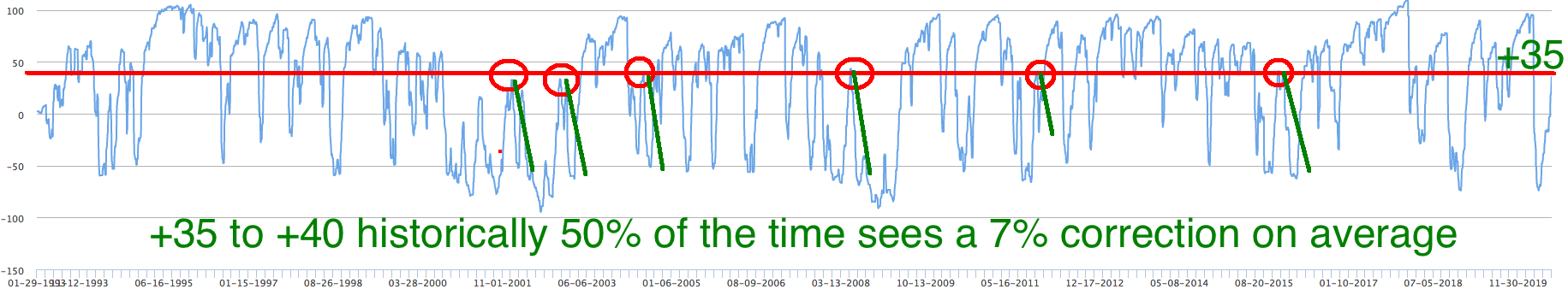

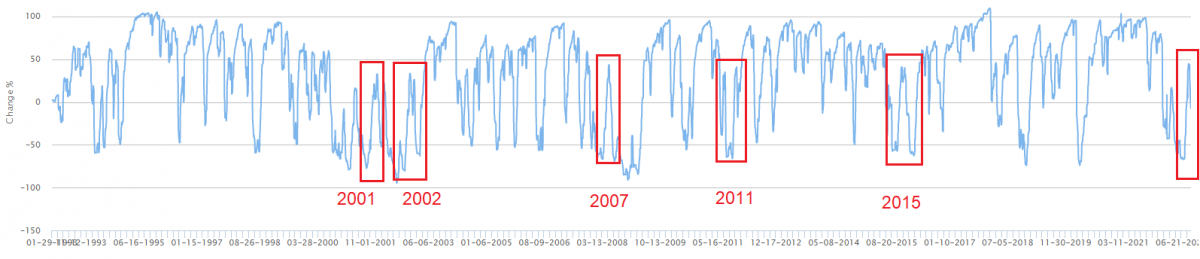

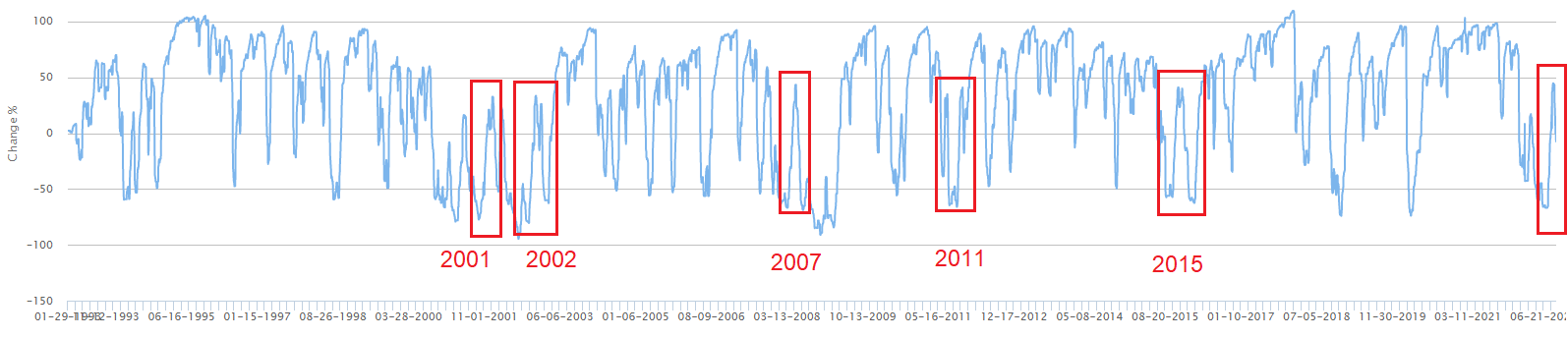

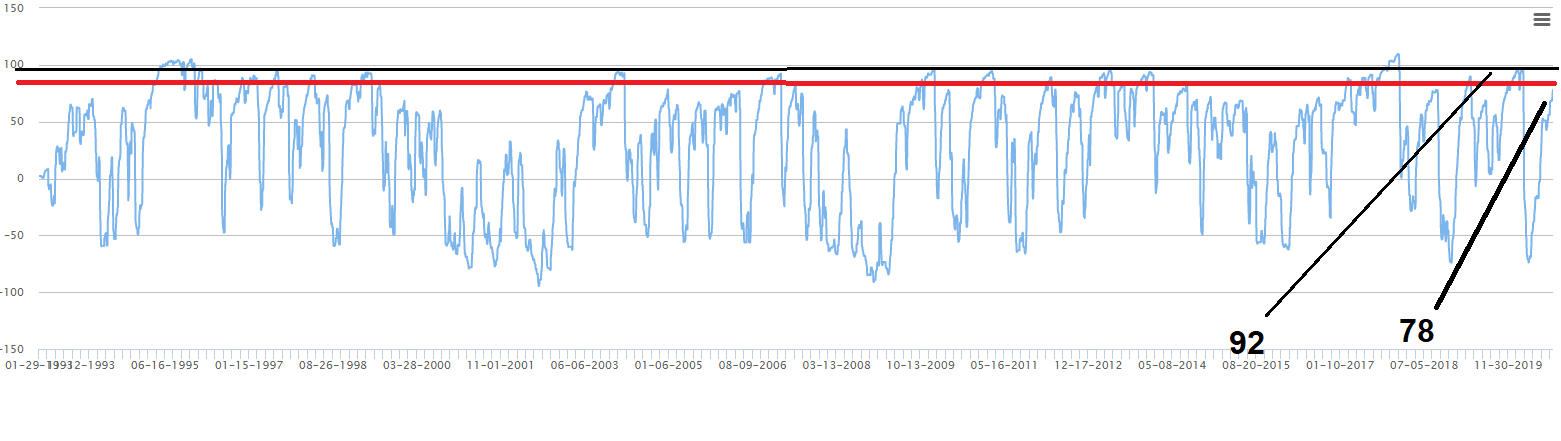

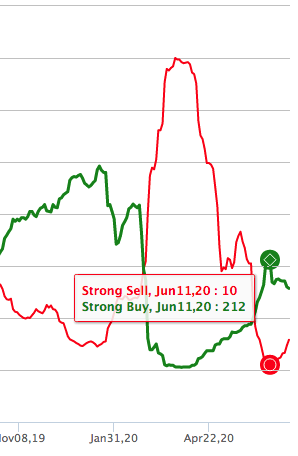

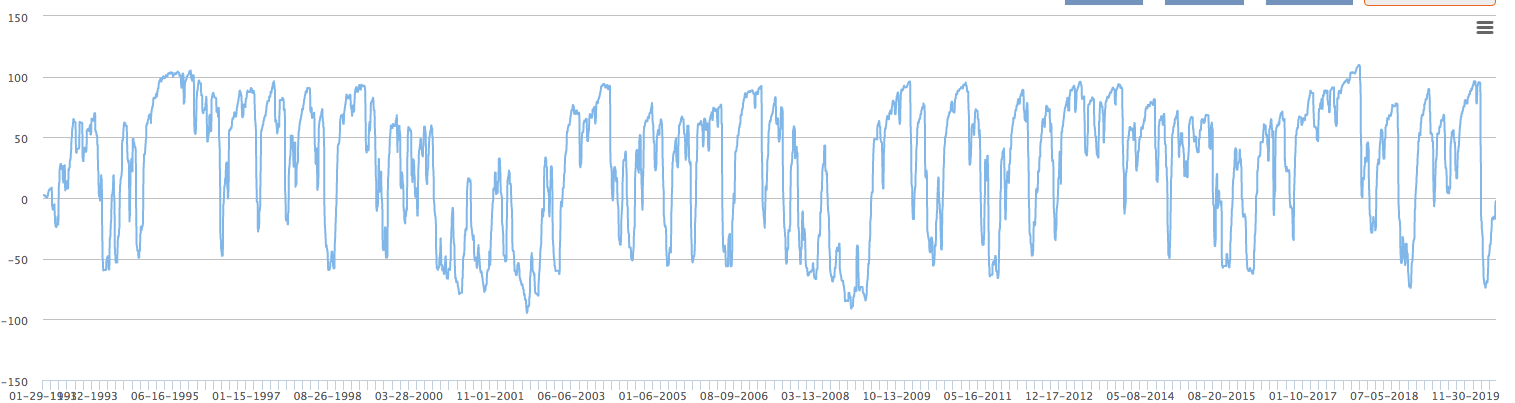

- Money Market Cash Level: Another more mechanical market structure positive is the massive amount of Money Market Cash that Goldman Sach points out (see chart 11 below). Now keep in mind there is more fiscal and monetary liquidity than 2008, but there is currently $900 billion in Money markets than 2008. Never has there been this much in Monday Markets, $4,850 trillion, slightly more than 2020. Another reason equity markets have such a strong underneath bid when markets rally. If this cash flows to the markets, the ultimate level on the S&P 500 futures, we would take down some risk would be 4,300. (see 12th chart). Dynamic Alpha will not take down exposure, only the All Weather Models will. Dynamic Alpha operates on an individual stock basis not the index level. However, Dynamic Alpha is not allowed to buy any new stocks if our S&P 500 model is at 90, its currently a 57, a long ways away. (see chart 13 below of S&P 500 model)

Summary: For those of you wanting to sell value and move back into growth, give it a little more time, you will have another opportunity at much better prices. Our job is not to make long term market forecasts, there are no good long term forecasters. As quants we never get too bullish or bearish, but what we are conveying here is be objective with these current facts. Just because the markets have rallied, you have an amazing opportunity to de-risk and review Trowbridges All Weather Strategies that seek a similar market cycle return to a 60/40 or 80/20 with 40% to 50% less drawdowns now is the time. You can explore more here on these strategies. Or if you build your own models review Dynamic Alpha that is a Large Cap U.S. equity concentrated portfolio that from inception of March 2015 to Dec 30th 2022 has generated a greater return than the S&P 500 with 3.50% less annualized volatility, outperformed all major drawdowns and 83% of the time outperformed the S&P 500 18 worst monthly performance. See Dynamic Alpha here

Or set up a time to speak with me to review your current allocation vs our All Weather Strategies.

Friday Feb 3rd

What an intense week and we hope everyone can get some rest this weekend!

We have a few clients asking why not move into technology as this move occured. The answer is we are systematic and unemotional and that is the benefit long term of our process. Our system will not buy into short covering rallys, over 30 years of testing individual equities response to short squeezes causes too much portfolio volatility. If we were trading the stocks on a 14 to 30 day time period yes, there is absolutely alpha to be generated from short squeezes. To reiterate, Dynamic Alpha long term wants to outperform the S&P 500 but with less volatility. In all of our research and testing, this current period we are witnessing is not sustainable and does’t not warrant a mass rotation into the most shorted stocks high beta that are up 40% in three weeks. That is not investing, it’s trading.

The past few weeks have been nothing more than a massive short covering rally.

-

- Goldman said yesterday’s short covering was the largest in 8 years and was in the 99.9th percentile vs. the past 10 years.” (See 2nd Chart below)

- Goldman said yesterday was the highest option volume ever in history. This is important as it is causing gamma squeezes. (See 3rd chart below).

- Options have been gaming the stocks within the market unlike anything we have ever seen before as funds manipulate the gamma squeeze. This was seen in 2020 with Discovery Communications and many other stocks by hedge fund manager Bill Hwang. If you haven’t read the story, click here.

- For weeks we have told everyone reduce growth exposure if the NASDAQ hit 12,800 as it was a massively important level that we did not believe would be taken out on a closing basis. Today we closed at 12,600. Eventually, we will break out, but again, under the current economic conditions and earnings compressing within tech, it’s not probable.

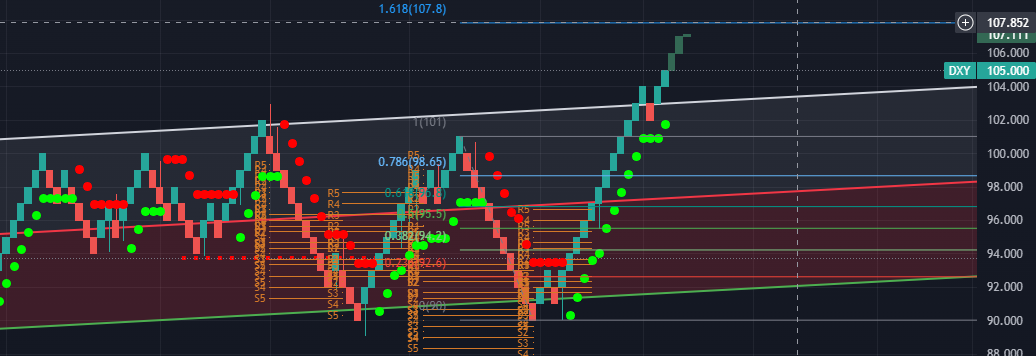

- Rates: As I discussed yesterday, I thought it was a weak showing both on the dollar and the 10-year yield neither had broken down. Then today, the jobs number significantly flipped the momentum trade upside down where inflationary benefactors and defensive names along with financials caught a bid.

- 10 year yield, this part of the carve is what I watch mostly, and 3.556% is the next level of resistance. If we get a close above this level we could get a full measured move counter trend rally back to 3.723% which is something to watch for those trading longer duration cash flow names.

- USD: via the DXY. Equally important as the 10 year, keep an eye on $103.50 as a small counter trend rally is developing as $102 could not break lower.

- NASDAQ: To reiterate the step function of a potential decline on the nasdaq. A closed below 12,580 is as follows

- 12,300 in play Monday and a close below here the big test of (updated) 11,930.

- S&P 500: 4,127 break we roll to 4,067. The make or break level is now 3,984

- China: FXI rejected an upper level and had a medium term break at $31.25 and if this doesn’t hold $30.60, $28.50 is in play. This is seen in the first chart. As you know we do not like China as an asset class in our All Weather portfolios because of the lack of alpha low sharpe ratio and volatility.

Feb 1st

Powell completely caved today and was rather weak, shifting the narrative for the markets to believe the end is near rather than higher for longer. Sending the Terminal rate projections down 50bps with his disinflationary rhetoric He started off with two hawkish statements that more work needed to be done and requiring a restrictive policy. Then markets went parabolic when Powell completely brushed off when asked about the easing of financial conditions, which was the main cause for the hawkish consensus view that everyone and their mother has been referencing including myself. I doubt the market does any serious back and fill at this juncture as the terminal rate projection fell by .50bps and doubt this flips tomorrow.

- S&P 500 Futures: Yesterday we stated, “A close above the 4,118 level would take the index to 4,170. Today’s high was 4,163.25 and even though we did not hold or close above 4,170 I expect a retest of this level at min. At which point I will have to defer to the readings on my model to determine if the ultimate reading of 70 is a high probability. Remember, per my email yesterday a 70 reading gets us close to 4,300. So in the interim, dips will be bought for a test of 4,170.

- NASDAQ Futures: Yesterday I stated, “have medium conviction to reduce longs at 12,480”. Today’s high was 12,525 and settled around 12,400, however with META’s reporting after hours today, NASDAQ futures are sitting above 12,500. It seems logical that the ultimate level we discussed of 12,800 is probable. The first attempt to break above 12,800 will be exceptionally difficult as discussed for the last several weeks and I believe the first attempt is a high conviction set up to sell. However, a close at this pivotal level, especially on a Friday, the NASDAQ can have an extremely powerful move to the upside. If this does trigger, I would get long calls on the index, because it’s a strong probability we will see 13,650. This will be confirmed with a complete break down in the dollar and the 10 year that we have discussed many times.

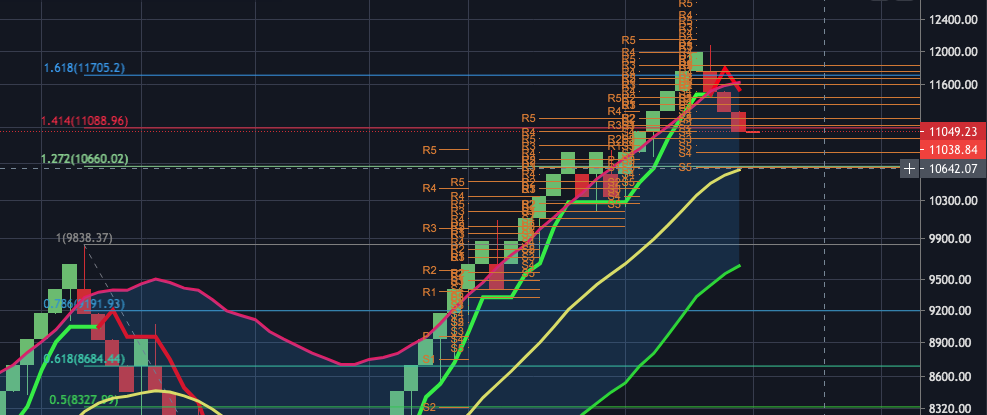

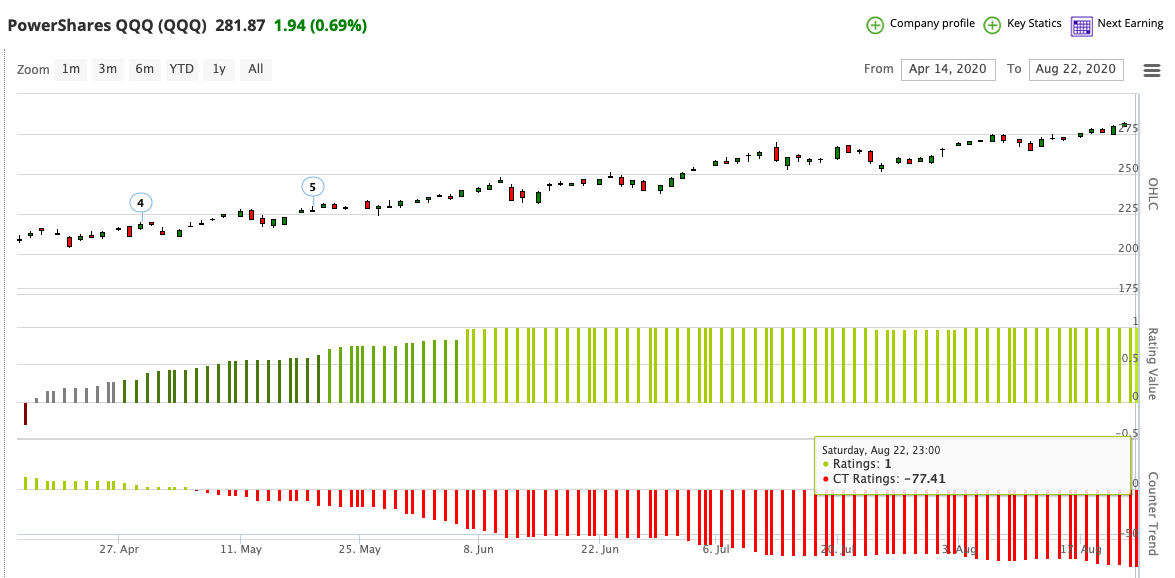

- Apple: Since Apple is reporting tomorrow, its worth discussing as it will impact our 12,800 level. Unlike MSFT, META, AMZN or GOOG, Apple is still heavily shorted and over sold on a relative basis based on our counter trend model. Our counter trend model as seen below is a +19, while not in the 99 percentile of oversold, its enough to propel the stock up to the big resistance level of $154 providing some bullish carry to 12,800. Which would still be a sell. (see first chart below – green bars)

- My models on the indexes have not updated yet, so I don’t have visibility into the readings after the close just yet.

- U.S. Dollar: I have been discussing the Dollar via the DXY ETF and the $100 level as a tailwind for growth since we took out $109. Keep an eye on this level. You take out $100 on the downside on a close, tech is going to get a bid. See below (second chart).

- 10 Year Yield: I have been discussing for the last month, a weekly close below the 3.38% on the 10 year as a powerful tail wind. I would expect we will need some weaker BLS data to break this level on a close. (third Chart)

- Per my long trade setup mentioned yesterday, the medium term back up the truck long trades remain S&P 500 3,880 and NASDAQ 11,450. For those who want to add to long exposure on any initial decline caused by Powell’s presser, you may get a bounce off of S&P 500 3,943, however this is nothing more than a day trade.

- S&P 500 Futures: A close above 4,118 add long exposure for that 4,170 level that we discussed on January 12th below.

- NASDAQ Futures: No longer a seller at 12,390. Strictly based on my NASDAQ model’s last similar move in August, I have a medium conviction to reduce longs or short at 12,480. Remember, the high conviction short trade I discussed back on January 12th would be the 12,800 region. A close above 12,480 will get you to that 12,800. This would be the same vol stop failure the index saw in March 2022 and August 2022.

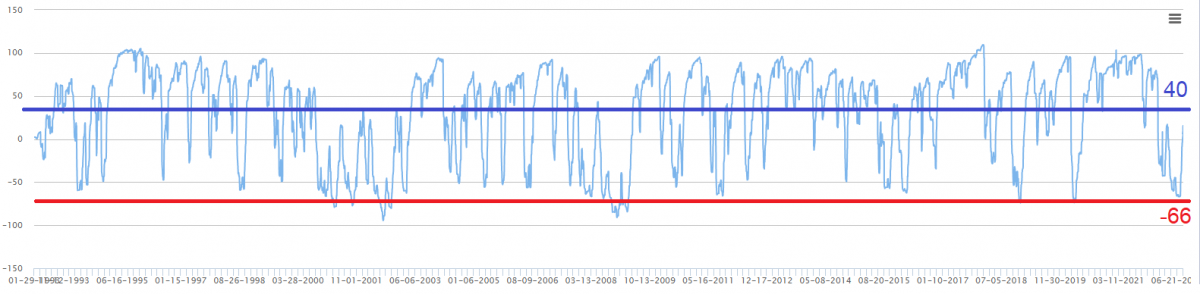

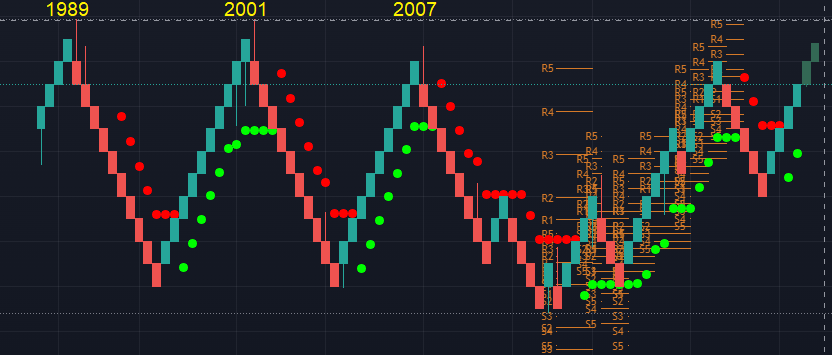

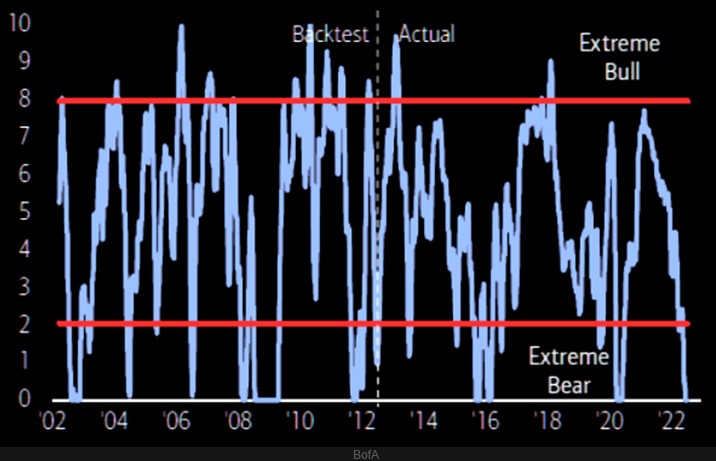

- Our S&P model is currently reading a 31, click the first chart below to enlarge.

- This reading is lower than both previous failed break out attempts of:

- 35 reading Dec 13th 2022

- 43 reading Aug 23rd 2022

- If the model takes out the 43 reading on the upside the model will pick up significant strength from my calculation to reach roughly a 70 before failure.

- This percentage move correlates inline with 4,300 on the S&P 500 above my 4170 upper level target.

- Currently, I see this as a low probability from everything I see. If we retest 43 from the summer that puts us at almost 4,170, as I mentioned a week ago and would be a seller.

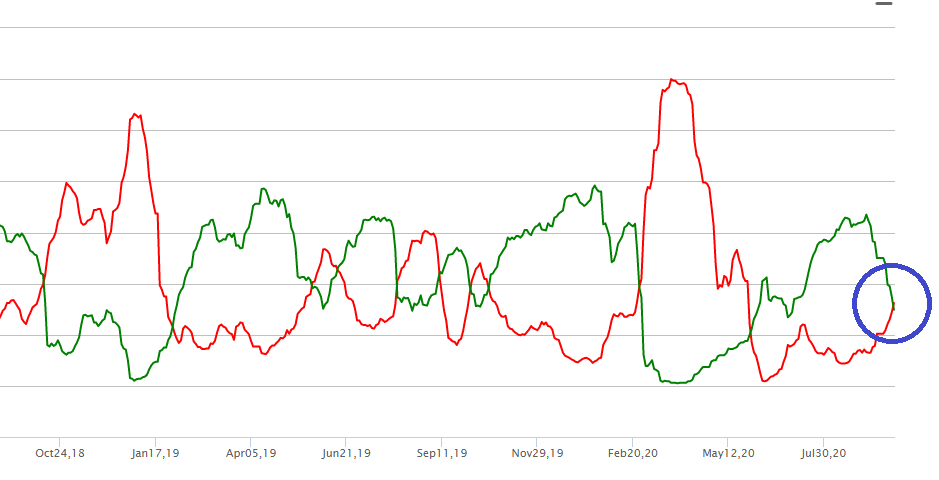

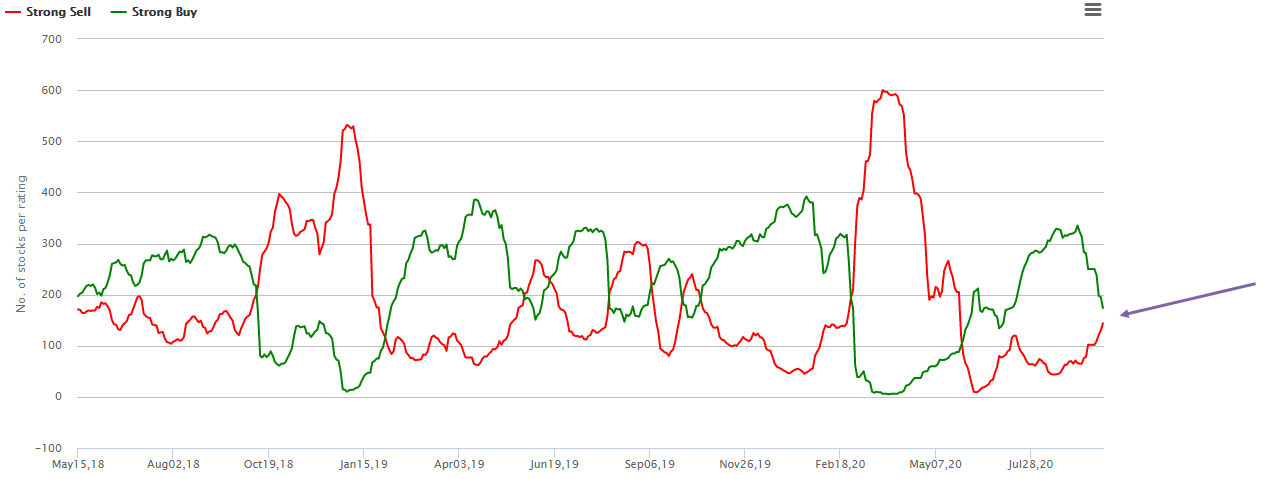

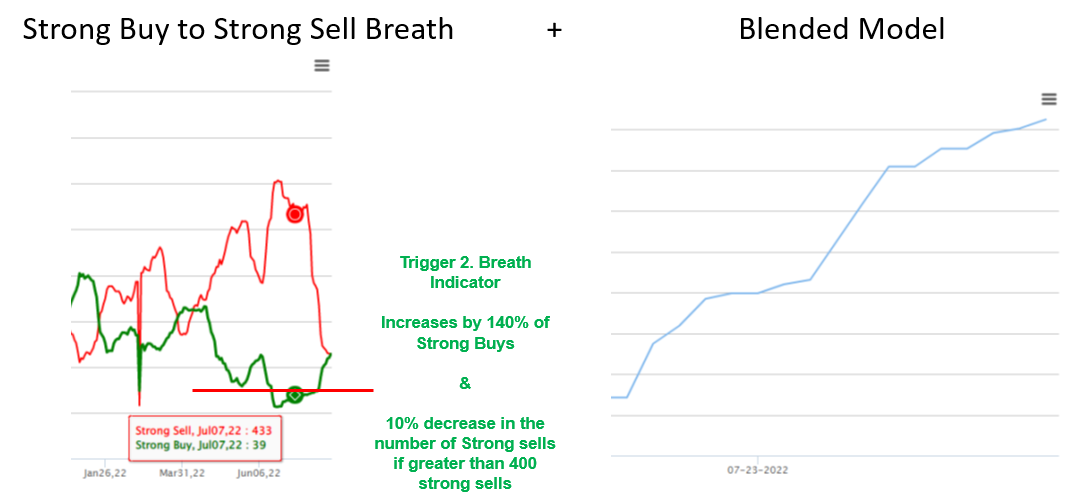

- My proprotary Strong Buy to Strong Sell ratio of S&P 500 stocks is sitting around 288 strong buys. This is a very solid way of looking at breadth. From my testing if the S&P 500 does not move above 330 strong buys this is where historically the S&P 500 starts to stall.

- Summary: If the S&P 500 model can not significantly break above the 43 reading, regardless of the current level, I will have much conviction to take down long exposure and short the index.

Saturday, January 28th

S&P 500 Failure: What now? Friday’s 4,100 failure on the S&P futures was not as concerning as many strategists would lead you to believe. Yes, we were sellers on the first attempt of this breakout which failed, but we were not bearish just yet.

Here is how I view the current set up and how to play this coming Wednesday’s Fed meeting:

- The first attempt of a significant break that has massive supply overhang is alway a difficult challenge. So I would not read too much into this failure. Failure needs to take time to exhaust its exuberance with another attempt!

- I would expect a little back and fill pre-market based on Fridays close on Monday which will be bought. The next small level of support on the S&P is 4,040. The rationale for dip buying is as follows:

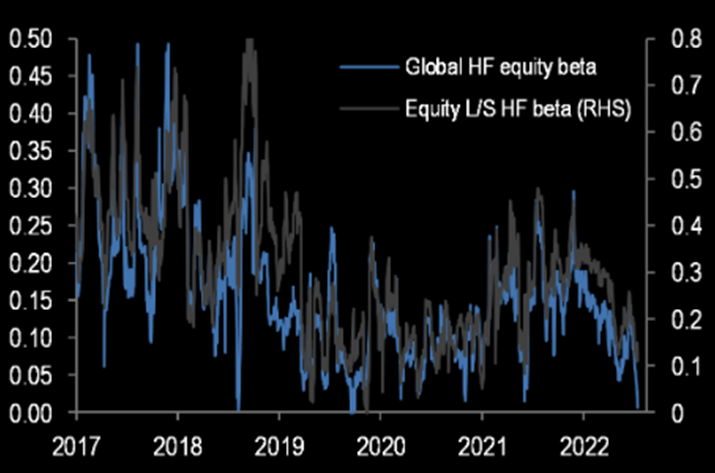

- Mutual fund beta exposure is at the lowest level since 2019.

- L/S exposure is almost at the lowest long exposure since January 2021, excluding summer 2022.

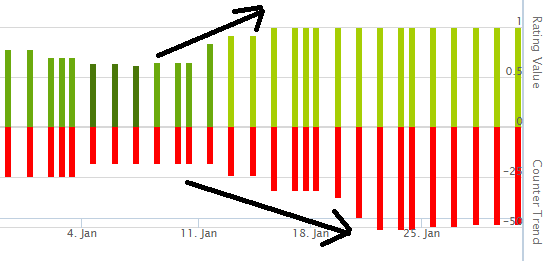

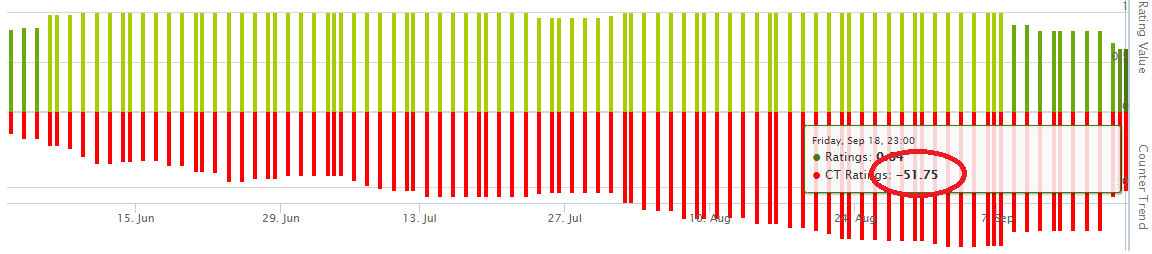

- Our S&P 500 & NASDAQ rating value (composite trend model) strength continually builds on strength and typically does not reverse course on trend just yet.

- Bottomline is that many long only investors still need to play catch up and will buy the dip as low vol, defensive high momentum stocks are negative for the month of January, providing additional support to chase growth/NASDAQ. Our rating value for the NASDAQ just went positive .20 almost an identical move as we saw over August and if this plays out in similar fashion we have another 4% on the upside.

The Set Up:

The big wild card for the S&P and NASDAQ will be Powell’s presser Wednesday. Financial conditions based on the bloomberg index (see below) are at the lowest or most easy financial conditions since March of 2022. This gives Powell all the opportunity to talk down the markets and be hawkish. Preferably, I would like to see growth / Tech move higher into Wednesday’s Powell’s presser as the risk is to the downside. I will be less bearish on any decline on the NASDAQ heading into Wednesday, which does not seem likely at this juncture. Ideally, 12,390 pre Wednesday would be an opportunity to lean into the growth factor on the short side as Powell has every opportunity to deliver a hawkish stance. While ISM and leading inflationary indicators have declined since his last presser, Powell most focused indicator of wage and labor data has not declined to any meaningful degree. If Powell’s message sets up dovish the next stop is 12,800 on the NASDAQ and 4,170 on the S&P 500.

A more hawkish Powell: Downside target for the NASDAQ is 11,750 & 3,960 for the S&P 500.

Friday, January 27th

Quick follow up from our S&P 500 call yesterday Jan 28th: “For anyone looking for a short term trade, I would be a seller of the S&P 500 at 4100 and take it off if we get a Friday close above this level.

- We have 2 hours left, to irretrate, take off this short trade if we close above 4,100. The close is key and a close above here is going to be very powerful. There is a lot of supply at 4100 so it won’t be easy to take this out on a closing basis.

NASDAQ: no change in our view, the next stop seems probable we discussed yesterday of 12,390.

Wed Jan 25th

What an exciting day. The equity markets had every opportunity to fail today and rejected that notion. Our S&P 500 target of 4,130 seems likely at this juncture unless AAPL, GOOG, AMZN and even NVDA completely blow up earnings. To see our NASDQ (futures) level please visit our January 13th note below)

As we mentioned several times (see January 11th note) the market currently under the narrative that rate cuts are coming in Q4 doesn’t care about earnings contraction. Case in point was MSFT today, the street knew earnings, margins and rev growth would come in light, this was never in question. The enterprise business saw some of the greatest secular growth of any group within technology as a result of COVID. What caused concern early premarket was MSFT guided lower, which was in our opinion to set expectations for a Q1 beat. Every trader knew this as MSFT was providing some room for themselves and the decline was bought.

Another important reason for the rally today was investor positioning.

- Long only Investors are underweight equities. Long only investors are under allocated and after a massive start to the year this gave them the opportunity to add some exposure. The second pullback won’t be so easy of a buy the dip. If you doubt this rational for the rally, just look a the recent survey conducted by JP Morgan of investment managers.

- Then there are hedge fund who are heavy short technology. On January 24th, Goldman Sachs prime brokerage desk saw the largest 1-day notional short covering since June 22 which they said was in the 99th percentile in 5 years.)

- Below 2 great charts from Barclays on investor positioning. The first chart shows mutual fund equity beta is really low! The second chart shows that Macro hedge funds are not short equities anymore and actually increasing their long exposure as seen in the second chart.

Friday, January 20th

Don’t get too excited about today’s move higher in markets. Today’s price action in the CASINO “AKA” the Market was just another typical massive option’s expiration move trying to pin the index’s to the nearest strike. We have witnessed this exact behavior for the last few years, but the volumes are growing which causes gamma squeezes. The amount of short dated options being traded has exploded in volume causing the indexes to get pinned into large levels. Even though the S&P 500 futures closed up 70 handles, it was just shy of its pin at 4,000 with a close at 3,989.

For those who question the option expiration theory today as being the cause for today’s move, look at this chart from Goldman. 50% of options traded on SPX expire today, WOW. Unfortunately, this has completely turned the markets into a Casino. Brilliantly, market pundits on TV were out in full force today, scratching their heads throwing reasons in the wind why the markets were up 1.50% to 2.50%. The reason was mechanical unfortunately and nothing has changed yet! The S&P 500 is getting tighter and tighter and is about to make a binary large move.

Source: Goldman Sachs

Stagflation? As we all know global inflation is dropping like a rock which is welcomed. Although it will put pressure on profit margins in many industry groups for a while who benefited from their rising revenue last year. Here is a chart from Credit Agricole on the global inflation front.

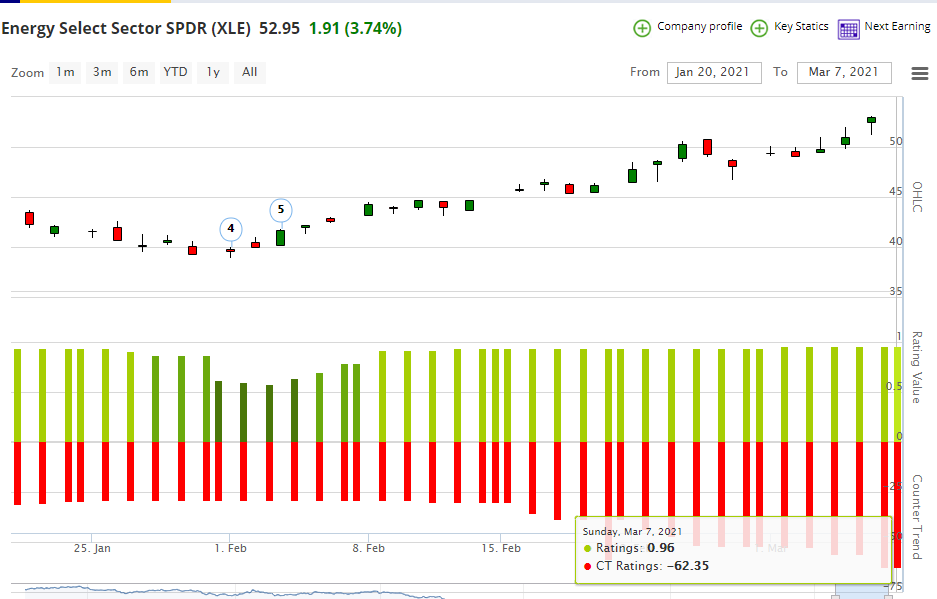

All Weather Models

For the last 2 months we have been discussing increasing our allocation to fixed income for a medium term trade. Below we have highlighted our rating value and counter trend models for AGG, which drove our process to increase exposure to Treasuries. Medium term for those curious would be the 10 year Yield trading into 2.80% region, a massive level. As you know our models have been underweight fixed income relative to their benchmarks by 50% to 70% depending on the strategy. If and when yields hit our target, we will look to take down our allocation back to the model’s historical weight. We believe fixed income will be a drag on performance once inflation has normalized.

Today, we added 2% across the board as the 10 year yield closed up 2.68% and we look to add on any sell off within Treasuries as our models increase in strength.

Wed, January 18th

Two things for today’s sell off we wanted to point out.

1. The market rejected the move on the 200 day moving average over several days. We are not a fan of using moving averages and have found in our research the 200 day moving average has a 50/50% probability of dictating future price performance well. However, it gave some reason to traders to short the market and sell on the PPI and retail number this morning which leads us to the important issue.

2. On January 9th we discussed one of Mike Wilsons (Morgan Stanley) concerns: “He believes earnings collapsing supersedes inflation normalizing as companies operating leverage will decline and hurt companies margins (earnings) as costs fall faster than end prices”. Well today in the PPI the cost for goods sold declined or plunged the most since COVID lockdowns (see below from Bloomberg). This is why we are seeing massive selling in consumer goods today like canned goods and food companies like HSY, GIS and CPB. This is why low vol ETFs like SPLV are significantly underperforming the S&P 500 by .90% alone today.

We own GIS and CPB as well, which had a high score on our models until the last 4 or 5 days, however it was too early to sell as the socring was not low enough. So we will have to wait to see where these stabilize in price. However, for those of you using low volatility ETF, be very cautious here as many consumer defensive names are slightly expensive after the 2022 run and now the market is growing concerned with negative operating margins within this group. This is pure mean reversion from the 2022 winning trade.

Lastly, we have discussed several times that the 10 year yield has massive support at 3.40% and a close below this level will cause more buying within the 10 Year Treasury.

Friday, January 13th

S&P 500 Futures

- Friday, January 6th: We discussed 4,015 as being a large level of resistance that warrants some reduction of risk. A close above this level will take the index back to 4,100.

- Wed, January 11th: We said 4,015 was the level to look for after the CPI print and it was immaterial that 4,015 failed to hold and still think 4,080 and 4,130 are areas to reduce long exposure (increase shorts or hedges). One exception is if the 10 year yield as previously discussed closes below 3.40%. This might change the market dynamics.

- Failed Rejection: Today the indexes had every opportunity to fail as weak longs never sold the recent front running of a cooler CPI. Additionally, the Money Center banks solid reversal from premarket lows will support the bullish narrative in the short term.

- Medium Duration CTA’s: Looking at our own S&P 500 model (see first graph below) which is medium frequency (60 to 120 days) just moved from a -.07 to a +.11. For your reference, .11 is a very weak long or neutral reading and .65 is where markets start to squeeze. The key point is that it went positive. The CTA duration is important because the longer the duration, the more money is allocated to the trade. That is why shorter quant systems have capacity constraints.

- Conclusion:

- Many negative momentum stocks within the S&P are about to go positive, which will provide some upside fire power on the index and draw in short term system buyers before we can see a meaningful reversion lower. In my opinion, this is a typical pattern of January and less of a real regime change in longer term momentum. So weak longs will be sucked into the market.

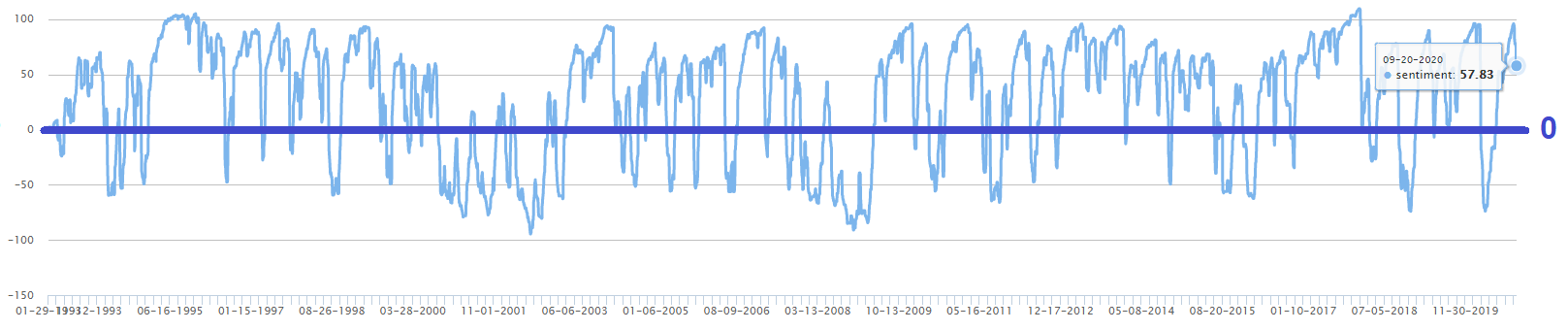

- Before this current cycle is complete, the target levels I am looking at are 4,130 to max 4,170 with a reversion back to 3,874. I am basing this move on our S&P 500 composite forecast model (as seen in the second chart below). It’s sitting at a .05 and I am looking for a +30 before falling back to 0 once again.

S&P 500 Compositive Model (click to enlarge)

NASDAQ Futures

The NASDAQ currently has a -.74 reading vs the S&P 500’s +.11 on our model, which certainly provides the NASDAQ a lot more outperformance over the S&P 500 on any weaker economic or job’s number data via lower yields.

- Based on the current very weakened state of our NASDAQ models reading, it wont take much to get to the 12,000 level where I would be a seller.

- As mentioned yesterday, a close below 3.40% on the 10 Year Yield is all air until 3%. This could be a large enough catalyst, in my opinion, to get the NASDAQ to the ultimate level of 12,800, at which point I would be a strong seller at the first retest. I think the 12,800 level is extremally premature.

Jan Friday 13th

CPI came in exactly as expected and our target on the S&P 500 4,015 was hit. The most negative momentum names within technology like semis lead the market and safety stocks with the great momentum lagged. Today was textbook! If we had to guess it will take a higher level on the S&P 500 like the 4,130 we discussed for the narrative to change that the economy is weakening and corporate margins are compressing. We believe the easy money in these deeply oversold technology stocks have largely been played out unless we get that massive move lower on the 10 year yield discussed below.

1. The 10 year yield is approaching a massive level. I spoke with a few of you about that 3.42% level. I think it will be very difficult to close below this level without a large catalyst like another weaker ISM services or a miss on BLS jobs. However, a weekly close below 3.40% is going to cause a large rally in bonds that will cause a lot of positive vol as it is all air until 3%. This will have a very positive effect on longer duration growth names.

2. We have been discussing $103 for the last month as the next large area of support for the DXY / U.S.D. Well the line in the sand for DXY is now approaching critical support at $102.30 which I think will take a great deal to crack. A close below here you are sitting at $100.

3. Lastly, for those who received our piece on the S&P 500 levels yesterday for CPI’s setup. A close below 4,015 will have a non-material impact in my opinion. Until January’s rotation into negative momentum stocks is complete, I still believe the large level to derisk longs as mentioned yesterday ill be the 4,080 & 4,130 region respectively.

Jan Thursday 2nd

Is Inflation about to crash and corporate margins compress?

The great thing about having a systematic investment approach is you never get too bullish or bearish. If you have recently read Morgan Stanley’s Chief Strategist Mike Wilson’s note, you are now liquidating your portfolio and going to 100% cash. While he makes a lot of very valid arguments for his bearish view and we agree the market is expensive and corporate margins will compress further based on the fundamental backdrop. However, we do disagree about one vital thing, markets care more about QT/QE (quantitative Tightening/ Quantitative Easing) over earnings.

In Wilson’s latest very bearish note he believes (CPI) inflation is crashing much faster than the Fed realizes and by the time the Fed can do anything about saving the economy, it will be too late as earnings will already be collapsing. The first chart below is why Wilson believes CPI is about to fall off a cliff and why the markets rallied so hard on last Friday’s weaker ISM. The chart clearly shows that ISM always leads CPI, which has fallen off a cliff. He also shows in the second chart below that never in history has the Fed raised rates while both ISM Manufacturing and Services declined. He does realize that falling inflation is a positive, although he believes this takes a back seat to margins compressing. He believes earnings collapsing supersedes inflation normalizing as companies operating leverage will decline and hurt companies margins (earnings) as costs fall faster than end prices. Which makes complete logical sense, unfortunately, for well over a decade, the market traded more on liquidity and no true price discovery from the addiction of the Fed’s $9 trillion balance sheet bubble.

Wilson believes the S&P 500 earnings are vastly overstated and writes the market has 20% lower regardless how much inflation declines. In his note he suggests that the S&P 500 will ultimately earn around $190 base case and $180 bear case vs consensus $225. Wilson writes that the equity risk premium will need to rise, which will cause the S&P 500 P/E to fall to 13 times forward earnings. This is where we disagree. The first sign of a pivot from a decelerating trending CPI, multiples will expand regardless how bad earnings start to compress. The market will get more expensive. The markets are upwardly biased and addicted to easy monetary policy more than quality earnings. This is why the S&P is not currently trading more at equilibrium of 15 times and why the stocks multiple expanded 3X over the last few years. The market only cares about easy money.

While we agree the E or P/E will decline in 2023, however the market is upwardly biased and will focus on inflation first, not earnings. This will result in the need to be a stock selector and not buying at the index level. The bottom-line trying to forecast longer term future direction of markets is not a game you can win. Over the last several months there has been no clear regime change for a long term bullish trend in sectors or industry groups. Dynamic Alpha has played it close to the vest with more defensive areas of the market and some trades that did not transpire into strong gains. While this may remain the case in the near future, our mission once our model identifies the best risk to reward opportunity is to invest in these stocks. If these investments present risk or the broad market has systematic risk then the models look to reduce risk and wait for the next opportunity.

In conclusion, based on the recent ISM data, Thursday’s CPI looks to come in cool and 4,015 on the S&P 500 futures is the next stop then 4080. For those who are concerned with risk 4,130 is an area that might warrant de-risking.

Friday, January 6th

Round 1 goes to the soft landing scenario as wage inflation and ISM declines!

On Tuesday January 3rd we stated,

- We said the good news was everyone was bearish. “The Consensus Street View is full on Bear, (remember consensus never generates alpha) the good news is almost all of the Wall Street Strategists coming into 2022 were wrong (exception Mike Wilson & Michael Harnett)”.

- Additionally, we also said the only thing to drive 2023 market returns will be the labor market. “In our opinion the unknown, “most important variable” will be the labor market. This will drive the soft landing and the Fed pivot”.

Wage Inflation: Today’s highs of 2.50% or 97 points on the S&P 500 was a little over zealous. This was clearly more from every investor being off sides on their long positioning and hedged. As we can see below Average hourly earnings was revised lower from 4.8% to 4.6%, the lowest since Aug 202, sparking hopes of a more accommodative Fed.

Today we saw a 2.21% gain for the S&P 500 as the jobs number came in stronger, however, wage inflation pressure showed signs of easing. The Treasury market took this seriously as the 2 year-yield declined 4.35% and the 10 year-yield declined 4.11%. As you know we have been bullish on bonds for the first half of the year, regardless of a recession or a market recovery. The next massive level to watch on the 10 year yield as a game changer will be a close below 3.42%.

All Weather Portfolio’sUnfortunately, we did not get the chance to add the last half of our fixed income exposure as we were waiting for 4% on the 10 year treasury. The good news is we added the first half at higher levels and are allocated to other asset classes that are working.

Dynamic Alpha

We feel very comfortable with the current positioning of Dynamic Alpha. The portfolio is roughly 21% cash and still is defensive, yet the portfolio is just about inline with the S&P 500 for January. The portfolio added XOM on Wednesday and reduced AZO as a recessionary play. We expect to see more rotation happening in the next few weeks.

S&P 500 Levels

For those investors who want to be tactical, 4,015 is a large level of resistance on the S&P 500 futures that would warrant some reduction to risk. A close above this level will take the index back to 4,100 and a 18.2 times forward earnings multiple.

Nov 17th

Today was concerning as the response within the market felt that the narrative is changing to recessionary fears. As we pointed out yesterday, we felt this narrative change would happen in Q1 2023, we stated: “We could see the narrative go from celebrating the decline of CPI/PCE/PPI and recovery to the realization that markets have yet to see the full impact of rising rates. Thus, this will result in even lower economic output and earnings revised even lower.”

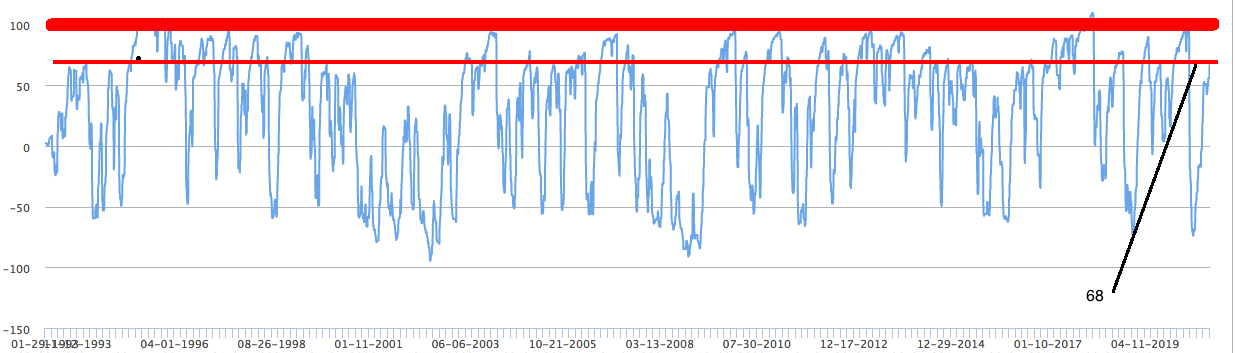

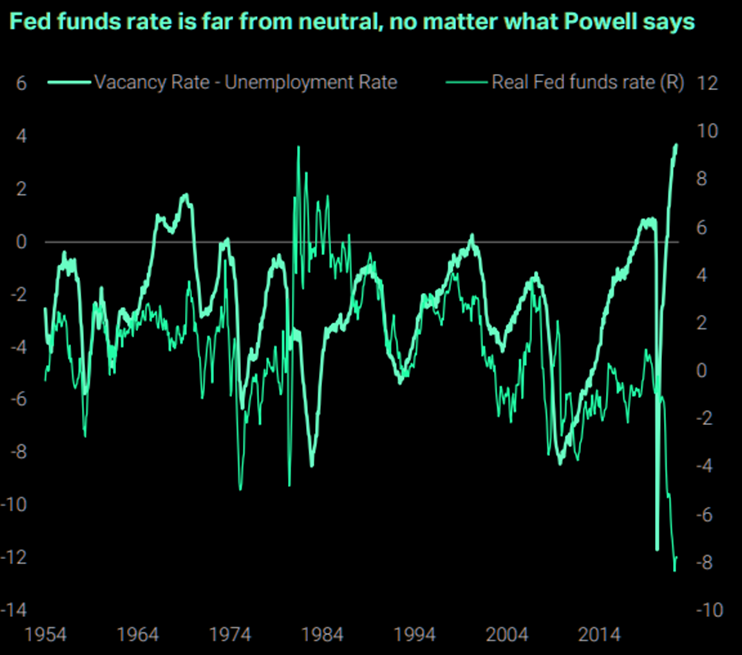

So why today do we feel that the narrative started to change toward the fear of increased recessionary concerns? It was todays simple breakout of the 2/10 yield spread, a further bear steepening of the yield curve. Yes, the yield curve has been inverted for 7 months. However, this is not what is relevant. What is relevant is that over the last several months the 2/10 yield curve has been inverted between .30bps to .55bps. Finally today the curve inverted .67, a level that has never been seen, at least as far back as our data from 1989 suggests.

Does this mean there is a chance of an eminent correction, that is not what we are saying. These are longer term signals that are not extremally timely. However, it is concerning if you care about managing risk. We felt that ultimately the narrative would change from celebration of lower inflation to one of recession. To reiterate, we would use any seasonal strength in the S&P 500, especially if we can test 4080 to move into more defensive recessionary areas or the All Weather portfolios (see here) or Dynamic Alpha (see here). If recession odds do increase, treasuries will be a much better alternative than the previous 12 months as most of the pain as already occurred. What triggered the yield curve breakout?

- Micron Technology (MU) said it was slashing capex by reducing DRAM and NAND wafer starts by about 20% versus 4Q 2022 in response to market conditions.

- More importantly the consumer is showing signs of cracking:

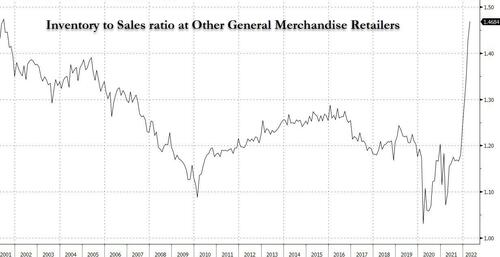

- Target (TGT) consumer are pulling back. “Clearly it’s an environment where consumers have been stressed,” said Target Chief Executive Brian Cornell on a call with reporters. Management said, consumers are waiting to purchase items until they spot a deal, buying smaller pack sizes and giving priority to family needs.

- While WMT – Walmart raised guidance and earnings seemed good enough yesterday. However, the low end consumer is spending down. Walmart said its lower-income customers swapped out deli meats for less expensive hot dogs and canned tuna.

Tuesday, November 15thToday’s softer than expected PPI across all line items saw the S&P 500 premarket trade 30 points from our 4,080 target to hit a high of 4,050. Even after the mid day sell off after a reported missile killing two Poland civilians the indexes closed very strongly. While markets await NATO’s response tomorrow, we doubt the response will result in any meaningful risk off event. Tactically the indexes remain constructive for more positive price action and any sizable dip in our opinion caused by Geopolitical risk will be bought into year end.

The PPI services print that caused a 50 S&P 500 rally premarket as seen below by Bloomberg came in negative for the first time since 2020. We believe a lot of this deflation was priced in as the dollar and treasuries really did not make significant moves until the late day Geopolitical risk off event.

Friday, November 11th

On the index level the markets seemed constructive, however, underneath the surface we had a massive momentum rotation out of defensive and inflationary stocks. This put significant pressure on Dynamic Alpha as the portfolio is heavily weighted to recessionary and inflationary equity plays. This is not unusual every 12 to 24 months if there is a regime change and initially slightly painful until the portfolio does make changes if deemed necessary. We would expect that Dynamic Alpha’s systematic process over the course of the next 3 weeks will slowly reduce some exposure to healthcare and inflationary stocks if this rotation continues at an accelerated pace.

- Inflationary plays like HSY (Hersey) saw a 2 Standard Deviation move to the downside today on no news, strictly as machines and traders are selling the inflationary stocks.

- Defensive cashflow plays like CAH (Cardinal Health), HUM (Humana), MCK (McKesson) saw a 3 Standard Deviation move to the downside today as health care was sold across the entire sector.

- The only inflationary sector that caught a bid was Energy as crude oil rallied on the back of another China reopening story.

- When stocks experience a 2 to 3 standard deviation move lower especially on a regime change these stocks will typically not participate on the upside and will slowly consolidate as a large theme is underway underneath the markets.

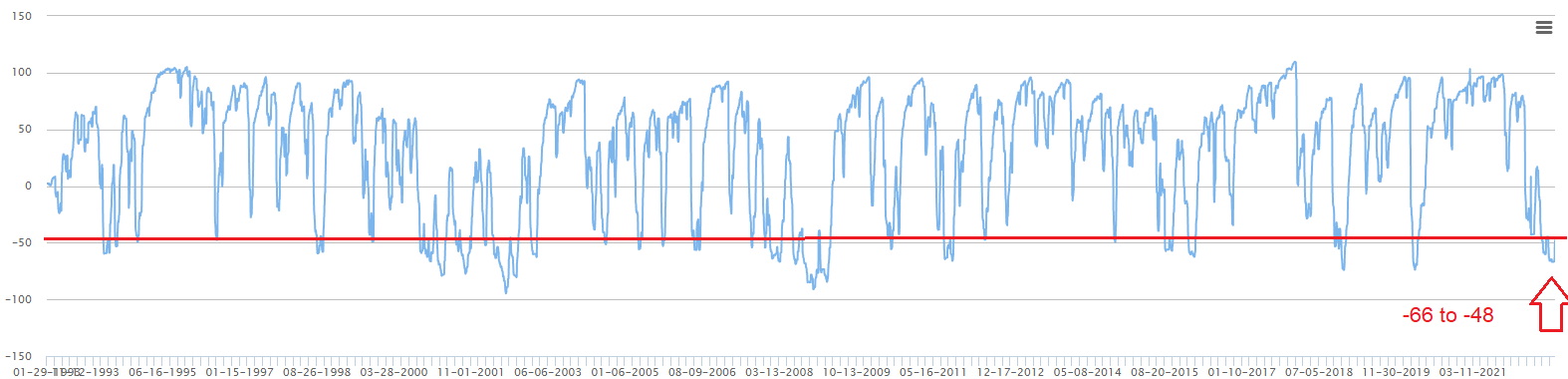

S&P 500 Model Update

One of the many reasons we were constructive on the S&P was the positioning of our S&P 500 model. We have now rallied from a -63 to a -22 and believe the model will get to a slightly positive reading before any reversal on the index. To reiterate as we have been discussing for the last month, the logical resistance level as seen from Thursday’s chart is roughly 4,100.

We will have to wait and see what developments both fundamentally, technically and Macro if and when we get there. If we are sitting at 4,100 into the Dec CPI print and we see another downside print, the S&P 500 could go parabolic into 4,300. This is not our base case, but certainly nothing is outside the realm. 4,100 is still a level that seems to warrant a more defensive stance to either raise cash, buy protection.

NASDAQ Update

As we discussed yesterday 12,600 (800 higher) on the NASDAQ (futures) would be an excellent level to reduce growth and technology exposure.

Thursday, November 10th

As we laid out in our bullish CPI case yesterday, that a .20bps to .30bps decline in headline consensus of 7.9% inflation would get the S&P 500 back to 3,900. Well the S&P 500 futures closed at 3,962 today. Keep in perspective today only saw a .20bps slightly softer CPI print to come in at 7.7%.

- Today the 60/40 portfolio jumped 3.4% today and only two times since 1988 has a 60/40 portfolio rallied more than 3%.

- The Terminal rate has now fallen from a high of 5.20% last week to 4.87% with the odds of a .75bos move in Dec a t 0% odds according to Bloomberg.

- According to Bloomberg today was the 3rd largest short squeeze on record.

- It now seems likely that every dip will be bought until the next CPI print as systematic traders are going to reengage to the long side. We can certainly see some back and fill from today’s massive 5.52% rally on the S&P 500. However, mechanically system traders will indiscriminately get long growth at this juncture after taking out 3,920 on the S&P 500 on a closing basis. We would not expect tomorrow to be a large give back day unless the S&P fails at 4,000.

Now, What We Expect?

We have not wavered from our October 6th commentary for a year end rally to 4,100 on the S&P 500 as we listed four strong catalysts, now make it a fifth. This level will certainly be an opportunity to rebalance into more defensive strategies, sectors or cheap protection. As measured by headline CPI, inflation still sitting at a whopping 7.7%, so unless we can get a meaningful decline in December, we do not see taking out 4,100 on a weekly basis to reach 4,300.

In the very near term, 3,998 on the S&P 500 (futures) is a formable resistance level and would expect some selling initially into this level.

Dynamic Alpha

This morning we added AMD (Semiconductor). However, we have no other exposure to technology. 80% of the portfolio is still defensively positioned within Healthcare, Consumer Goods and Energy. All these sectors will lag the S&P 500 if higher beta growth names continue on a deflationary belief. Unfortunately, for the interim Energy will struggle regardless if fundamentally cheap as long as inflation continues to decline and money will flow back temporarily into growth.

For clients or interested investors, click this link to access Dynamic Alpha tear sheet.

Wed, November 2nd

Fed alludes to a slowdown put no step down

Powell attempted today to thread an almost impossible needle. As we said yesterday, “we would not be surprised to see a disappointed market sell off into the close even if the Fed delivers an inline message, then a rally on Thursday”. See conclusion for levels we are looking for.

1.) The S&P 500 initially rallied 37 points based on the below statement of a potential slow down in the pace.

“The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments”

2.) However the gains quickly reversed as the S&P 500 fell 117 points from the highs of the day as the press conference was half way through.

Powell lost credibility as he doesn’t seem to have clear visibility on the lag effects of rising rates and the economic impact. Then what sealed the market’s fate was Powell suggesting that terminal rate might need to be higher than current projected levels to combat inflation that may be ingrained in the economy. Below was his exact statement regarding the terminal rate.

“We have some ways to go,” adding that the ultimate level of the terminal rate may be higher than previously expected. “The question of when to moderate the pace of increases is now much less important than the question of how high to raise rates and how long to keep monetary policy restrictive.”

As shown by Bloomberg, the Terminal rate hit new cycle highs of 5.10%.

Conclusion

The markets pulled forward a lot of return in the last 10 days and as we said 3,750 would be seen on a reversal lower. Investors might find entry around the 3,730 level on the S&P 500 to deploy capital IF underweight equities. However, we have jobs on Friday and a blow out number will put the S&P 500 looking at 3,677. After todays strong ADP we can expect the labor market to remain tight and strong.

Friday, October 28th

What an incredible rally from last night’s low on the S&P 500 of 3,760 to close today at 3,915, which is a 155 point (or a 4%) rally in 1 day. So why did we rally today after lackluster Mega Tech Earnings? Earnings were certainly not the catalyst as Apple really was not good regardless of the price reaction (or what the sell side analysts say) and Amazon’s highest margin highest and growth business (AWS) experienced margin compression.

Today’s Rally

Over the last two weeks we have listed 4 major medium term catalysts below for a melt up. In our opinion, discretionary traders have already tried front running a lot of these. Not mentioning our blended S&P 500 model was setting up for a counter trend rally. However, today was about options expiration more than anything else. Nomura’s Charlie McLligott Cross-Asset Macro strategist suggested the 0 to 1 days-to-expiration in U.S. Equities Index / ETF helped fuel today’s melt up. He pointed out that 64% of all SPX options trading today were 0 to 1 day expiration and 60% for all QQQ. Additionally, 13% of ALL SPX options had a strike of 3,900, 8% at 3,880 and 7% at 3,875 a total of 28% of all SPX options pegged 75 handles above the cash open! Between the quants and the options market, the market mechanics are exacerbating these large moves.

4,080 S&P 500?

The bottom-line is that every Central Bank has blinked. First it was the Fed, as we discussed, with their leaked message to the WSJ as they were worried about cracks in the credit market. Then, Canada lowered less than expected and then just today, the BOJ pivoted today reengaging in QE.

4 Positive Catalyst’s, but beware of the 4th!

- The largest corporate buy-back: A potential $190 billion to buy into year end. 75% of all S&P 500 companies can start buying Tuesday, November 1st.

- CTA’s have close to $170 billion of available capital to deploy to the long side according to Goldman.

- Stocks are under owned: BofA manager survey shows the highest cash level since April 2001. (Refer to Oct 18th post)

- The Fed Blinked but… This 4th catalyst is already getting priced in. As we already know, last Friday the Fed leaked to its mouth piece at the WST that the Fed is concerned with something breaking. The market took this as a sign of a dovish step down in their terminal rate. Although, a few inline to hotter inflation data points today like today’s PCE (inline) and ECI – Employment Costs Index (in-line), could dial back this message.

Today the S&P 500 futures settled at 3,919 as we have been discussing for several weeks a counter trend rally to 4,080 was in the cards. We have the Fed on Wednesday and consensus is at 75bps and 50bps there after. To get a rally to 4,080, the Fed must convey Nick Timiraos at the WSJ messagethat they are going to slow the pace and to give the economy time to digest the rate hikes, if not the market will be liquidated.

- If the Fed does message a set down or a so-called mini Pivot, 4,080 seems probable.

- If the Fed does not deliver this view of a step down and pulls the rug out from under investors, then the S&P 500 could easily trade back to 3,750 quickly. It will be a rather binary outcome.

Michael Hartnett of BofA who has been very good this year says it will take a 5.5% unemployment rate for a real Fed pivot for a collapse in inflation & payrolls. We have been saying without job destruction of large negative prints that we can not see a collapse in CPI. The Fed is in a tough spot because it can not pivot any time soon until the economy is progressively worse.

Today was not a Pivot, but a melt is coming!

For the last 2 weeks we have discussed three potential positive catalysts as to why a short term melt up was probable. Everyone knows these catalysts (see below) and they are old news. Now today, we can add a fourth positive catalyst to the list, a “Worried Fed”. Let us stress these are all short term catalysts and they do not change the broken Marco environment or the fundamental backdrop. Although ultimately even if the S&P 500 can test 4,080 on a year end rally, a retest of 3,503 is likely in 2023.

Four Positive Catalysts:

- The largest corporate buy-back black out period is over next Tuesday with a potential $190 billion to buy into year end.

- CTA’s have close to $170 billion of available capital to deploy to the long side according to Goldman. Goldman also says CTAs are currently short $22 billion of S&P and could flip with a 3,812 level on the S&P 500 futures.

- Stocks are under owned: BofA manager survey shows the highest cash level since April 2001. (Refer to Oct 18th to see chart.)

- The Fed is worried and blinked today:Today’s rally was all about a Fed that is concerned about breaking global financial markets, which we have discussed over the last few weeks. The Fed clearly panicked with their leaked message, however we do not believe this was intended to be a pivot and strictly an attempt to ease the Dollar’s euphoric rise which has unleashed stress across global markets. It is certainty too early to call for a pivot as inflation data has not even begun to decline in the most meaningful areas of wage and shelter inputs. However, the Fed blinked today as stocks surged off the back of the Fed whisperer Nick Timiraos at the WSJ who relayed a Fed message that future rate hikes are being questioned. Then, after this leaked measure from the WSJ, Mary Daly of the Fed came out saying the Fed might be moving too fast and she even mentioned that the Fed could break something and could cause contagion in a worldwide Dollar shortage. So why today did the Fed panic with this leak? In our opinion, the Fed panicked as the Bank of Japan and the Swiss National Bank both in the last two days needed to inject roughly $50 billion of US dollars. The world is being squeezed with the lack of USD. Essentially, the Fed needs to get the dollar down and ease financial conditions as other sovereign nations are getting squeezed. However, the issue is that the Fed is attempting to jawbone down rates and the Dollar to avoid breaking financial markets while at the same time, trying to combat inflation. So the markets can welcome this in the short term, but make no mistake, inflation is not on the decline yet.

Positioning is everything in a bear market squeeze

Below is a great chart from Goldman showing the Goldman Sachs Prime Brokerage Long/Short ratio to S&P 500 open call interest. Investors. The second chart provided by Goldman shows that hedging protection has been almost expensive since 2008. Everyone is positioned for lower levels.

Dynamic Alpha

Dynamic Alpha is in a high level of cash, roughly 14%. While there are few stocks within the S&P 500 that are showing evidence of constructive price behavior where they meet our buy requirements, our S&P 500 blended model overlay currently will not allow the strategy to buy just yet. This could change this week if a melt up does occur and lifts the restriction on the S&P 500 overlay. While we can not catch the tops or bottoms of a market, we do believe over the long term our process is far superior to anything in the long only space.

Dynamic Alpha has out-performed the S&P 500 by 2.43% on an annualized basis while outperforming EVERY MAJOR S&P 500 drawdown over the last 7.8 years.

Past performance is not indicative of future results. Fees are based on .28% annualized. Dynamic Alpha benchmarks to the S&P 500 even though the strategy is designed to be benchmark agnostic.

2022 Drawdown Risk

Past Performance indicative of futures returns2020 Drawdown Risk

Past Performance indicative of futures returns2018 Drawdown Risk

Past Performance indicative of futures returns2016 Drawdown Risk

Past Performance indicative of futures returnsDynamic Alpha has out-performed

the S&P 500’s 16 worst months 80% of the time.

Past Performance indicative of futures returns

Tuesday, Oct 17th

Bottom-line.. there is no demand destruction yet and therefore there is no peak inflation

It is only Tuesday and we have made moves on the index level that historically take weeks if not months to make.

- Today the S&P 500 rallied 80 handles before almost going flat on the day to close up 44 points.

- The NASDAQ futures were up 300 points at the open before going red 30 points to close up 100.

- Mid day news of Apple (potentially) telling suppliers to halt production sent the NASDAQ down, however, the strength across the index in our opinion remained strong.

- Earnings:

- Netflix reported earnings and after hours the stock is trading up 14% as the company’s subscriber growth crushed expectations by 1.3 million coming in at 2.4 million new subs. While this is a company secular specific story, consumer demand here is not slowing!

- United Airlines is trading up 7.5% after earnings as the company reported all time revenue and profit quarter, consumer demand here is not slowing even though it was widely anticipated travel demand remains strong!

- Macro View: It’s still hard to make an argument for peak inflation when consumer demand remains as we are witnessing this earnings quarter. Without job losses there will be no consumer demand destruction and NO Peak Inflation:

- We have been saying earnings risk was not to the downside as S&P 500 EPS was already sliced by 7% for Q3. While earnings are clearly coming in much better than expected of late, like NFLX, UAL, GS, BAC, it’s also an indication that inflation is not slowing down as the consumer demand remains intact because jobs remain unrelentingly strong. Until we start seeing large negative print on Non Farm Payroll, inflation has yet to peak.

- We can see a scenario where we continue to rally in the short term as earnings are better than feared as jobs remain strong. Although, reality will once again set in that inflation is not breaking until the labor market breaks and then we get a real sustainable rally as the Fed will need to Pivot.

- Below is a good chart provided by Deutsche Bank, showing 14 Fed hiking cycles since 1950’s and the unemployment rate and current forecast.

Current Set UpNo one is invested, S&P 500 historically still oversold and record buy backs start next week.

- According to the first chart below, B of A Global Fund Manager Survey, the FMS average cash level has not been this high since Oct 2002.

- The second chart provided by BofA Global Research Investors is now a 3-signa underweight equities, far greater than the full blown panic during the peak global financial crisis.

- Refer to yesterdays note on the potential level on the S&P 500 for this bear market rally.

Monday, Oct 17th

Today’s 2.60% move higher on the S&P 500 was nothing more than a delta squeeze as hedge funds and sophisticated investors were squeezed based on Thursday and Friday’s positioning. Nothing fundamental or earnings related was the catalyst. However, as we know all initially rallies start with short covering.

One important thing to point out that could be a very positive catalyst for the equity markets is corporate buybacks. The blackout period is over next Oct 25th and companies can start buying back authorized repurchases. This will put a strong bid underneath the market as it is going to be the largest authorized repurchase of corporate buybacks in history. If this does firm up the market in early Nov, in our opinion this could lead to a yearend rally taking the S&P 500 to 4,080, which will ultimately fail and retest 3,500 in Q1 2023.

A few highlights:

- Buy back volumes might be elevated as new tax rules take effect in 2023 on corporate buybacks. Corporates may front load heavy repurchases before year end because of the tax changes in 2023.

- There is $190 billion of repurchases in the last two months of 2022 or $4.5 billion every day, which is said to be front loaded in November, which we cannot verify.

- Below is a corporate buy back chart going back to 2005 from GS Global Markets, Birinyi Associates and Bloomberg. You can see why this could be a very positive catalyst on the market.

Earnings Season has Begun

Earning season is underway and we don’t believe it will present a downside risk as investors already know how bad EPS cuts have been. This chart provided by Deutsche Bank shows how big this earnings season cuts have been relative to the last 12 years. The only thing that matters now is jobs which in return controls wages inflation, thus liquidity from interest rates. With the jobs market so resilient, earnings will come in most likely better than feared. Until Non Farm Payrolls start losing jobs to fight wage inflation, earnings are not going to completely blow up unless it is more of a dollar story.

Where can a Bear Rally take the S&P 500?

On Oct 6th we stated we don’t attempt to predict or forecast longer term price moves, although a bear market rally to 4,100 is possible as everyone is positioned so negatively for lower levels. With the current positioning of hedge funds and under weight positioning from CTAs/Global Macro (based Goldman flows). It is certainly possible a massive year end rally would take the S&P 500 back to 4,100, which would be an opportunity to sell unless inflation has structurally changed for the better as the Fed pivots.

Bottomline, positioning has not changed and with $190 billion in capital inflows available to backstop the market, this could cause some real pain to the upside for those off sides.

Saturday, Oct 15th

Last week investors endured one of the most volatile periods since March of 2020. The matter of fact is when liquidity becomes an issue, volatility becomes more pronounced than ever before. The structure of the markets are very different from only a decade ago, largely because there is more capital allocated to quantitative funds which strictly invest based upon price as a signal. Then you have derivatives and options that are more widely used than ever that cause gamma disruption (squeezes) by dealers to hedge.

We were highly critical of Thursday’s rally as financial conditions actually worsened within credit and fixed income spreads. We also said a close above the short term important resistance level on the S&P 500 futures of 3,740 would have caused more buying. The S&P 500 futures premarket traded as high as 3,734, before reversing 140 points on the day.

As we pointed out at the bottom of our last email on Thursday, Goldman referenced that $1 trillion worth of puts were to be struck at 3,500 on the S&P 500 futures. The largest ever! This caused a massive amount of buying once the S&P 500 ticked 3,503.

So where are we now?

We have been saying for a while we believe there was a high probability for months that our S&P 500 blended model would get close to a -74. The model is currently reading a -66.50 and has not moved much at all over the last two weeks. A move from -66 to -74 would be roughly another 4% to 6% lower on the index.

This means that the massive support level of 3,500 on the S&P 500 will likely not hold and 3,400 could be in range. As we discussed before, this type of trigger may allow Dynamic Alpha to re-engage slightly to allocating again, but certainly not 100%.

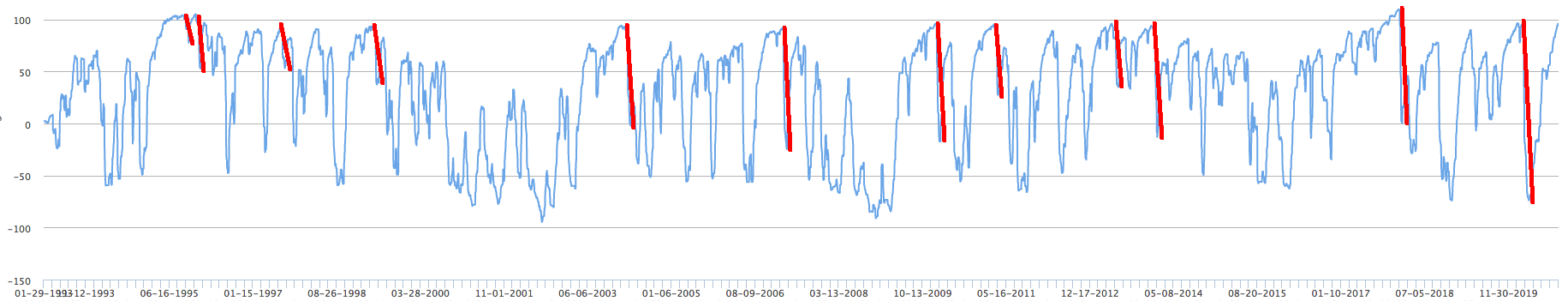

Based on the data below, we can estimate that a reading between -74 yo -78 will cause a large counter trend rally that might outweigh the risks to deploy cash. However, since 1992 the lowest readings of -93 and -89 were caused by a systemic shock to the system which can’t be ruled out. While this can’t be ruled out as we have never seen this type of liquidity drained from the system, something is bound to break before there is a catalyst to save the markets.

Click to enlarge

Hedge fund Flows

The below chart reference by JP Morgan shows that net flows from US hedge funds are certainly negative, but no way near the June 2020 lows.

Thursday, October 13th

A draw dropping 207 S&P 500 handle reversal on a hotter than expected CPI print! As we pointed out yesterday in our base case of a Stronger CPI Print: If the headline is above 8.29% and core 6.6%, the S&P 500 could easily test 3,500 & NASDAQ (futures) 10,490 with no signs of a pivot in sight. A .20% increase on both headline and core, could actually put the 3,500 level in significant jeopardy of holding on a Friday close. Ultimately, 3,380 is in the cards if this is the outcome.

The S&P 500 futures reached both our targets on the S&P 500 and NASDAQ (Futures) of 3,502 and 10,484 respectively. However, a massive counter trend reversal came into play caused by 1.) extreme pre-positioning from hedge funds and CTA’s and 2.) Massive support at 3,500 that we have been discussing for several months.

Remember one thing, when there is no visibility into earnings like the current environment, the Macro backdrop dictates the short term pricing of markets. Short term price direction is 100% driven by technicals and nothing else. This is why it is so important in understanding CTA positioning that relies on price trends. Don’t be fooled by strategists if they change their narrative of today’s events. In our opinion, there was simply no other factor that caused today’s counter trend reversal besides technical positioning. Fundamental conditions got worse in fact as financial conditions got tighter as we saw a significant bear steepening of the 2/10 yield spread of to .52bps.

- We tested the 3,502 level on the futures that we have repetitively over the last five weeks mentioned as significant support. We said back on September 22nd, “3,500 has a tremendous amount of supply and demand that took 5 months to breakout at this level” (see yellow dotted lines below)

- Hedge funds significantly de-risked and delivered for the last several months. As seen below by the chart provided by Goldman Sachs Prime Broker Hedge funds net positioning is about as low as it has been in 2 years. know one is long or levered.

- The Market was completely Hedged: According to Goldman there was $1 trillion of 5-day rolling average notional of index puts, the highest ever. This caused a backstop.

- CTA’s (Trend Following quants or Global Macro have according to Goldman Sachs $160 billion to buy in an upmarket. While they don’t define what an up market is exactly, we can surmise they have a lot of cash to buy if they flip to buying. Today was nothing more than an old school key reversal and that could cause more buying if we get a weekly close above 3.740 on the S&P 500 futures), which will have much more room to run as funds are significantly under allocated to the long side.

- ECB headlines also helped firm up the market, while we would put this at the least important factor for today’s rally. Reuters reported that an ECB staff model sees a target-consistent terminal rate of 2.25%, beneath the 3.0% level that markets are currently pricing in, however, policymakers are skeptical.

All Weather Conservative: Remains in 21% in cash.

All Weather Moderate: Remains in 32% in cash.

Wed, October 12th

We all know tomorrow is the all important CPI, much more important than today’s PPI which was up .20% and the market really had a muted reaction. First and foremost is the wage input then shelter inflation will be the key data points. While energy and food are of course important this is not what the market cares about. Wage inflation is what drives all inflationary pressure and to get wage inflation down and the Fed to pivot, the market needs job losses.

It is a foregone conclusion that the Fed is moving 75bps in three weeks. However, what is going to impact the next 6% up or down on the S&P is tomorrow’s CPI. Consensus for tomorrow is 8.1% for Headline and 6.5% for Core.

Here is our guesstimate for the markets reaction:

- Inline: If the headline is in-line at 8.1% and core is 6.5%, with no signs of wage gains the market will see volatility, but will not trigger any meaningful closing declines in the indexes. We would expect a bounce off the S&P 500 lows if the index tested 3,571.

- Slightly weaker: If the headline is slightly less than 8.10 to 8.00% and core is less than 6.5% to 6.40%, the S&P 500 could have a relief rally trade to 3,658 & NASDAQ (futures) 10,970. Yet this does absolutely nothing in terms of the Fed’s decision. So reducing long equity exposure seems warranted on an intermediate term basis.