Creating a Repeating Trend Following Approach

Principles with the process:

- Risk Management generates alpha.

- Invest or trade in high quality fundamental companies in the S&P 500 that have the most Sell-side coverage and liquidity.

- Sector rotation is vital to break down high correlated stocks.

- Momentum or Trend following has decades of empirical data that produces real returns and works for all investors.

- You must understand why using robust technical tools to mitigate false signals is the key element of trend following.

The Process

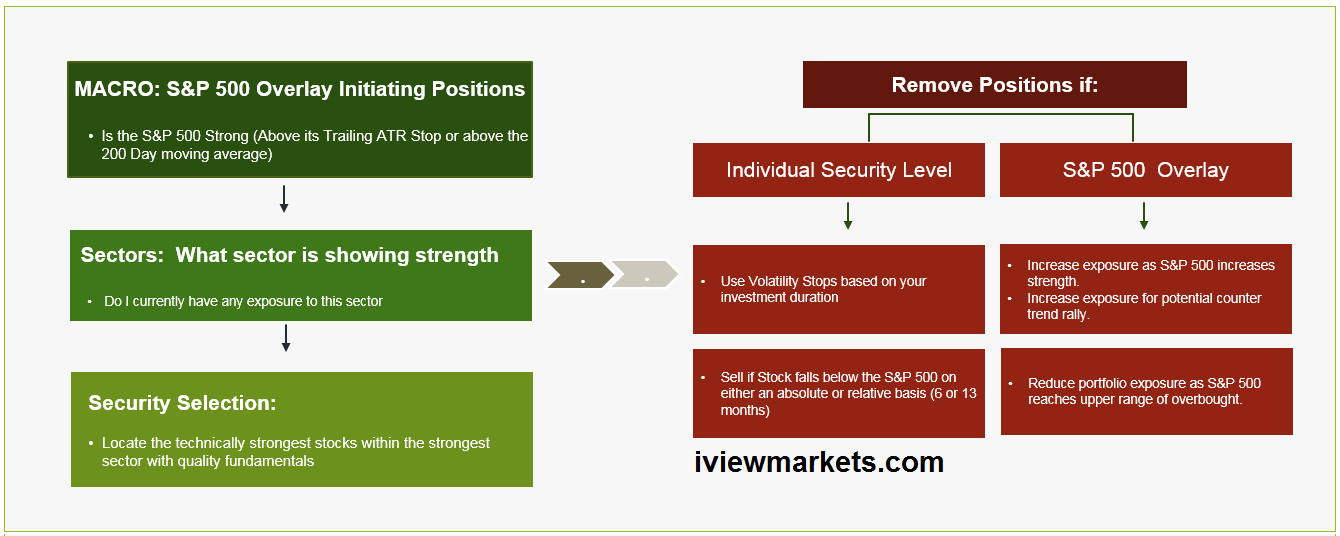

Let’s take a look at a very simple three-step process for investment selection. Let me stress, this column is for beginners to intermediate-level investors. Above in the first image is a very simple process to review that will help you create some simple rules and a game plan that will reduce a lot of guess work.

First, we want to ask ourselves is it worth deploying new capital to the market based on a macro level. For this column, we are looking at S&P 500 stocks, so we will defer to the S&P 500 index. Keep it simple. I like to look at the trend strength (currently a five out of 10) coupled with the ATR trailing buy (using a 20-period, multiplier of 3).

If the price of the S&P 500 is above its ATR trailing buy with an equal-to-or-greater-than-seven trend score, I will look to add long exposure within sectors that are strong. Of course, this is all dependent upon your own current asset-allocation mix.

Currently, the S&P 500 is below its ATR buy point and only has a five trend score. Unfortunately, the Macro Overlay is not allowing our process to move to the next step. However, for this exercise, let’s say the S&P 500 has met our objective of being above the ATR trailing buy and has an-equalto-or-greater-than-seven trend score. Let’s move to step two.

Video: You can also watch a video on how to use iVIEWMarkets here.

Sector rotation

The next step is to look for the sector with the greatest trend score (10 is the strongest, zero is the weakest).

Currently, technology is the strongest sector. Now let’s make sure its short-term price action is favorable by looking at the same ATR trailing buy inputs. Typically, if a sector is not rated at least a six and below its ATR trailing buy, I will not allocate to that sector.

As we can see below, the Technology Select Sector SPDR ETF’s price is currently above its ATR trailing buy, so now we have another rule that passes on the sector selection.

Security selection

Finally, you can move to the security selection if you are not outright buying the sector ETF. Since we are looking at technical’s first, we are going to look at the sector’s strongest stocks based on medium trend relative strength located on the list page found here

Selling

Now, for the most important step, selling. I will not reduce position exposure if the sector ETF price falls below the ATR trailing buy or an ATR trailing stop is initiated. If you are trying to mitigate as much downside as possible, start with an ATR multiplier of 1.5, if you are willing to take more risk for greater return set the multiplier at 2.5. The chart below of Micron Technology, which in this example is well above its ATR Trailing buy (multiplier of 2) at $16.80. A close below this price for risk-averse investors would lock in profits.

Lastly, our process does have an S&P 500 and relative strength overlay for selling as well. In our next column, we will does how to apply these rules so longer-term investors avoid moving to cash as little as possible.